In 2026, Web3 gaming is expanding rapidly as the play-to-earn models and on-chain economies are attracting interest from both crypto investors and traditional gaming studios. The Web3 gaming expansion extends beyond entertainment value.

At the forefront of this expansion is Immutable (IMX), one of the leading Web3 gaming tokens, which powers the Immutable X layer-2 ecosystem. CoinMarketCap shows the price of IMX fluctuating around $0.22 – $0.24, with a market capitalization of approximately $450 million to $490 million, reflecting significant recent volatility due to broader trends in the cryptocurrency market.

In this article, we will take a closer look at Immutable (IMX) price analysis, its historical performance, and fundamentals, as well as discuss the impact of industry trends on pricing scenarios for 2026.

What is Immutable & IMX — a primer

Immutable is primarily focused on the creation of Web3 gaming tokens and scaling game infrastructure. The blockchain has one of its best-known offerings called Immutable X, a Layer-2 solution that does not require gas fees to perform transactions between multiple parties, such as minting or trading NFTs and playing games on the Ethereum blockchain. Zero-gas-fee transactions are enabled at extremely high speeds while maintaining the same security level as Ethereum.

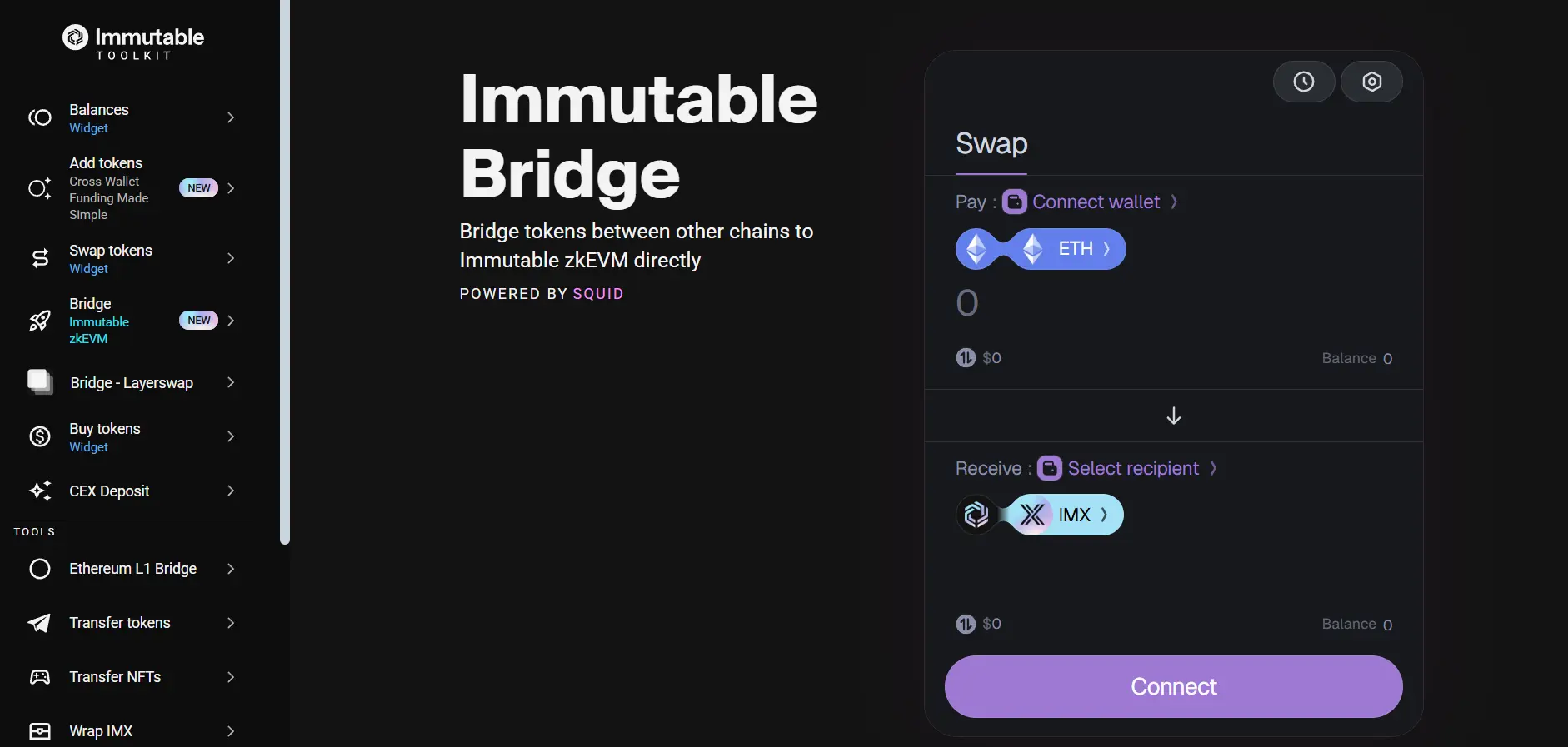

In addition to Immutable X, the network offers Immutable zkEVM, which expands the capabilities of Immutable X by offering developers additional tools for creating smart contracts between different blockchain networks. This allows greater flexibility when designing complex gameplay and tokenomics features.

At the core of the entire Immutable ecosystem sits the IMX Token, an ERC20 utility token that has many use cases, such as paying for network transactions, earning staking rewards, voting on governance proposals, and receiving incentives from the Immutable ecosystem to encourage user participation and growth.

Most recently, Immutable has migrated all of the IMX Staking from the original Ethereum network to the new zkEVM chain and has created a more streamlined platform for users and developers by providing a better framework for both user transactions and developer integrations, further improving on Immutable’s commitment to driving NFT game adoption across the crypto space.

Tokenomics & Supply Dynamics

