- The IMF says stablecoins reshape payments but deepen monetary and capital risks.

- Rapid stablecoin growth links digital markets with key debt markets worldwide.

- The IMF urges unified rules to limit spillovers and close global oversight gaps.

The International Monetary Fund has delivered its sharpest assessment yet of the stablecoin economy, saying the fast-growing sector could reshape global money movement while exposing countries to new financial and monetary threats. A new IMF report released Thursday outlines both the structural advantages of stablecoins and the emerging vulnerabilities created by fragmented oversight, rapid cross-border flows, and increasing links to traditional markets.

Stablecoins Gain Global Influence as Adoption Surges

According to the IMF, the combined market capitalization of the largest stablecoins has tripled since 2023, reaching about $260 billion. Trading activity rose 90 percent in 2024, with more than $23 trillion in volume. Asia leads global stablecoin usage by volume, while Africa, the Middle East, and Latin America show the highest activity relative to GDP.

IMF Says Stablecoins May Shift Global Money but Risks Loom (Source: X)

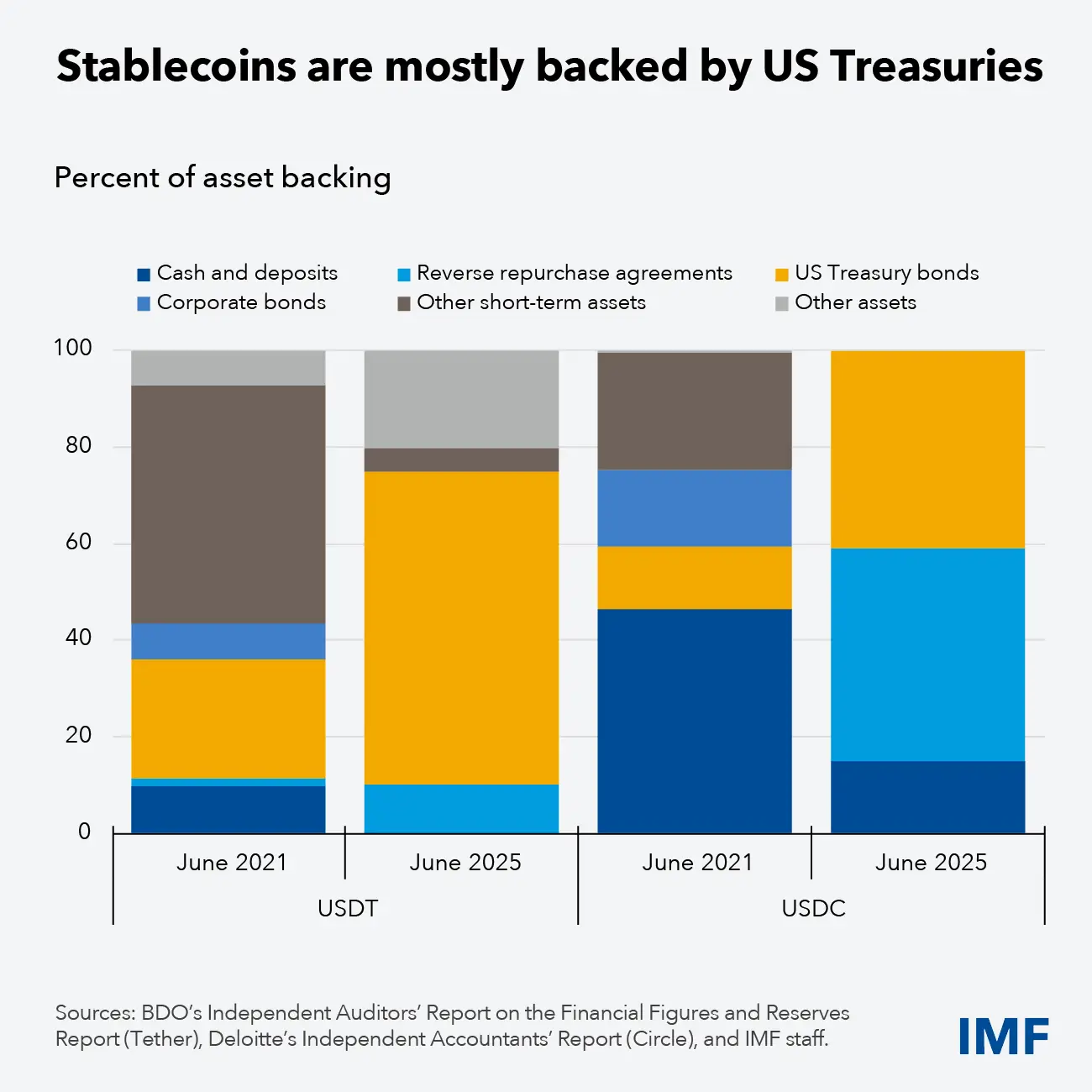

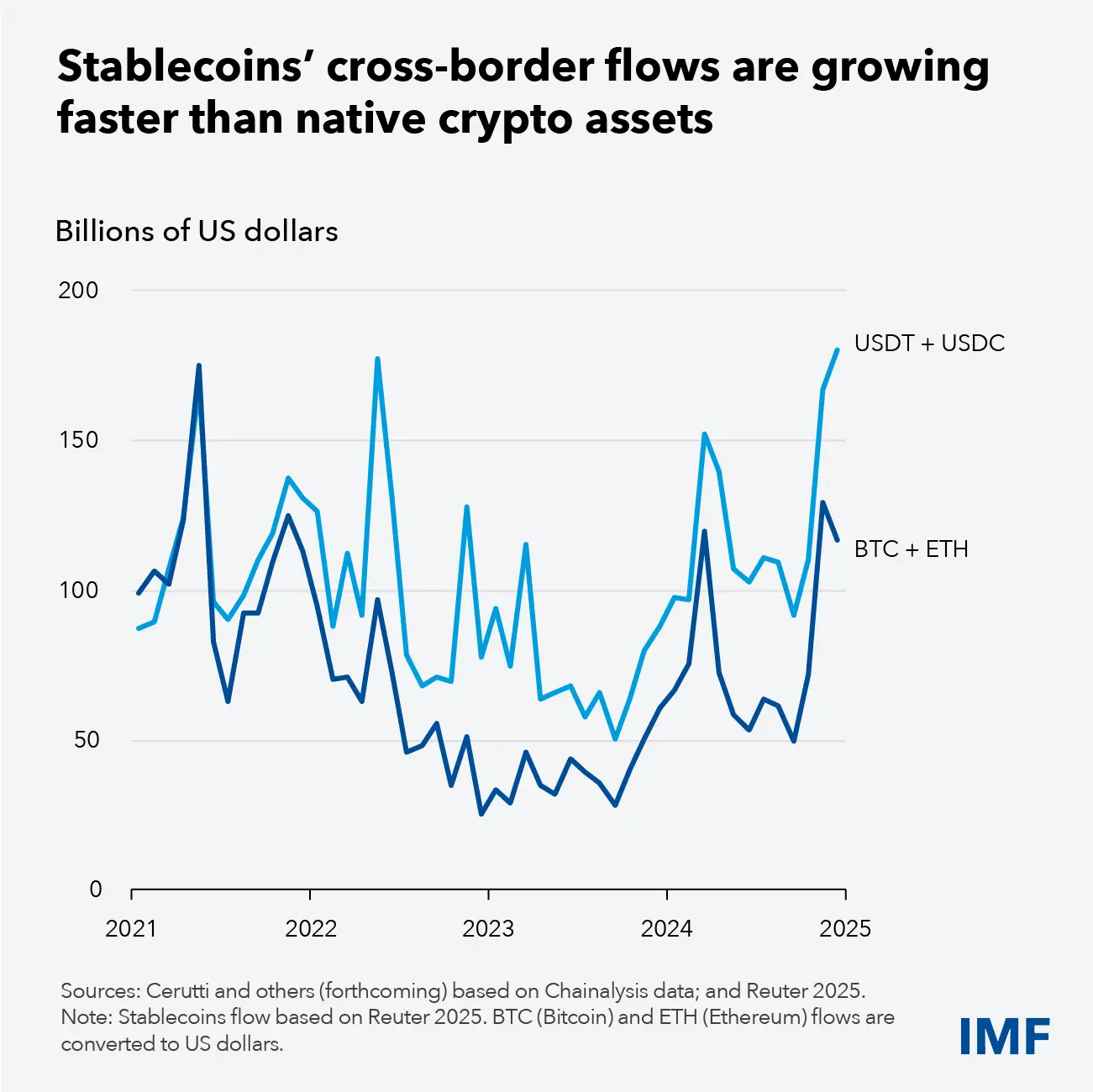

The report attributes this growth to two main factors: their widespread use in crypto trading and their emerging role in cross-border payments. Stablecoins, mostly backed by U.S. Treasury bills and cash-like assets, offer value stability compared to highly volatile crypto tokens.

Tether’s USDT and Circle’s USDC dominate the market, with the IMF noting that 75 percent of USDT reserves and 40 percent of USDC reserves sit in short-term U.S. government debt, linking digital tokens directly to traditional financial markets.

Cross-Border Payments and Financial Access Drive Adoption

