- Brad Garlinghouse stated that banks are currently using XRP, as he had predicted a year ago.

- The IMF discussion marked Ripple’s progress in the global growth of payment technology.

- XRP showed steady market action while investors reacted to institutional adoption.

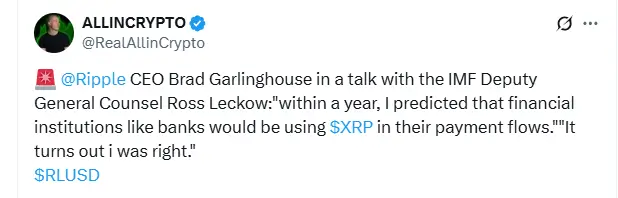

Ripple CEO Brad Garlinghouse said his forecast about XRP’s role in global banking has materialized within the predicted time frame. Speaking with IMF Deputy General Counsel Ross Leckow, Garlinghouse recalled his earlier statement made a year ago.

He said, “Within a year, I predicted that financial institutions like banks would be using XRP in their payment flows. It turns out I was right.” The discussion, shared by ALLINCRYPTO on X (formerly Twitter), has gained traction as it marked Ripple’s growing recognition among financial institutions.

Brad Garlinghouse XRP Prediction (Source: X)

The conversation took place during an IMF event, where both executives discussed blockchain integration in traditional banking. Garlinghouse’s comments were made in the context of Ripple’s attempt to grow its On-Demand Liquidity system, which has XRP as its backbone for the quick and inexpensive worldwide transactions.

Brad Garlinghouse’s Broader Vision Gains Traction

The exchange showed Garlinghouse and Leckow exploring how blockchain partnerships could reshape cross-border payments. Their talk pointed to the increasing collaboration between technology innovators and global regulators.

This interaction occurred shortly after Garlinghouse publicly addressed SWIFT’s blockchain-based shared ledger prototype. Earlier this month, Garlinghouse criticized SWIFT’s prototype, describing it as a “publicity-driven move” rather than a real innovation.

His reaction, detailed in a shareholder letter and explained by Jake Claver, CEO of Digital Ascension Group, reignited debate over Ripple’s market dominance. In a video posted by Abs, host of the Good Morning Crypto podcast, Claver explained that Garlinghouse viewed SWIFT’s project as a marketing attempt timed to precede the Sibos conference.

Numerous global banks have adopted Ripple’s ODL technology as an alternative, enabling the continuous conversion of currencies using XRP. It results in quicker and cheaper settlements compared to traditional systems, such as SWIFT, thus allowing instant international transfers. Ripple’s network has hence been cited as a significant infrastructure in the scope of digital finance developments.

XRP As Market Data Reflects Investor Interest

According to CoinMarketCap, on October 29th, the XRP price was $2.62, representing a 0.4% drop from the previous day’s closing price. The chart for the last 24 hours indicated that the token started at approximately $2.64, increased to more than $2.66, and then subsequently decreased to under $2.58 for a brief period.

The trading activity indicated a narrow range of consolidation between $2.60 and $2.65, pointing to regular accumulation. XRP’s 24-hour trading volume was $4.91 billion, while its market capitalization was $157.64 billion, with 60.01 billion tokens in circulation.

The volatility-to-market-cap ratio of 3.12% indicated that investors exercised some control over market movement due to their caution. The analysts noted that the price movement was very similar to the market’s reaction after the CEO spoke at the IMF, indicating that traders’ optimism was somewhat restrained.

Market observers also linked XRP’s stable performance to Ripple’s expanding partnerships with banks and central institutions. As the IMF continues to explore digital assets and central bank digital currencies, Ripple’s collaboration with global regulators has grown more visible.

Garlinghouse Vision For XRP’s Institutional Crypto Adoption

Ripple, which is currently solidifying its place in institutional finance, is the subject of his comments, which come at a crucial juncture. His statement that banks are presently using XRP for payment flows is undoubtedly the most desirable stage for a crypto utility, which has been awaited.

The conversation with Leckow also indicated the IMF’s gradual acceptance of blockchain in the area of cross-border finance. The dialogue brings up a critical issue: Is the success of Ripple an indication that institutional crypto adoption has matured?

Most people in finance view this occasion as the start of real integration between digital assets and traditional systems. Ripple, on the other hand, continues to build up its regulatory relationships, and the metamorphosis of XRP from a speculative token to a utility asset is still in progress.