- BitMine’s ETH stack reached 3.63M tokens after adding another $200M to reserves.

- The firm now owns 3% of the ETH supply as crypto and cash holdings rise to $11.2B.

- On-chain activity shows BitMine steadily buying market dips as liquidity thins.

BitMine Immersion Technologies added another large block of Ethereum to its balance sheet this week, lifting its total holdings to 3.63 million ETH and reinforcing its position as the world’s largest Ethereum treasury. The move came as crypto markets continued to cool, presenting an opportunity the company has repeatedly used to expand its reserves.

Major ETH Purchase Lifts Total Supply Share to 3%

The latest accumulation followed two weeks of aggressive on-chain activity tied to BitMine-controlled wallets. According to the company, it added 69,822 ETH last week and more than 200,000 ETH in the prior week, bringing its total to 3,629,701 ETH as of November 23. This represents 3% of all ETH in circulation, moving the firm two-thirds of the way toward its long-telegraphed goal of acquiring 5% of the token’s supply.

At the current market pricing of $2,840 per ETH, BitMine’s stack is valued at just over $10.2 billion, although the company notes its broader crypto, cash, and “moonshot” holdings total $11.2 billion. The balance sheet also includes 192 BTC, $800 million in unencumbered cash, and a $38 million stake in Eightco Holdings (ORBS).

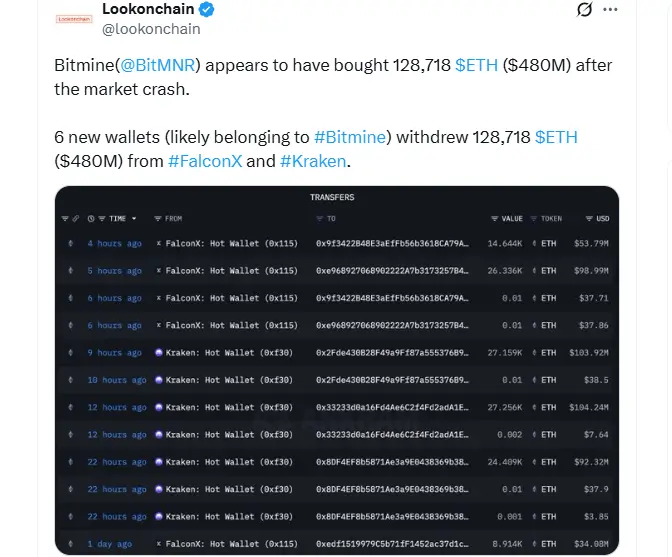

Blockchain analytics firm Lookonchain separately observed withdrawals of 128,718 ETH from Kraken and FalconX over the weekend from newly created addresses likely linked to BitMine, aligning with the firm’s updated totals.

Bitmine Buys 128,718 $ETH ($480M) (Source: X)

Market Decline Opens Accumulation Window

BitMine’s latest purchases occurred during a sharp decline in crypto markets. Ethereum has fallen nearly 30% in the last month, slipping from above $4,500 to around $2,800. The company pointed to weakened liquidity since October 10, as well as technical pressure across major assets.

BitMine chairman Thomas “Tom” Lee said the firm viewed the environment as an opportunity, explaining that liquidation-driven volatility can force prices below fundamental value. “The crypto liquidation over the past few days created a price decline in ETH, which BitMine took advantage of,” he said.

Besides, the firm previously projected potential downside toward $2,500, a level now within reach, and noted the current price zone offers “asymmetric risk/reward” for long-term strategic accumulation.

“A few weeks ago, we noted the likely downside for ETH prices would be around $2,500, and current ETH prices are basically there,” said Thomas “Tom” Lee of Fundstrat, Chairman of BitMine. “This implies asymmetric risk/reward as the downside is 5% to 7%, while the upside is the supercycle ahead for Ethereum.”

BitMine: A Leading Player in the Digital Asset Treasury Sector

BitMine continues to sit among the world’s top digital asset treasuries (DATs). It is now the #1 ETH treasury globally and the #2 overall crypto treasury, behind only Strategy Inc. (MSTR), which holds 649,870 BTC valued at $57 billion.

Investor support for BitMine remains broad. The company is backed by institutions including ARK’s Cathie Wood, MOZAYYX, Founders Fund, Bill Miller III, Pantera, Galaxy Digital, Kraken, and individual investor Tom Lee. This investor base has helped BitMine expand its NAV per share faster than its peers while maintaining strong trading liquidity.

Its stock, BMNR, is one of the most actively traded equities in the United States. With an average dollar volume of $1.6 billion per day over the past week, BitMine ranks #50 in U.S. trading activity, wedged between Mastercard and Palo Alto Networks among more than 5,700 listed stocks.

Next Steps: Shareholder Meeting and MAVAN Rollout

According to reports, BitMine will hold its annual shareholders meeting at the Wynn Las Vegas on January 15, 2026, where it is expected to provide updates on its Made in America Validator Network (MAVAN). The company says this staking infrastructure will launch in early 2026 and is intended to be a “best-in-class” validator framework for Ethereum’s proof-of-stake network.

The firm recently reported $328 million in net income for the fiscal year ending August 31. It also announced a forthcoming dividend and approved a share-buyback initiative earlier this year, making it one of the first DATs to pursue both strategies while continuing large-scale ETH accumulation.