- Fusaka aligns Ethereum around Layer 1 scaling and revenue-focused protocol design.

- New blob-fee floor and PeerDAS could raise long-term economic value for ETH holders.

- Based rollups and preconfirmations may shift more activity and fees to Ethereum L1.

Ethereum’s upcoming Fusaka upgrade marks a structural shift in how the blockchain captures value, according to new analysis from Fidelity Digital Assets. The research team said the upgrade introduces the network’s most cohesive and economically aligned roadmap to date, reshaping the balance between scalability, monetization, and long-term sustainability across Ethereum’s ecosystem. Fusaka, which combines the Fulu and Osaka upgrades into a simultaneous execution- and consensus-layer release, is scheduled for activation on December 3, 2025, at slot 13,164,544.

Ethereum’s Fusaka Upgrade: A More Focused Roadmap Centered on Value Accrual

Fidelity said Fusaka reflects a decisive move away from Ethereum’s historically fragmented upgrade process. Instead of broad stakeholder-driven priorities, Fusaka consolidates development around a narrower set of economic objectives: scaling Layer 1, strengthening data availability, improving usability, and reinforcing pricing power across Ethereum’s core products.

Analyst Max Wadington wrote that while value accrual is not explicitly listed as a core initiative, the theme is visible across nearly all components of the upgrade. Fidelity said these changes collectively signal Ethereum’s maturation into a cash-flow-oriented platform, where protocol revenue becomes a more central element of the roadmap.

Layer-1 scaling sits at the core of this shift. Fidelity noted that Layer-1 transactions direct meaningfully more economic value to ETH holders than Layer-2 activity, positioning the throughput improvements in Fusaka as a direct driver of future revenue.

Data Availability Enters a Monetization Phase

A central feature of Fusaka is EIP-7918, which introduces a blob-fee floor to prevent underpriced data availability during periods of low demand. Under previous conditions, blob fees regularly fell to zero because developers expanded blob supply without market constraints. Fidelity said the new reserve price represents the first clear demonstration of pricing power in Ethereum’s data-availability market.

Ethereum’s Fusaka EIP-7918 (Source: Fidelity Digital Assets)