A thorough evaluation of IMX tokenomics involves understanding price potential and whether it will maintain its long-term viability as a project. The potential IMX supply is capped at only 2 billion. As of now, listings of the IMX token on CoinGecko show that approximately between 819 million and 1.96 billion.

Initially, the distribution occurred through the development of the ecosystem rewards, through project development, private and public ICOs, and reserves held by the foundation. The subsequent distributions took place at certain intervals to help align the investments of all involved parties.

IMX tokens will also serve different purposes besides providing access to transaction fees, staking rewards, voting rights for governance purposes, and as incentives to promote gaming and marketplace activities. Holders may stake them and receive a portion of protocol fees and incentives staked since inception, reducing the circulating supply of IMX Tokens, and thus creating more price stability.

The on-chain standards to monitor include staking levels, volume inflows into and outflows out of exchanges, the remaining float supply, the number of active wallets, and any large amounts of IMX Tokens held by individuals or organisations. These standards will provide an indication of the likelihood of demand for IMX Tokens and the potential market opportunities available for them.

Price History & Technical Picture

The past IMX price movement was primarily driven by the excitement generated by the project early on, as well as the steep declines during 2022’s crypto winter. Additionally, there was an inevitable bounce back for IMX as the overall market and Web3 gaming sentiment improved.

After launching in November 2021, IMX skyrocketed to nearly $9.50 due to strong demand for gas-free NFT minting and trading on Immutable X. Unfortunately, throughout 2022, the NFT market dwindled, and the crypto market was in a prolonged bear cycle which led to a fall of over 90% in value for IMX, following a similar trend seen across the broader crypto market.

IMX has been on an upward trajectory throughout 2023, as it has traded above $1 for short periods before rallying back towards approximately $2.50 by the end of the year, coinciding with renewed interest in gaming tokens and partnerships, including Ubisoft and AWS.

2025 was a difficult time period for the token as it experienced extreme volatility with multiple months in which it traded between historic lows, approximately $0.34 in mid-2025, and rapid short-term rallies.

