- The NFT market has seen $85 million in trading volume over the past week in 2026.

- This marks a massive 30% increase from the past week.

- Despite this growing activity, the NFT Paris event has been cancelled.

The NFT market now presents a contrasting picture, sparking renewed interest and speculation. Despite a promising start to 2026, with the NFT market generating a trading volume of over $85 million in the past week, NFT Paris, one of the largest and most anticipated annual crypto events, has been cancelled.

This decision to cancel the NFT Paris 2026 event was a shock to many, especially given the market’s recent resurgence. What’s striking is that the organizers cited “market collapse” as the major reason for the cancellation of the event. This indicates that despite the early 2026 resilience, the market is still a long way from its initial glory.

Analyzing the NFT Market’s 2026 Revival

As 2026 is here, the NFT market is showing early signs of revival, with a notable upswing in the first week of January. After a prolonged downturn spanning over three months in 2025 Q4, the market has generated a trading sales volume of over $85 million in the past week.

While top non-fungible tokens posted notable dips in the last week of December 2025, the market saw a significant hike of 30% in sales volumes. This indicates that the stage is set for a massive rally in the NFT space.

According to NFT sales data from CryptoSlam.io, a leading market data aggregator, the global market has seen a significant surge in trading volume over the past week, with a 30% increase to $85 million. This marks a notable turnaround after the 2025 market crash.

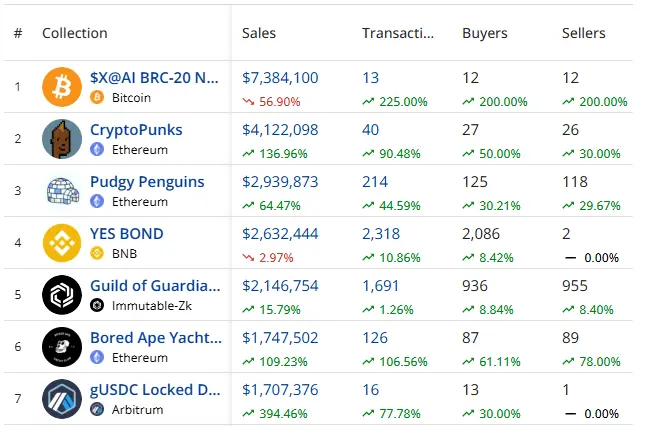

During the first week of 2026, Bitcoin, the blockchain network behind popular NFT collections like Runes, BRC-20, and Ordinals, dominated the space. According to the latest data, Bitcoin-based NFT collections saw a staggering $185% surge in volume, reaching $31 million in the past week.

Similarly, the Ethereum blockchain remained a major player in the NFT market, with its collections ranking second in trading activity during the same period. With a 37% week-over-week increase, Ethereum’s non-fungible tokens soared to $28 million in sales volume.

This positive sentiment is further reiterated by the Times of Blockchain’s previous report, which highlighted the NFT market’s promising 2026 start. As per the report, the industry saw a significant hype in the beginning, with top collections like Pudgy Penguins, Bored Ape Yacht Club, and Lil Pudgys showing notable upticks.

As of press time, the total market cap of the NFT industry has reached $1.07 billion. Although this marks a significant hike from January 3’s $828.4 million, it is down by a massive 34% over the past day. This indicates that the industry is showing high volatility now.

NFT Paris Cancelled Amid Market Challenges

Despite the NFT market’s reported resilience in 2026, the NFT Paris conference has been cancelled. The event will not take place in 2026, marking the end of a four-year journey for the Web3 event. The organizers attributed this cancellation to a “market collapse” that made the event financially unviable, despite efforts to trim expenses. The organizers wrote,

“NFT Paris & RWA Paris 2026 are cancelled. After four editions bringing together the global Web3 community in Paris, we have to face reality: NFT Paris 2026 will not happen. The market collapse hit us hard. Despite drastic cost cuts and months of trying to make it work, we couldn’t pull it off this year.”

This is primarily due to the NFT space’s challenging experience in 2025, which couldn’t be reversed by the early 2026 resurgence. Trading volumes on major marketplaces plummeted by about 95% from their 2021 highs, according to industry estimates. Also, once-high-flying assets like BAYC and CryptoPunks saw significant declines in prices last year.