- Tokenization gives investors early entry into the Maldives hotel project.

- The 80-villa resort is planned to open by late 2028 near the capital, Malé.

- Tokenized real estate is projected to grow from $300M to $4T by 2035.

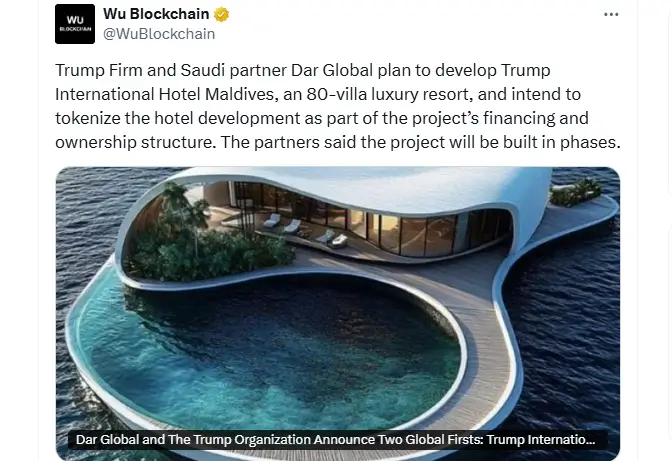

The Trump Organization and London-listed luxury developer Dar Global have announced a project that breaks new ground in both high-end hospitality and digital finance. Together, the two companies will develop Trump International Hotel Maldives while also rolling out what they describe as the first hotel development ever to be tokenized at the construction stage.

A New Funding Model Built on Tokenized Ownership

The partnership centers on a financing structure that differs from anything used previously in large real estate projects. Instead of waiting for a property to reach completion before offering fractional digital ownership, the Maldives resort will be tokenized from the start of development.

Trump Org and Dar Global Back Tokenized Luxury Hotel in the Maldives (Source: X)

This approach opens the door for investors to gain exposure during the earliest phase of the project, well before the resort welcomes its first guests. It also gives the developers a way to raise capital with greater flexibility, while offering buyers the potential to trade their holdings around the clock.

The timing aligns with a rapid expansion in tokenized real-world assets. The Deloitte Center for Financial Services projects the value of tokenized real estate to climb from under $300 million in 2024 to about $4 trillion by 2035, driven largely by demand for fractional access to high-value assets.

Inside the Resort Planned for 2028

The resort is due to open by the end of 2028 and will sit roughly 25 minutes by speedboat from Malé. Plans call for around 80 ultra-luxury beach and overwater villas, designed to appeal to travelers seeking privacy, seclusion, and world-class service.

The Trump Organization views this as its first major step into one of the world’s most coveted destinations. Eric Trump, executive vice president of the company, said the Maldives location and the tokenization model together establish “a new benchmark” for future hospitality developments.

Dar Global’s CEO, Ziad El Chaar, said the project embodies the company’s aim to push boundaries in both design and investment structure. He noted that bringing tokenization to the development phase sets this project apart from every other high-end property the firm has built.

Why Developers Are Turning to Tokenization

The move reflects a broader shift underway across global finance. Developers are increasingly exploring digital structures that allow investors to buy into real estate projects without traditional high entry costs or long investment lockups.

By breaking ownership into blockchain-based units, tokenized models give investors several advantages:

- Entry at the earliest stage rather than after completion

- Lower minimums compared with traditional real estate investing

- Continuous trading, rather than being tied to slow, illiquid markets

- Clearer ownership tracking through digital records

These features have drawn interest from both retail and institutional buyers. They also provide developers with a capital pipeline that can move faster than traditional real estate fundraising.

The Trump Organization’s move into this area comes as the family’s broader digital-asset ventures continue to expand. Reports earlier this year estimated that the ecosystem surrounding Trump-linked cryptocurrency projects, including World Liberty Financial and various branded tokens, has generated close to $1 billion in pre-tax profit.

A Strategic Expansion Across the Gulf and Beyond

The Maldives project adds to a growing list of collaborations between Dar Global and the Trump Organization. Dar Global is developing Trump Towers in Dubai and Jeddah and working with the Trump brand on real estate and hospitality ventures in Qatar and Oman.

While the companies have not released details about the rights attached to the Maldives tokens or the jurisdictions involved, they stated that investor onboarding will begin well before construction finishes. That would make the resort one of the first major hospitality assets to raise capital through early-stage tokenization.

As the real estate sector experiments with new digital models, the Maldives development may become a reference point for how luxury properties are funded in the coming years. If the project gains traction, other developers, especially those targeting high-value tourism markets, could adopt similar strategies.