- The NFT market shows a sharp decline in trading volume.

- Both Bitcoin and Ethereum-based collections have declined in sales.

- Top NFT platforms like Nifty Gateway and Foundation are closing or changing ownership.

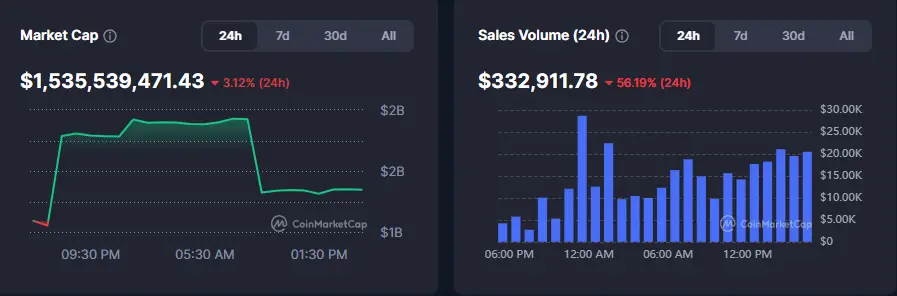

The NFT market, once driven by hype and million-dollar sales, is now facing a steep decline. The total market cap and trading volume of the assets have dropped sharply. This reflects the fading interest from both investors and collectors. What was once seen as the future of digital ownership now seems uncertain.

Adding to this slowdown, many NFT projects and marketplaces have shut down or gone inactive. With fewer buyers, limited real-world use cases, and growing scepticism, NFTs are struggling to maintain relevance. But why is the initial hype fading?

What’s Behind the NFT Market Crash?

The global NFT market is currently facing a slowdown, with many of the once-prominent collections now under significant pressure. Per CoinMarketCap data, the total market cap has declined to $1.53 billion, down 3.12%. The 24-hour trading volume is also down by a massive 56%, reaching $332K.

According to CryptoSlam data, over the past week, the NFT market has experienced a severe drop in its sales activity. Both Bitcoin and Ethereum-based assets have declined in sales. While Ethereum-based NFT sales plummeted by 56%, Bitcoin-based assets dropped by a more notable 78%.

Pudgy Penguins, one of the most popular NFTs, has seen a notable plummet in its price over the past 24 hours, down by 32%. However, the collection has seen a notable hike of 21% over the past week in its sales activity. With 121 buyers and 116 sellers, Pudgy Penguins have seen a total transaction of 207 over the past week, up 56% from the week before.

At the same time, the top Ethereum-based NFT collections like Flying Tulip and CryptoPunks recorded notable declines in weekly sales. While Flying Tulip’s weekly sales are down by 77%, CryptoPunks sales have plunged by 22%.

Since the beginning of 2026, the space has been exhibiting this downtrend. As Times of Blockchain reported earlier, the NFT market sales volume saw a sharp decline during the initial days of January.

Notably, the sudden drop in the hype of the NFT market is driven by a mix of factors. High-profile scams and failed collections have shaken the confidence of collectors, significantly affected their prices and sales activity. The overall negative sentiment across the broader crypto market has also cast a shadow over the future of NFTs.

In addition, rising gas fees and high transaction costs have made buying and selling less attractive for casual collectors. Regulatory uncertainty is another major reason for the fading enthusiasm surrounding the NFT market.

NFT Marketplaces Are Shutting Down

Adding more fuel to the prevailing negative sentiment around the NFT market, more collections are facing closures. Over the past few weeks, several top platforms either shut down or changed ownership. Social media reports suggest that these exits mark the end of a major phase in digital art.

For example, Gemini announced that Nifty Gateway would close on January 24, later extending withdrawal deadlines after user feedback. This incident moved off 650,000 NFTs from the platform.

Meanwhile, Foundation transferred ownership to digital display company BlackDove, while Rodeo, a social NFT app, confirmed it was shutting down entirely.

The NFT market started experiencing these closing events even earlier. MarkersPlace closed in January 2025, and KnownOrigin shut down in July 2024 after eBay acquired it in 2022. Async Art stopped operations in October 2023. In addition, Kraken NFT, Bybit NFT, X2Y2, and LG’s Art Lab have exited the NFT market over the past few years.

Despite this broader negative trend, experts remain optimistic about NFT’s expansion in the healthcare industry. Times of Blockchain reported recently that healthcare NFTs are poised to hit $295 million in 2026.