- Cathie Wood expects Bitcoin to drive most of a $25 trillion crypto market by 2030.

- Institutional investment continues to lift Bitcoin toward global financial integration.

- Historical data show Bitcoin’s consistent gains, strengthening its long-term dominance.

Cathie Wood, the head of ARK Invest, has made a bold prediction that the entire cryptocurrency market will reach $25 trillion by 2030, with Bitcoin accounting for the majority of that market share. During a recent interview released by Bitcoin Archive, Wood expressed her continued faith in Bitcoin’s long-term prospects, citing the increasing participation of institutions and clearer regulations as the two main factors that will support the rise of this digital asset worldwide.

Institutional Adoption Accelerates Bitcoin’s Growth

Wood has stated that the ever-increasing institutional interest in Bitcoin is primarily due to its role as a digital gold alternative and its status as an inflation hedge. Pension funds, sovereign wealth funds, and big corporations are now investing small portions of their portfolios in Bitcoin and other cryptocurrencies.

According to internal research by ARK Invest, if institutions allocate even just 5% of their holdings to this area, it would result in the price of Bitcoin reaching $1 million per coin by 2030. Wood noted that the cryptocurrency’s finite supply of 21 million coins strengthens its scarcity-driven value proposition as global demand rises.

Meanwhile, U.S.-based spot Bitcoin exchange-traded funds (ETFs) have attracted billions of dollars in inflows. Wood described these as a structural shift toward BTC’s mainstream recognition as a reserve asset. She said, “We have done an interesting forecast of the entire crypto asset system… We expect to hit $25 trillion in 2030, the vast majority of that in Bitcoin.”

Wood also compared BTC’s rule-based framework to the gold standard, which the United States abandoned in 1971, calling it a critical monetary innovation. She stated that the crypto ecosystem represents the kind of disciplined financial system that traditional markets have lacked for decades.

Market Trends Support Long-Term Projection

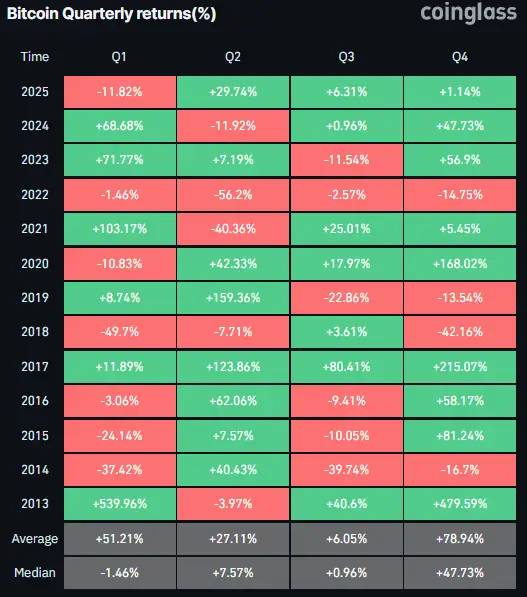

Recent data from Coinglass strongly supports Wood’s prediction, as it demonstrates Bitcoin’s stability in the last three months of the year. The exceptional years were 2013 and 2017, when price hikes in the previous quarter exceeded 200%, indicating the tops of firm bull markets.

Bitcoin Quarterly Returns (Source: Coinglass)

During the second quarter of 2025, BTC witnessed a substantial rise of 29.74%, while the following periods recorded lower increases: 6.31% in the third and 1.68% in the last quarter. The beginning of the year was marked by uncertainty, but the crypto market gradually regained its footing as traders’ confidence increased and the overall market became more stable.

According to analysts, the rebound fits with Cathie Wood’s long-term projection. They note that consistent institutional buying and reliable liquidity flows have played a crucial role in helping the cryptocurrency remain stable amid shifting global conditions. Those same factors, they added, continue to give the currency a base of strength even when volatility returns.

In 2018 and 2022, when human and market sentiment were largely negative and people were dumping their cryptocurrencies, the incremental Bitcoin data for each quarter still reflected short-lived recoveries, thus confirming its ability to bounce back and remain noticeable.

This cyclical strength in the market is what is gradually building investors’ trust, with large financial institutions being the first to have made up their minds and are slowly entering the crypto space through diversification.

Bitcoin’s Current Momentum Reflects Confidence

According to CoinMarketCap, the price of BTC is $115,140, reflecting a minor daily loss of 0.14% alongside a 15.32% decrease in trading volume to $52.13 billion. The total market value of the asset remains at $2.29 trillion, mainly due to the fact that 19.94 million BTC have been mined out of a total of 21 million, the maximum that can ever exist.

The token traded in a narrow band between $114,930 and $116,000, exhibiting only slight movement throughout the day while maintaining its overall steadiness. Analysts noted that this firm tone followed a week of heavier institutional trading, a pattern consistent with Cathie Wood’s outlook for Bitcoin’s long-term command within a more developed digital economy.

With prices holding near record territory and large investors showing renewed interest, one question now defines the market’s next chapter: Can BTC keep this stride and ultimately meet Cathie Wood’s $25 trillion projection by 2030?