- Zebec enables workers to receive part of their salary in USD1 through on-chain payroll

- USD1 supports instant earning, spending, and transfers using blockchain payment rails

- Zebec cards allow USD1 spending anywhere Mastercard payments are accepted

Zebec Network has expanded its blockchain-based payroll system by integrating World Liberty Financial’s USD1 stablecoin. This enables on-chain dollar payments for more than 65,000 workers across the United States and global markets.

The action takes digital dollars right to the payroll and card services, giving staff the ability to gain, use, and move USD1 via wallets and cards issued by Zebec. The combination intends to give access to salaries in real-time while linking blockchain payments to the world of routine buying.

Zebec Expands USD1 Daily Payroll to 65K+ Global Workers (Source: X)

The rollout places USD1 inside Zebec’s existing payroll and card suite, which already supports continuous salary disbursement. Stablecoins can be an option for workers to get a portion of their income and, at the same time, have traditional card payment access.

However, the issue still remains when stablecoins dive deeper into the regulated payment flows: can on-chain dollar usage influence the movement of salaries through the global market in a different way?

Payroll Integration and Real-Time Payments

Zebec designed its payroll system to stream payments continuously instead of processing wages in batches. Through this structure, employers can send salaries as they accrue, while workers gain immediate access to earnings. The USD1 integration extends this functionality using a dollar-pegged stablecoin.

Employees paid through Zebec can now receive USD1 directly into supported wallets. They can also access funds through Zebec-issued cards, which allow spending wherever Mastercard is accepted. This setup links blockchain settlement with familiar payment rails.

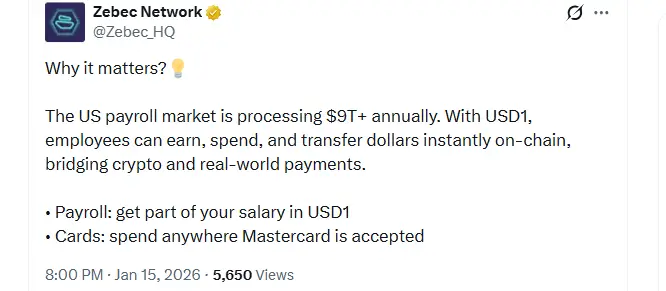

In a statement shared on X, the firm explained the scale of the opportunity. “The U.S. payroll market is processing $9T+ annually,” the company said. It added that USD1 enables workers to “earn, spend, and transfer dollars instantly on-chain,” while bridging crypto and real-world payments.

USD1 Enables Instant On-Chain Payroll and Card Payments (Source: X)

Regulatory Context and Everyday Use

Zebec also connected the USD1 rollout to evolving regulatory frameworks. The company stated that the GENIUS Act creates clearer rules for digital dollars. According to the firm, this regulatory clarity supports broader adoption of stablecoins in compliant payment systems.

The company announced that with the help of the new digital currency USD1, the workers will receive a portion of their wages in on-chain dollars. Besides, they can use their card for payments at regular stores. The dual aspect of digital currencies eases both the transfer of assets and the acquisition of non-digital ones.

The integration of USD1 by Zebec into salaries and cards is a move to make stablecoins a functional form of money, not just crypto instruments. The approach is grounded in acceptance, as well as the current payment behavior.

Zebec Market Data and Token Performance

Despite the Zebec-USD1 joint effort, the ecosystem’s native token, ZBCN, has experienced modest price fluctuations. Per CoinMarketCap’s data, the altcoin price action remains muted, with its current value hovering around $0.002883, marking a minor 0.75% increase in the past 24 hours.

Besides, its market cap has seen a similar surge, now trading in the $279 million zone. At the same time, 24-hour trading volume fell to $10.5 million, marking a 15% decline over the same period. The divergence between stable pricing and declining volume suggests cautious positioning among traders.

While the Zebec–USD1 integration expands real-world utility, near-term market behavior around ZBCN appears measured, with participants waiting for stronger confirmation before repricing the token.