- Ripple USD enables instant, transparent global aid transfers for major humanitarian groups.

- World Central Kitchen, Water.org, Mercy Corps, and GiveDirectly now use Ripple Payments.

- Ripple USD nears a $900M market cap, ranked among the top 100 global digital assets.

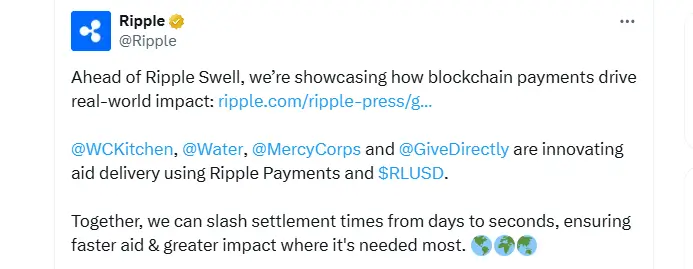

Ripple has introduced a new way for aid groups to move money quickly and safely across borders. In a Ripple official report, the company confirmed that four major nonprofits—World Central Kitchen, Water.org, GiveDirectly, and Mercy Corps—are now using its Ripple Payments platform and the Ripple USD stablecoin (RLUSD) to deliver emergency funds with far greater speed and accuracy.

Ripple USD to Boost Global Aid Relief (Source: X)

The system allows transfers to clear within seconds, operating continuously throughout the year. Because the platform is licensed and dollar-backed, it removes the need for slow traditional banking channels.

The result is faster aid delivery, fewer intermediaries, and full visibility into how and where money moves. Ripple President Monica Long called the joint efforts a turning point for humanitarian finance, noting that innovation paired with purpose can reshape how help reaches people in crisis.

“Our partners and customers are redefining how urgent aid, sustainable development, and financial support reach those who need it most,” said Monica Long, President of Ripple. “It’s a powerful example of what happens when innovation meets purpose.”

Ripple USD: Global Partners Modernize the Flow of Aid

World Central Kitchen, led by chef José Andrés, has expanded its union with Ripple after years of collaboration on disaster-response efforts. Using Ripple Payments and RLUSD, the organization now routes funds to field partners in hours rather than days.

That change means local kitchens and suppliers can act immediately when storms, fires, or conflicts strike.

“With Ripple, we’re testing new financial technologies to settle payments in hours instead of days, even in challenging environments, allowing us to serve more communities in their most vulnerable moments,” said Joshua Tripp, President of Innovation at World Central Kitchen.

Water.org, founded by Gary White and actor Matt Damon, is also widening its work with Ripple. After early success in Brazil, Mexico, and Peru, the group plans to move all Latin American transactions to Ripple’s network and explore expansion into Africa and Asia.

The shift enables faster lending to local partners who provide clean-water and sanitation loans. “Through our collaboration with Ripple, we’re exploring how digital payments can help us move funds more efficiently to our local partners,” White explained. This unlocks “capital faster so more families can access the solutions they need to survive and thrive.

Stablecoin Pilots Show Promise in Kenya

Notably, in Kenya, Ripple’s alliance with Mercy Corps Ventures is testing how RLUSD can power direct financial aid and small-scale insurance for families with limited or no access to banking. The goal is to shorten the time between crisis and relief.

“For families waiting on emergency cash or insurance payouts, even a few hours can make a difference,” said Scott Onder, Chief Investment Officer at Mercy Corps. “Blockchain-enabled payments are helping us close that gap,” he added.

GiveDirectly is running similar tests, using RLUSD to send cash directly to recipients. The approach eliminates unnecessary layers in the aid chain, ensuring that more funds reach households instead of being lost to transfer fees or delays.

Ripple USD Nears $900 Million Milestone

Beyond its humanitarian use, Ripple USD is gaining steady traction in the global finance sector. Market data places RLUSD’s capitalization near $898 million, ranking it among the world’s top 100 digital assets. Each token is fully backed by U.S. dollar reserves verified through monthly audits.

Ripple has also committed more than $1.5 million in new academic grants under its University Blockchain Research Initiative, all funded in RLUSD. The company’s prime brokerage arm, Ripple Prime—created after the acquisition of Hidden Road—now allows clients to hold balances or post collateral in RLUSD.

At the same time, Ripple’s 120-day review with the U.S. Office of the Comptroller of the Currency has concluded, marking an important step toward the establishment of Ripple National Trust Bank. If approved, the license would enable Ripple to offer custodial and digital asset services under federal oversight.