Besides, the IMF highlights promising use cases that could make stablecoins a powerful tool for global finance. In cross-border transfers, current systems rely on multi-layered correspondent banking channels that create high costs, delays, and opaque settlement workflows. Some remittances still cost up to 20 percent of the transferred amount.

However, stablecoins allow payments to move on a single blockchain ledger, reducing friction and potentially lowering fees. Their speed and interoperability could also expand financial access, especially in regions with limited banking infrastructure.

Stablecoins’ Cross-Border Flows (Source: X)

Notably, many developing economies already rely heavily on mobile wallets and digital cash, making them early adopters of tokenized payment rails. Increased competition with traditional providers could lead to cheaper and more diverse financial services.

IMF Warns of Monetary Risks, Market Fragility, and Regulatory Arbitrage

Despite the benefits, the IMF stresses that stablecoins carry major macro-financial risks. Their ability to move across borders without relying on banks could accelerate currency substitution, especially in countries facing high inflation or low confidence in domestic monetary systems.

This shift weakens local currencies and reduces the effectiveness of national monetary policy. The fund also warns that large-scale redemptions could trigger the rapid sale of Treasury bills, disrupting short-term funding markets central to monetary policy transmission.

Because stablecoins often operate across multiple blockchains, regulatory and technical fragmentation increases operational risks. Issuers can base operations in lightly regulated jurisdictions while serving users globally, creating regulatory arbitrage and weakening oversight of reserves, liquidity management, and anti-money laundering controls.