The overall trend of the current IMX metrics shows relatively neutral-to-negative signs of movement, which means that the price will continue to drop until it begins its recovery process. Currently, IMX is trading below its 50 and 200-day moving averages, which have historically been a sign of continued downward pressure on the price and therefore indicate that IMX will eventually continue to rise and recover.

The Relative Strength Index (RSI) has remained in the neutral-to-oversold area, which means that there is little to no bullish market interest in IMX and therefore has the potential for mean reversion if there is renewed buying activity by investors of the asset or token. The overall level of support is found between $0.23 and $0.26, and the estimated level of resistance is about $0.30 to $0.32.

The current market sentiment, along with on-chain activity and social media engagement levels, shows that IMX has not yet reached the peak level of attention or interest that it received at one time. However, the high trading volumes and speculative interest in the token may lead to increased short-term peaks in price levels. These indications are important parts of the IMX price prediction 2025 and beyond.

Fundamentals Driving IMX Value (ecosystem & adoption)

The worth of IMX and other Web3 gaming tokens is heavily reliant on ecosystem acceptance, utility, and real-world success. Immutable has integrated hundreds of gaming studios through its platform, with over 625 games having already been integrated or are currently in development. The games range from independent projects to larger studio projects, including Guild of Guardians, Gods Unchained, RavenQuest, Immortal Rising 2, and Treeverse.

The Zero Gas trading for NFTs, plus the scalability zk-rollup/zkEVM infrastructure, means that NFT holders can quickly and affordably conduct transactions while remaining secure on Ethereum. All of these features on Immutable allow developers to build games and provide a positive experience to their player base.

In addition to product benefits, the IMX ecosystem incentives encourage gamers to participate in the ecosystem. In June 2025, Immutable and the IMX Ecosystem Foundation launched a large airdrop to reward IMX Stakers with in-game currency from Treeverse. This now motivates staking, as well as promoting gambling that is part of the treeverse ecosystem. As of today, there are over 14 million IMX staked, and the total value locked (TVL) has also seen an increase of over 50% following the introduction of zkEVM staking.

Immutable’s partnerships with gaming publishers and platforms, such as Spielworks and Wombat, allow greater visibility and customer acquisition. It also extends cross-ecosystem promotional events and reward opportunities.

These fundamental factors – network effects, developer tools, incentives, and mainstream onboarding – provide the basis for the long-term growth potential of IMX and other Web3 gaming tokens.

Web3 Gaming Landscape & IMX vs Peers

The blockchain gaming market includes types of cryptocurrencies specific to the ecosystem, such as play-to-earn and infrastructure tokens. Major players in this market include Axie Infinity (AXS), The Sandbox (SAND), GALA (GALA), Enjin Coin (ENJ), and Immutable (IMX). Each of these tokens operates in differing roles and is driven by different value drivers.

AXS (AXIE), SAND (SAND), GALA (GAME), and ENJ (ENJ) are primarily game tokens associated with in-game economies, land ownership, and asset values. IMX, meanwhile, primarily provides an infrastructure role fuelling the Immutable X Layer 2 Network. The Immutable X Layer 2 Network facilitates cost-free and scalable transactions for a broad range of developers, rather than anchoring a single title in the blockchain economy. This means that IMX price sensitivity is driven more by the growth of the overall platform than the economic success of an individual game. Thus, it would likely provide a more stable price relative to gaming tokens tied to a single title.

When it comes to the comparison of market shares and volumes for NFTs, many users rely on DappRadar, OpenSea, or Blur statistics for current assessments of which game ecosystems are generating the most activity. This is an important relative measure for determining actual user interaction and subsequent economic productivity of the vast blockchain gaming industry.

2026 Market Outlook for Web3 Gaming

In 2026, the Immutable X price outlook will be impacted by trends happening within the broader Web3 gaming industry, as reported by Yahoo Finance. Through the second half of the decade, the Web3 gaming market is expected to continue growing at a strong double-digit CAGR, which will result from the adoption of blockchain technology and NFTs, as well as improvements in how developers monetise their games.

