- Ripple joins Bahrain Fintech Bay to grow RLUSD and blockchain use in the Gulf.

- The partnership aims to build pilot programs and train fintech innovators in Bahrain.

- RLUSD expansion into Africa and Europe highlights Ripple’s global compliance drive.

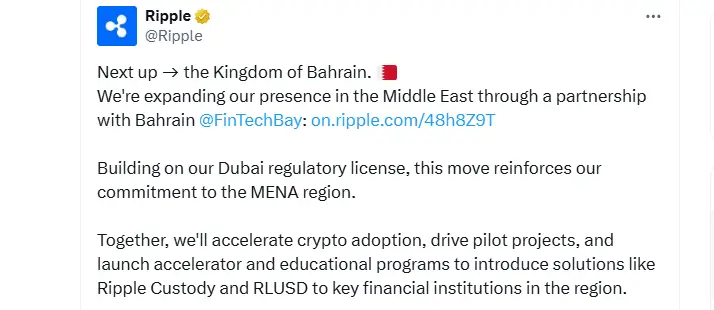

Ripple has deepened its reach in the Middle East through a new partnership with Bahrain Fintech Bay, one of the Gulf’s most active fintech centers. The deal signals Ripple’s intent to strengthen blockchain use across regulated markets while reinforcing Bahrain’s early lead in digital finance.

Ripple: Building a Stronger Blockchain Base

According to the reports, Ripple and Bahrain Fintech Bay plan to develop pilot programs and run workshops for local banks and startups. They will also host accelerator sessions designed to help firms test blockchain in payments, asset tokenization, and stablecoin systems.

Ripple Partners with Bahrain Fintech Bay to Boost RLUSD Utility (Source: X)

Universities and regulators are expected to join these efforts. By involving a wide range of players, the initiative aims to build the skills needed to support Bahrain’s financial modernization.

Ripple will bring its international experience and technology to help local institutions move from traditional operations to digital asset infrastructure.

“At Ripple we look forward to working with Bahrain Fintech Bay to continue laying the foundations for a thriving local blockchain industry, as well as ultimately offering our digital assets custody solution and stablecoin Ripple USD (RLUSD) to Bahrain’s financial institutions,” said Reece Merrick, Managing Director, Middle East and Africa at Ripple.

RLUSD Takes Center Stage

One major focus will be Ripple’s U.S. dollar–backed stablecoin, RLUSD. The asset is built for financial institutions that want faster, more transparent settlements between conventional and blockchain networks.

The move builds on Ripple’s earlier progress in the region. The company recently earned a Dubai Financial Services Authority license, making it the first blockchain payment provider approved under the DFSA framework. That step confirms its compliance standards and expands its footprint in regulated markets.

Ripple’s work with RLUSD is also widening beyond the Gulf. In Africa, it is linking with Chipper Cash and Yellow Card to integrate stablecoin payments. In Europe, Ripple chose Luxembourg as its base for RLUSD under the EU’s MiCA framework.

A Push Toward Regional Growth

Bahrain has long positioned itself as a testing ground for financial technology. Its flexible regulatory system has attracted blockchain projects from across the region. The new partnership is set to deepen that reputation by encouraging joint efforts in digital payments and tokenized asset systems.

The alliance supports Bahrain’s goal of becoming a regional fintech leader. It will also encourage dialogue between international blockchain experts and local market participants. The cooperation is expected to help the country host larger blockchain projects that meet global standards.

“This partnership with Ripple reflects Bahrain FinTech Bay’s commitment to bridging global innovators with the local ecosystem, creating opportunities for pilots, talent development, and cutting-edge solutions that will shape the future of finance,” said Suzy Al Zeerah, COO at Bahrain Fintech Bay.

Ripple will share its vision at the Fintech Forward 2025 event in Sakhir, joining banks, regulators, and innovators to discuss the next phase of financial transformation.

Closing Outlook

Ripple’s move in Bahrain marks more than an expansion. It’s a practical example of how blockchain can grow within a clear regulatory path. By combining Ripple’s global reach with Bahrain’s open approach to innovation, the partnership could quicken RLUSD adoption across the Gulf and inspire broader use of blockchain in financial systems.