The IMF notes a growing risk of contagion: deeper links between stablecoin issuers, banks, custodians, and exchanges raise the likelihood that failures in digital markets could spread into the broader financial system.

Push for Global Standards Intensifies as Policymakers Respond

To address these risks, the IMF is urging countries to converge on unified regulatory standards. The guidance calls for:

- Harmonized definitions of stablecoins across jurisdictions

- Consistent rules for reserve assets

- Mandatory 1:1 redemption at par, on demand

- High-quality liquid asset backing, primarily short-term government securities

- Shared cross-border monitoring systems

- Stronger anti-money-laundering enforcement

The IMF says stablecoins should follow the principle of “same activity, same risk, same regulation,” regardless of whether the issuer is a bank, fintech company, or crypto platform.

The report arrives as major economies tighten scrutiny. Europe’s central bank has warned stablecoins may pose spillover risks under the MiCA regime. China considers them a threat to monetary sovereignty. U.S. and UK regulators are reassessing capital requirements for banks with stablecoin exposure.

Industry observers say the IMF’s paper also signals an emerging shift: a move toward regulated, fully backed tokens that integrate directly with Treasury markets. Analysts note that the fund even references BlackRock’s BUIDL tokenization fund as a benchmark model, underscoring growing acceptance of blockchain-based settlement in global finance.

The IMF concludes that stablecoins and tokenized assets “are here to stay,” but their future impact will depend on coordinated global rules. Without consistent oversight, the fund warns, stablecoins could bypass national safeguards and transmit financial shocks across borders “at high speed.”