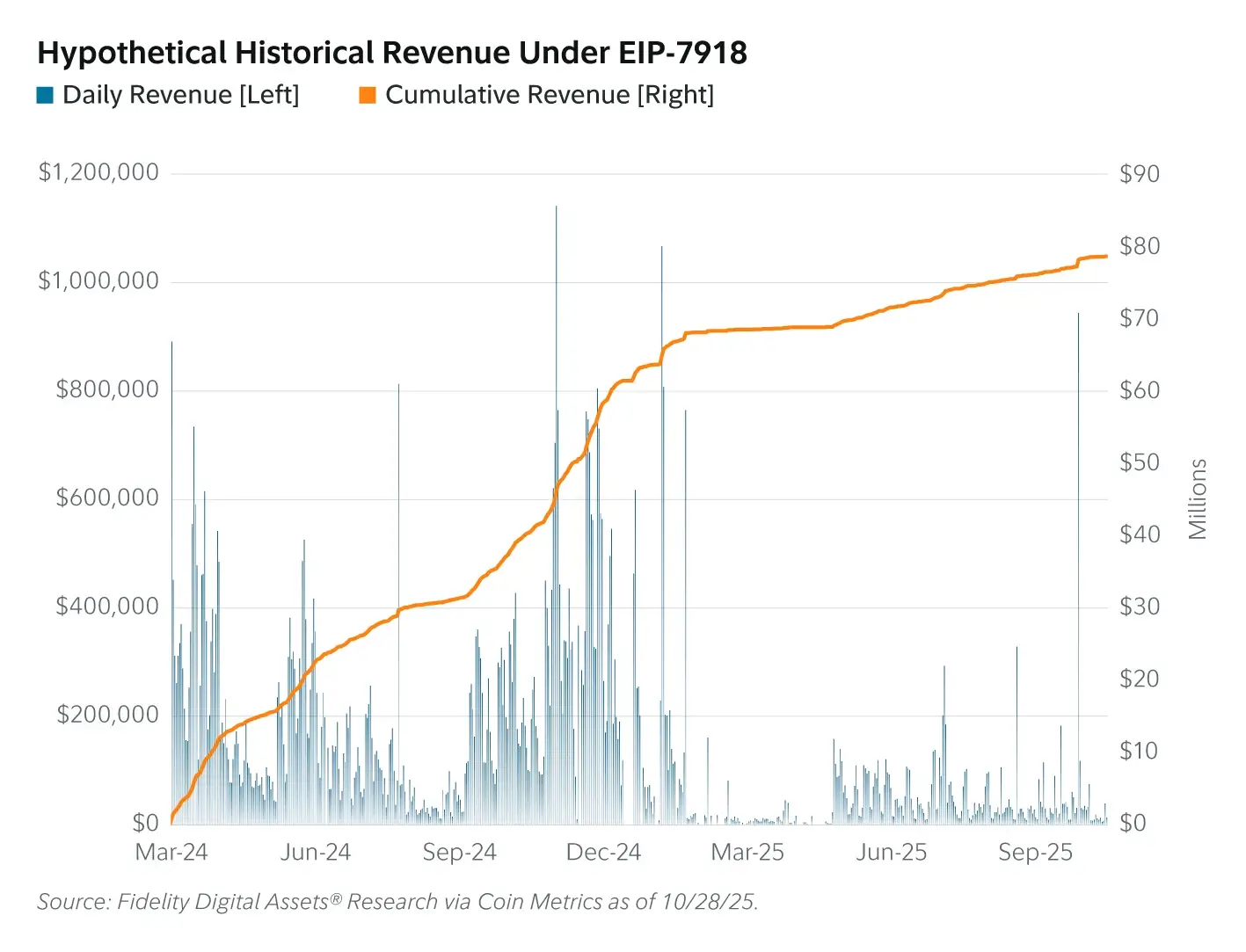

Fidelity’s analysis shows that if EIP-7918 had been active since the Deneb-Cancun upgrade, Ethereum would have generated an additional $78.6 million (24,641 ETH) in cumulative blob-fee revenue. The firm said that 93% of days since 2024 would have recorded higher blob fees under the new model.

