- Texas invested $5M in IBIT as its first step toward a formal Bitcoin state reserve.

- The state will adopt self-custody once its procurement and security review process ends.

- Other states like New Hampshire and Arizona are also exploring Bitcoin reserve models.

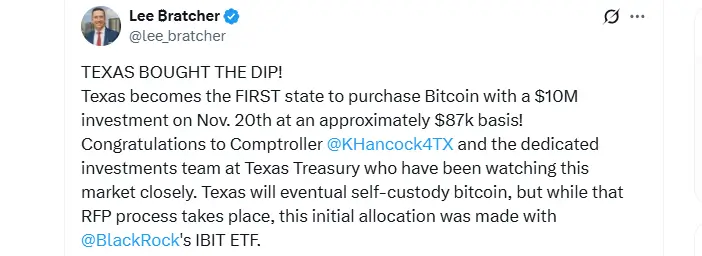

Texas has taken a major step toward establishing the country’s first state-backed Bitcoin reserve by purchasing $5 million worth of BlackRock’s iShares Bitcoin Trust (IBIT) on November 20. The acquisition, executed at an estimated basis of $87,000 per Bitcoin, was first disclosed by Lee Bratcher, President of the Texas Blockchain Council.

Although the state has allocated $10 million for strategic Bitcoin accumulation, officials clarified that only half of that amount has been deployed so far. The ETF purchase marks the first direct Bitcoin-related investment by a U.S. state government using state funds specifically dedicated to a reserve program.

Texas Deploys $5M Bitcoin ETF (Source: X)

While other states have invested indirectly through pension allocations, Texas is the first to execute a targeted Bitcoin exposure plan under newly enacted legislation.

ETF Used as a Placeholder While Texas Prepares Self-Custody

The transaction was executed through IBIT as a temporary measure, with the state planning to self-custody its Bitcoin once the final procurement process is complete. The comptroller’s office confirmed that a request-for-proposal (RFP) process is underway to identify secure custodial partners.

That process follows a statewide request for information that closed earlier this fall, gathering input from exchanges, custodians, miners, and wallet-service providers on best practices for Bitcoin storage, audits, and long-term reserve management.

Bratcher emphasized this staging approach, noting that “Texas will eventually self-custody Bitcoin, but while that RFP process takes place, this initial allocation was made with BlackRock’s IBIT ETF.” The ETF offers liquidity and regulatory oversight while the state formalizes its internal custody framework.

The investment originates from House Bill 1234, a legislative measure signed in June that authorized the creation of a Strategic Bitcoin Reserve without the use of taxpayer funds. The reserve is part of Texas’s long-term plan to diversify assets within major state-managed portfolios, including the Permanent School Fund, which holds approximately $60 billion in total value.

Legislative Background and Strategic Intent

The concept of a Texas Bitcoin reserve began circulating last year through draft legislation by State Representative Giovanni Capriglione. Those proposals included cold-storage mandates, yearly audits, donation mechanisms, and permissions for state agencies to convert other digital assets into Bitcoin.

The structure drew inspiration from federal-level discussions under President Donald Trump and Senator Cynthia Lummis, who have advocated for national-scale digital asset reserves. The Texas Blockchain Council played a significant role in shaping the bill, providing technical guidance to lawmakers and reinforcing Texas’s branding as a leading jurisdiction for Bitcoin mining, blockchain innovation, and energy-driven digital asset infrastructure.

The initiative aligns with broader statewide policies that support crypto mining facilities, blockchain regulatory sandboxes, and digital asset-friendly business environments. Industry advocates believe Texas’s move could encourage other energy-rich states to explore similar reserve strategies.

National Landscape Shows Growing Momentum for State-Level Bitcoin Plans

While Texas is the first to deploy state funds directly into a Bitcoin ETF for a reserve, several states are exploring parallel efforts. New Hampshire recently authorized a $100 million Bitcoin-backed municipal bond, requiring over-collateralization of roughly 160% and automated liquidation mechanisms to protect bondholders.

Similarly, Arizona passed legislation allowing unclaimed crypto assets collected by the state to form a crypto stockpile. Michigan and Massachusetts have also discussed reserve-style strategies but have yet to advance formal plans. Meanwhile, institutional interest continues to grow. Harvard University’s endowment recently expanded its IBIT position to $442.8 million, its largest publicly disclosed holding.

Emory University and Abu Dhabi’s Al Warda Investments have also increased their exposure to spot Bitcoin ETFs as part of broader diversification efforts. Bitcoin is currently trading around $87,500, nearly 30% below its all-time high, despite strong ETF inflows. Bratcher celebrated Texas’s timing, noting that the state “bought the dip” after prices fell sharply from above $120,000 earlier this month.

As Texas advances toward full custody and finalizes its procurement process in early 2026, the U.S. may see more states follow its model. For now, Texas stands as the first to formally initiate a Bitcoin reserve with dedicated state capital and a clear long-term plan for sovereign digital asset management.