- Bitget Wallet integrates HyperEVM to open direct DeFi access on Hyperliquid.

- Integration connects 80 million users for cross-chain trading and HYPE token use.

- HYPE surges 25% weekly to $47 as analysts watch resistance at $49 to $51.

Bitget Wallet has finished linking its system to HyperEVM, the Ethereum-compatible layer that powers smart contracts on the Hyperliquid blockchain. The move, revealed on Tuesday, plugs the wallet’s 80 million-plus users straight into one of the busiest decentralized exchanges on the market.

With the link active, users can move assets across chains, reach HyperEVM-based DeFi apps, and handle the HYPE token without leaving the wallet. More tools—perpetual trading, contract interaction, and additional DeFi modules —are lined up for release over the next few weeks.

Bitget Announces Full Integration With HyperEVM (Source: X)

“Our goal is to simplify access to one of crypto’s fastest-growing ecosystems,” said Jamie Elkaleh, Bitget Wallet’s chief marketing officer.

“By integrating HyperEVM end-to-end, we are enabling self-custody users to engage with a high-performance infrastructure covering trading, programmable finance, and cross-chain flows,” he added.

Hyperliquid’s Fast-Moving Engine

Hyperliquid runs a decentralized exchange built for speed. Its HyperCore engine delivers spot and perpetual markets with low latency and deep on-chain order books—performance that rivals centralized platforms. Adding HyperEVM opened the door for DeFi projects to build on top of that liquidity using smart contracts.

Since going live in 2023, Hyperliquid has cleared more than $1.5 trillion in trades and holds about $4.85 billion in total value locked, data from DefiLlama shows. The scale puts it among the top performers in decentralized finance.

Bitget users can now add the HyperEVM network, move tokens through deBridge, and trade via aggregators such as LiquidLaunch. A new HyperEVM dApp section within the wallet streamlines onboarding and makes multi-chain navigation significantly less cumbersome.

Expanding Multi-Chain Finance

Bitget Wallet already spans more than 130 blockchains and maintains a $700 million protection fund for user assets. The HyperEVM tie-in adds another layer of connectivity, providing traders and developers with a more straightforward path between lending, staking, and tokenized-asset markets. The company stated that the goal is broader than just one integration: to make cross-chain DeFi a routine, rather than an experimental process.

HYPE Token Extends Gains Following HyperEVM Integration

The HYPE token has regained a firm footing after the HyperEVM integration. In the last 24 hours, it has inched up almost 2%, extending its weekly climb to about 25% and trading just above $47.

Market data indicate that the token’s valuation now exceeds $16 billion, while daily trading volume has increased to over $650 million, representing a roughly 25% rise within the same period. The shift suggests investors are warming to HYPE’s growing role inside the expanding Hyperliquid ecosystem.

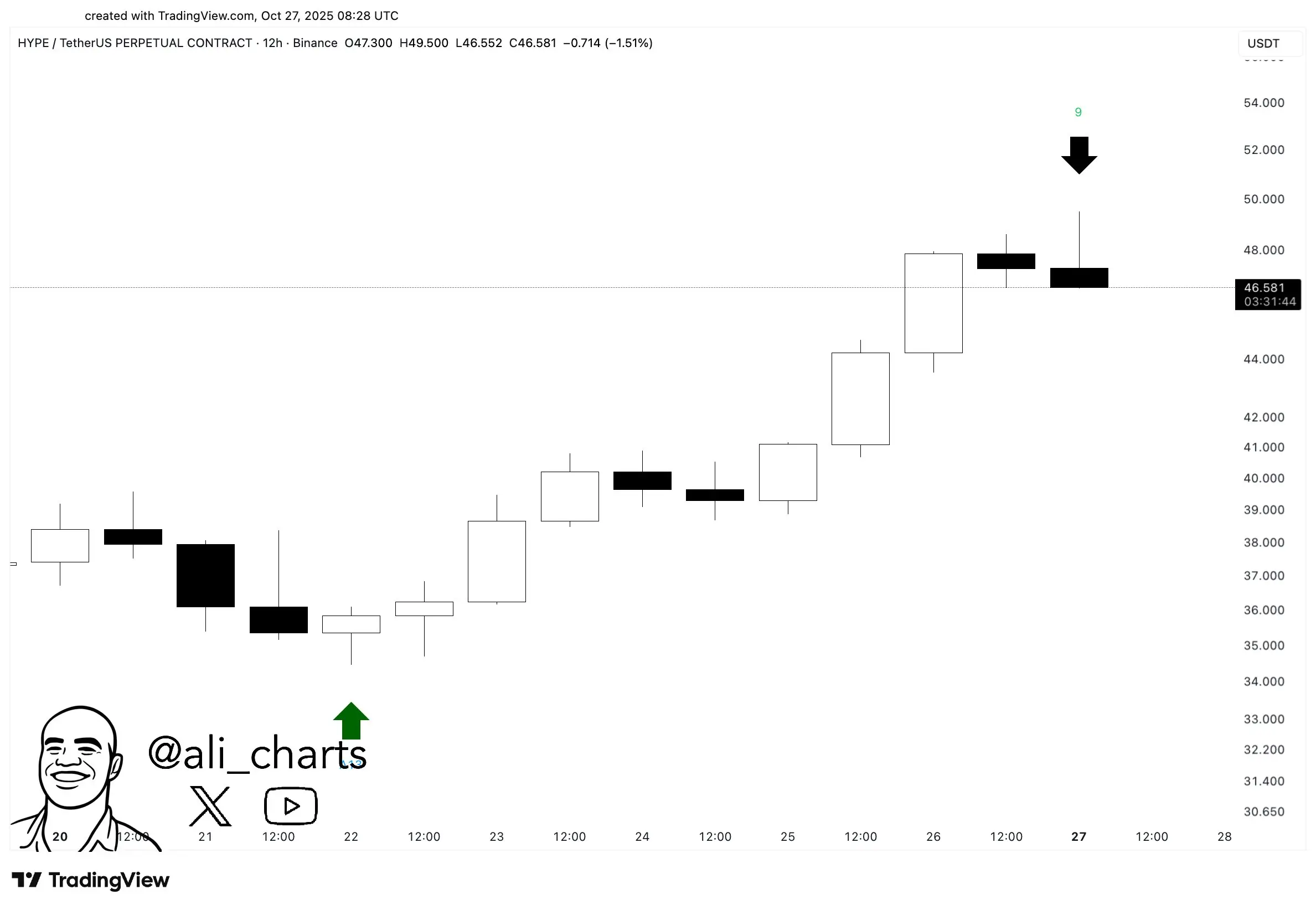

Technically, the token remains in a bullish structure. Prices have risen from $31 to recent highs near $49, where the market met resistance between $49 and $51. Analysts expect sideways movement within that band before any fresh upward push.

HYPE Price Action (Source: TradingView)

Similarly, the relative strength index, currently near 60, indicates solid momentum but suggests that gains may slow unless the ceiling is broken. Should buyers hold control, upside markers sit near $51 and $59.

However, not everyone sees the short term through the same lens. Market observer Ali flagged a TD Sequential sell signal on the HYPE chart—often a sign of a pause or brief pullback.

HYPE Price Chart (Source: X)

If prices retreat, support is expected to appear around the 0.618 Fibonacci level, near $44, and the 0.50 level, near $39. A deeper slide under those areas could send HYPE toward the $33 to $35 range, which served as a rebound zone earlier this month.