More and more traditional gaming studios are beginning to explore the use of Web3 features, in addition to a greater focus on improved user experience design (UX), wallet abstraction, and the increasing usage of stablecoins and blockchain-based payment layers, creating less friction for both players and developers.

But significant headwinds still exist. The possibility of another crypto winter, increasing regulatory scrutiny of NFTs and digital goods, and existing scepticism about the potential of GameFi from previous collapses are still issues for the mass adoption of NFT technology. Many traditional gamers are still reticent towards mechanisms that incentivise player ownership of a part of the game.

From this perspective, 2026 may be the year of evolution from speculative to sustainable economies in Gaming. This transition will be critical for IMX’s long-term validation.

Scenario-Based Price Outlook for IMX (bull/base/bear)

- Bull case: (Hypothetical $1.50–$3.00)

In a bullish case, mainstream game studios might adopt Immutable X or zkEVM. The volume of NFT marketplaces on Immutable X may continue to grow, and protocol upgrades may be deployed successfully to increase throughput and developer appetite for using the immutable ecosystem, with additional opportunities from deflationary dynamics, tightening the effective supply as demand for these tokens increases.

- Base case: (Hypothetical $0.60–$1.20)

In this case, we can expect to see consistent but moderate growth from developers using the Immutable Ecosystem and incremental volume growth on the NFT marketplace. IMX will track the crypto market cycle during this time and experience an increase in value from a sector recovering rather than one that achieves breakout ecosystem dominance.

- Bear Case: (Hypothetical Price Range $0.20–$0.40)

In a bearish scenario, there can be a macro decline in the crypto market, a slowing of NFT activities, a decrease in the number of gamers adopting NFTs, and increased sell-pressure as new tokens are emitted or unlocked. Due to this combination, there will be little to no opportunity for growth.

Remember that the above are hypothetical price bands and are subject to a constantly changing market environment based on several variables, including adoption, volume growth, and market structure. There is no guarantee that either of these hypothetical price ranges will be achievable.

Risks, Red Flags & What to Watch

When it comes to GameFi Tokens, the biggest identifiable risks stem from tokenomics. Token prices may fall dramatically due to large vesting cliffs, whereas if many tokens are held by too few people, there may be an increased risk of governance capture. The inflated supply of tokens may reduce yields for holders and obscure the true demand created for GameFi Tokens.

Risks associated with the GameFi Token Market include very thin liquidity, the potential for sudden delistings from exchanges, an increased number of wallet hacks, and an increase in government regulation or country-specific bans, freezing access to GameFi Tokens.

Since there was a lack of successful launches within the space, the risk of product and execution failure is still very high.

Always remember to develop a watch list of GameFi Tokens that exhibit potential demand for continued growth by monitoring on-chain metrics or other information, such as growth in the number of active wallets, daily retention rates on wallets, marketplace volume amounts, and the amount of revenue generated from transaction fees. By leveraging information from these metrics, investors can have an idea about “real” demand levels and the sustainability of GameFi Tokens across all market cycles.

Conclusion + Actionable Checklist for Traders/Analysts

Web3 gaming tokens will dominate the digital world in 2026, but it is unlikely that they will be dominant without breakout titles and smooth onboarding experiences. The likelihood of the sector’s growth depends on players being active rather than focusing solely on incentives to get those players active.

Overall, IMX is in a good position, due to its emphasis on infrastructure and partnerships with studios, but whether it leads or lags behind in growth will be based on IMX’s ability to execute and obtain adequate adoption over the next 12-18 months.

In order to assess IMX, traders/analysts can refer to the following six items:

- Monthly volume of NFTs and number of active users on Immutable.

- Total number of games currently live, upcoming games, and in development.

- New and expanded partnerships with recognized studios and publishers.

- Current staking participation rate and trends compared to token inflation.

- Price and volume trends during overall market price movement.

- Regulatory and platform policy regarding NFTs or gaming tokens.