- Toku enables instant USDC payroll on Sei as employers seek faster settlement across global markets

- Sei supports rising stablecoin flows with heavy volume and reliable throughput for payroll tasks

- CLARITY Act delays highlight policy strain while enterprise adoption of on-chain payroll accelerates

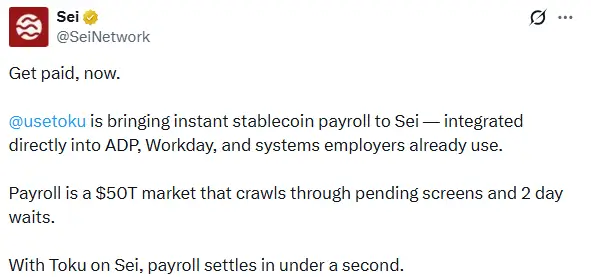

The payroll industry moves astonishing sums each year, yet workers still wait for funds to clear as if nothing has changed since the early days of electronic banking. Essentially, most payroll systems continue to rely on slow clearing windows and bank intermediaries. However, that longstanding lag is now being challenged by a new partnership between Toku and Sei, announced today in New York.

Their work folds blockchain settlement into everyday payroll operations, cutting delays down to seconds. In an official announcement, the Sei Development Foundation confirmed that Toku has integrated the Sei Network directly into its API-based payroll engine.

Toku Targets $50T Payroll With Sei Stablecoin Rails Push Bid (Source: X)

The move allows companies using major providers like ADP and Workday to route wages through USDC and settle instantly on Sei, without altering the software employers already use. It marks a shift from theoretical “real-time pay” pitches toward a system now functioning in production.

Native Integration Connects Payroll Giants to Blockchain Rails

Basically, Toku’s system sits quietly in the background of employer workflows. It sends payment instructions through its API, while Sei handles the settlement layer. The Foundation’s executive director, Justin Barlow, said the integration reflects a broader trend inside enterprises adopting faster payment rails under pressure to modernize operations.

He noted that companies using Toku can now issue payroll or vendor payments across borders without the usual delay. Toku’s chief executive, Kenneth O’Friel, further described the effort as part of a larger strategy to make stablecoin payroll available across several blockchain networks.

His focus, he said, is matching corporate compliance requirements with settlement systems that do not slow down under heavy volume. The Foundation itself uses the setup for its own payroll and token distribution cycles, offering an early example of an employer shifting critical transactions on-chain.

Infrastructure Metrics Back the Payroll Expansion

Reliable payroll depends on an infrastructure that does not stall during peak periods. Sei reported more than $3 billion in stablecoin volume over the past month alone, with over five billion transactions recorded since launch.

Moreover, nearly 100,000 unique wallets now hold USDC natively on the network. Not to leave out, daily active users exceed one million, a figure that underscores the chain’s steady throughput rather than any one-off surge.

The network is built as an EVM Layer-1 designed around financial traffic rather than general-purpose applications. Its transaction costs remain low, and the system has scaled across roughly 90 million wallets to date. That kind of capacity matters for a payroll sector that generates staggering numbers of recurring transfers.

A $50 Trillion Market Faces Structural Friction

Payroll remains a nearly $50 trillion market, yet the infrastructure pushing those funds forward often resembles systems built decades ago. Batch files, overnight processing, and assorted intermediaries keep clearing times slow. Toku’s approach, on the other hand, does not replace payroll providers; instead, it attaches a faster settlement layer to the tools companies already depend on.

The method trims the wait for employees and contractors who sometimes rely on predictable settlement times. For companies operating across multiple jurisdictions, the reduction in friction becomes even more significant.

Regulatory Uncertainty Clouds Broader Stablecoin Growth

The timing of this rollout arrives as Washington debates the stalled CLARITY Act, legislation aimed at shaping federal oversight of digital assets. Disagreements over stablecoin rewards, interest treatment, and their relationship with banking rules have slowed progress.

On one hand, banks worry that third-party reward structures could shift deposits away from traditional accounts, while crypto firms, on the other hand, argue that the restrictions would freeze innovation. A scheduled Senate Banking Committee vote collapsed after Coinbase withdrew support when new provisions were added.

Moreover, a meeting at the White House did little to narrow the divide. Even so, enterprise adoption has not paused. With Toku tying its payroll engine to Sei’s settlement layer, the shift from slow transfers to near-instant payouts is no longer a conceptual pitch; it’s now an active system operating in one of the world’s largest financial sectors.