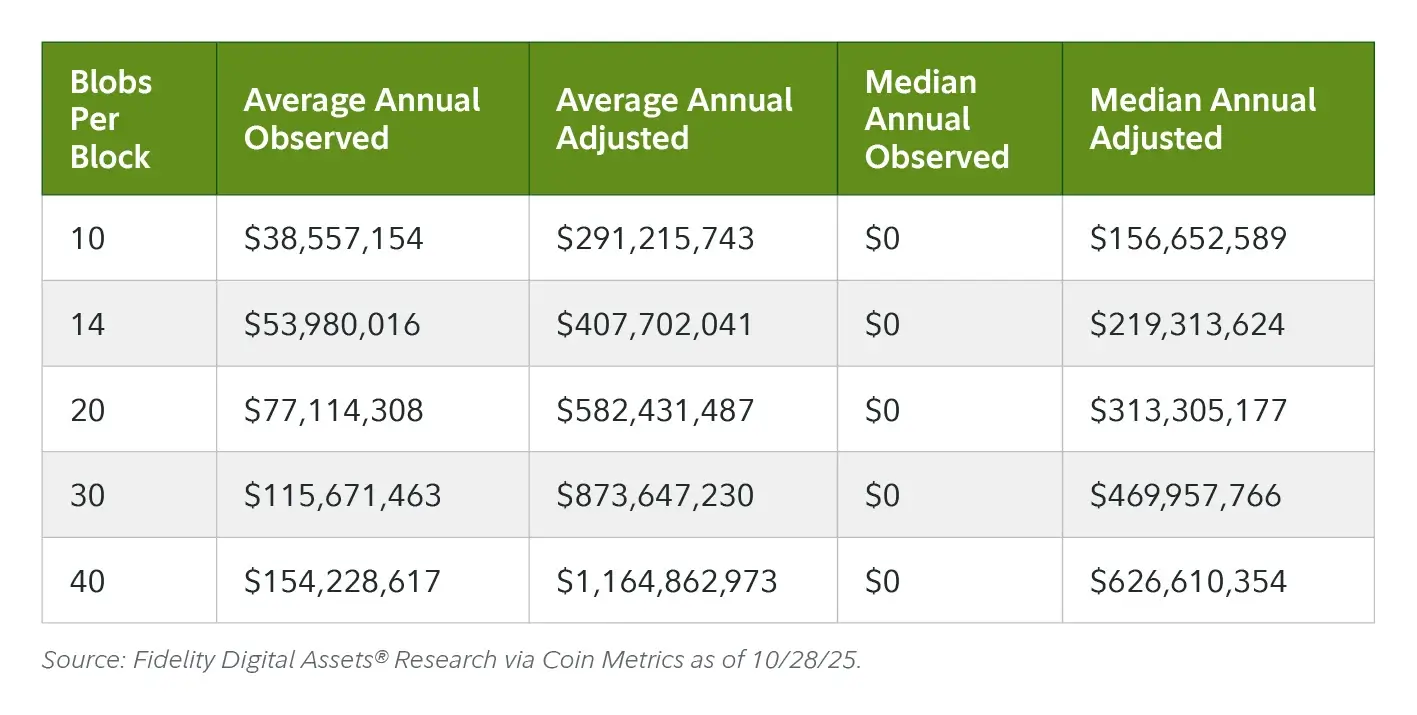

The upgrade is paired with PeerDAS (EIP-7594), which enables nodes to verify blob data through sampling rather than full downloads. This shift is expected to enable a 10× increase in blob throughput over time. Developers have already agreed to raise blob capacity to 10 and 14 blobs per block through BPO forks scheduled for December 2025.

Ethereum’s Fusaka Peer-to-Peer Data Availability Sampling (Source: Fidelity Digital Assets)

Fidelity noted that combining higher blob supply with the blob-fee floor transforms blobs from a subsidized utility into a scalable revenue source. The firm estimated that Layer-2 networks would face an added cost of about $6.02 per blob, with Base alone projected to incur approximately $30.6 million in added fees over a year.

Layer-2 Economics Shift as Based Rollups Gain Momentum

Beyond data availability, Fidelity said Fusaka introduces mechanisms that could reshape Layer-2 design and potentially shift more economic activity back to Ethereum Layer 1.

EIP-7917 adds deterministic proposer lookahead, enabling based rollups to use preconfirmations, which are validator-backed guarantees of transaction inclusion. These systems rely directly on Ethereum validators for sequencing, reducing reliance on single-sequencer models and strengthening censorship-resistance guarantees.

Fidelity said that based rollups carry two economic implications: higher blob usage and increased MEV and preconfirmation tips flowing to Ethereum validators. This could raise staking yields and drive more value to ETH holders if adoption expands.

Execution-Layer and UX Enhancements Strengthen the Foundation

Fusaka also includes optimizations across Ethereum’s execution and networking layers. These include:

- EIP-7935: lifting the gas limit to 60 million, expanding Layer-1 execution capacity.

- EIP-7825: Enforcing a 16.7 million gas transaction cap to prevent resource-heavy transactions.

- EIP-7951: adding secp256r1 support to enable integration with hardware such as Apple Secure Enclave and Android Keystore.

- EIP-7939: introducing a CLZ opcode to reduce costs for zero-knowledge and compression operations.

Fidelity noted these changes strengthen the network’s baseline performance while supporting broader adoption.

Conclusion

Fidelity Digital Assets said the Fusaka upgrade represents a turning point in Ethereum’s evolution, shifting the network toward monetizable infrastructure and clearer value pathways for ETH holders. The research team said the upgrade aligns scalability, pricing power, and economic sustainability in a way not previously seen in Ethereum’s roadmap.