- Swift partners with Consensys and banks to modernize global payments with blockchain.

- The $300B stablecoin market pushes banks to adopt faster digital payment solutions.

- The Ripple vs. Swift debate intensifies as banks weigh permissioned ledgers against XRPL’s openness.

Swift has announced the launch of a blockchain ledger to transform global payments, in partnership with Consensys. The initiative aims to facilitate real-time, 24/7 cross-border transactions at scale, thereby bringing tokenized finance into the mainstream of banking.

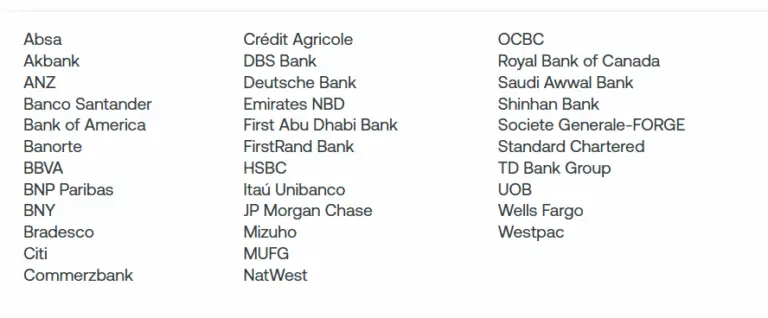

More than 30 financial institutions, including Bank of America, JPMorgan, HSBC, Deutsche Bank, and BNP Paribas, are joining efforts to design the system’s architecture and test its prototype.

Swift and Consensys Blockchain Ledger Supporters (Source: Swift)

The ledger will record, validate, and sequence transactions using smart contracts while meeting strict compliance and security requirements. According to Swift CEO Javier Pérez-Tasso, this effort marks the beginning of a new digital infrastructure stack designed to push global finance into its next stage of modernization.

Partnership with Consensys and Industry Involvement

With the goal of ensuring scalability, resilience, and interoperability, Consensys has made its Ethereum Layer 2 network, Linea, available. Swift will continue to be considered an infrastructure provider with a neutral nature, while commercial and central banks will still issue tokens.

Fellow institutions in Europe, Asia, the U.S., and the Middle East have all joined this project in very high numbers. Banks such as Citi, Santander, Standard Chartered, Wells Fargo, and BBVA are seeing instant, secure, and transparent settlements as a new market opportunity for their clients.

The collaborative approach ensures that the industry’s needs are reflected in the ledger, taking into consideration both technical operations and compliance requirements. Connecting traditional rails with blockchain, the ledger connects existing financial systems to burgeoning digital networks.

Swift emphasized interoperability as the key principle that should ensure compatibility across both public and private blockchains.

Responding to Digital Currency Competition

Swift’s netting approach comes against a backdrop of steadily mounting pressure from the tremulously rising $300 billion stablecoin market. With banks such as JPMorgan and Citi preparing their digital tokens and European banks gearing up to launch a stablecoin pegged to the euro by 2026, the global payments landscape is indeed undergoing rapid transformation.

The ledger is likely to provide banks with an institutional-grade alternative that combines the speed of blockchain with the regulatory oversight of established finance. The new payment mechanism complements ongoing upgrades being implemented on Swift’s traditional rails, including those aimed at increasing settlement speeds and enhancing fee transparency.

The dual approach thus positions Swift to fuel both the modernization of fiat payments and the assimilation of digital assets. Industry leaders have described the initiative as a milestone for global payments, whereby a trusted system is being formed for secured, synchronized settlements at scale.

Combining the reach of Swift and the blockchain expertise of Consensys, the project sets the stage for a unified financial infrastructure that supports both traditional banking and tokenized assets.

Ripple vs. Swift: The Debate Over Blockchain Payments

Swift’s decision to embrace blockchain has reignited debate about its rivalry with Ripple, the company behind the XRP Ledger (XRPL). Many in the crypto community question whether Ripple’s well-established cross-border payment system could be bypassed by banks rallying behind Swift’s permissioned ledger.

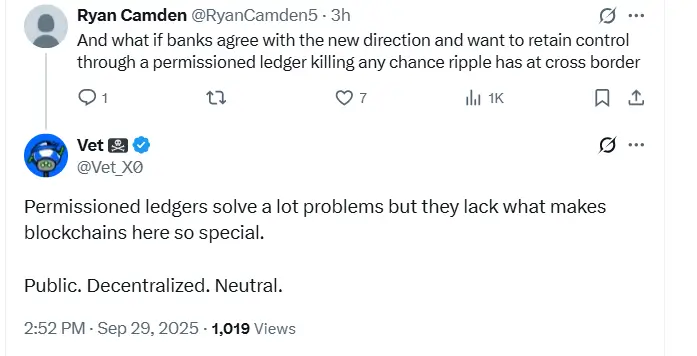

One XRPL validator expanded the discussion, opining that the shift by Swift shows a “desperate need for blockchain tech,” sparking further debate on the motives of banks. Another XRP supporter raised the concern that banks might prefer a permissioned system entirely under their control, crushing any hope for Ripple to play a relevant role in global settlements.

Swift vs. Ripple Debate (Source: X)

In response, a prominent validator known as Vet argued that while permissioned ledgers solve compliance and operational issues, they miss the essence of blockchain. “Permissioned ledgers solve a lot problems but they lack what makes blockchains here so special. Public. Decentralized. Neutral,” he emphasized, underscoring Ripple’s advantage in offering an open system that aligns with the original spirit of distributed technology.