- Buck Labs launches BUCK, a savings coin targeting about 7% rewards without a fixed peg

- BUCK rewards are funded by Strategy’s Bitcoin-linked preferred stock income streams

- The design mirrors Strategy’s long-term Bitcoin accumulation rather than trading yields up

Cayman Islands–registered Buck Labs has entered the digital-asset market with a product that borrows more from corporate treasury playbooks than from the stablecoin rulebook. The firm has rolled out BUCK, a crypto token it describes as a yield-bearing “savings coin,” aimed at users who want steady returns on dollar-denominated crypto holdings without relying on traditional pegged assets.

Buck Rolls Bitcoin-Backed Savings Coin Modeled on Strategy (Source: X)

BUCK launches at a reference price of $1, though it does not promise a fixed dollar peg. That distinction sits at the center of Buck Labs’ pitch. Rather than positioning the token as digital cash, the company frames it as a savings vehicle designed to earn rewards while capital sits idle. Moreover, rewards are currently targeted at roughly 7% annually and accrue on a minute-by-minute basis, according to Buck Labs founder and chief executive Travis VanderZanden.

In comments to CoinDesk, VanderZanden said the product is aimed at users who want predictable crypto-based returns without active trading. He described BUCK as filling a gap between spending tools and speculative strategies, arguing that existing stablecoins have largely optimized for payments rather than saving.

How the Savings Coin Is Structured

BUCK’s yield does not come from lending pools or trading activity. Instead, rewards are funded indirectly through Buck Labs’ foundation treasury, which holds Strategy’s Bitcoin-linked perpetual preferred stock, known as STRC. That instrument pays periodic income, and those proceeds are distributed to BUCK holders.

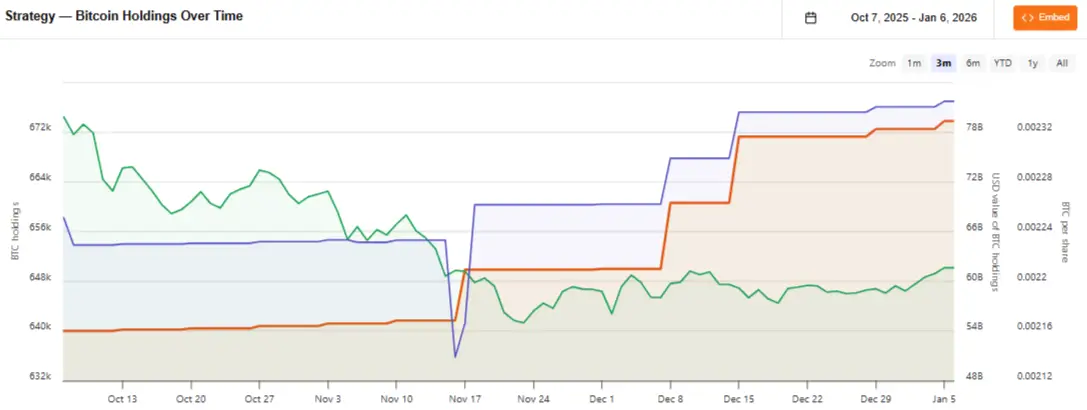

Notably, the token is backed by shares tied to Strategy Inc., the largest corporate holder of Bitcoin, with nearly 674,000 BTC on its balance sheet. However, Buck Labs has stressed that Strategy and its executive chairman, Michael Saylor, are not affiliated with the project and do not sponsor or endorse the token.

Strategy Inc. Bitcoin Holdings Over Time (Source: BitcoinTreasuries)

BUCK is also structured as a governance token. Holders can vote on protocol matters, including reward distribution mechanics. The company said the product will initially be available to non-U.S. users and is not being offered as a security. Buck Labs positions the token as complementary to stablecoins, intended for longer-term holdings rather than day-to-day transactions.

Strategy’s Bitcoin Accumulation as a Blueprint

The influence of the strategy’s balance-sheet strategy is difficult to miss. Over the past several years, the company has turned Bitcoin accumulation into a defining corporate policy. Recent filings show Strategy’s holdings exceed $50 billion at current market values, built through repeated purchases funded largely by equity and preferred stock offerings.

That approach has helped make Strategy a reference point for both institutional and retail investors seeking long-term exposure to Bitcoin as a store of value. Buck Labs appears to be adapting that model for individual users, translating corporate-level Bitcoin finance into a consumer-facing savings product.

Strategy’s buying has continued into 2026, including more than 1,287 BTC acquired last week alone. For Buck Labs, that consistency matters. The savings coin leans toward long-term Bitcoin exposure rather than short-term yield tactics, aligning its reward engine with a company that has made accumulation its core thesis.

A Launch Timed to a Shifting Market

BUCK arrives as the crypto market continues to recalibrate after bouts of sharp volatility. In recent cycles, total market capitalization has fallen by more than $1 trillion during downturns, reinforcing demand for products that emphasize capital preservation alongside returns.

At the same time, institutional involvement continues to deepen. Retail brokerage Robinhood has expanded tools for active crypto traders, including tax-lot selection and improved liquidity access. On the banking side, Morgan Stanley has filed with regulators to launch spot Bitcoin and Solana exchange-traded funds, signaling broader acceptance of digital assets within traditional finance.

Against that backdrop, Buck Labs is positioning BUCK as a savings-oriented alternative rather than a replacement for stablecoins. The firm’s bet is that a segment of crypto users wants exposure to Bitcoin-linked returns without chasing price moves or managing complex strategies.

By anchoring its rewards to income generated from a Bitcoin-heavy corporate treasury model, Buck Labs is testing whether Strategy’s approach can translate beyond boardrooms and into everyday crypto portfolios.