- Bitcoin miners’ margins tighten as difficulty stays high and older rigs near breakeven lines

- Newer hardware holds better ground, yet still needs strong BTC prices to stay secure

- Profitability metrics sink to yearly lows while miners adjust fleets to cut losses

Bitcoin miners are running into a tightening squeeze as network difficulty stays near record territory and energy costs give operators little breathing room. New figures compiled from Antpool show several widely used rigs drifting toward “shutdown price” levels, the point where electricity alone eats nearly all revenue. It’s not a sudden collapse, but the gradual erosion of margins across the sector is becoming harder to ignore.

Bitcoin Miners Face Shutdown Risk as Profitability Falls (Source: X)

The projections, built around an assumed $0.08 per kilowatt-hour power cost, suggest older machines are now operating in a narrow band where small market shifts carry outsized consequences. Bitcoin miners relying on legacy fleets or inflexible electricity contracts appear particularly exposed as the economics tilt against them.

Bitcoin Miners: Older Rigs Face the First Wave of Pressure

Antpool’s profitability chart places workhorse units such as the Antminer S19 XP+ Hydro, WhatsMiner M60S, and Avalon A1466I near breakeven. In practice, this means that a minor dip in Bitcoin’s price or an incremental difficulty increase could make continued operation uneconomical for many operators.

According to the report, several mining firms have already begun trimming activity in response to the squeeze, often starting with aging units that no longer justify their energy draw. While the sector has weathered cycles like this before, the current compression leaves little room for hesitation. Consequently, operators who cannot adjust quickly may have to shutter parts of their fleets until conditions ease.

Newer Models Hold Up, but Conditions Are Unforgiving

Even recent-generation hardware is not entirely insulated. Antpool’s estimates place the Antminer S21 line’s shutdown threshold somewhere between $69,000 and $74,000 per BTC, higher than many miners would prefer given the latest difficulty levels.

These machines are far more efficient, yet the steep competition across the network means efficiency alone doesn’t guarantee comfort. The picture shifts only slightly at the top of the market.

High-hashrate models such as the U3S23H and S23 Hydro have far more runway, with shutdown prices closer to $44,000 per BTC. Operators with the capital to deploy these higher-end units continue to enjoy a buffer that the rest of the field lacks.

Profitability Indicators Slide to Multi-Month Lows

Moreover, industry-wide metrics reflect the same trend. The miner profitability sustainability index tracked by CryptoQuant has slipped to its weakest reading since late 2024, pointing to softer revenue relative to fixed costs.

Bitcoin Miners Profit/Loss Sustainability (Source: CryptoQuant)

Weather-related disruptions in parts of the United States earlier this winter added another strain, curbing power availability and trimming hash rate for several operations. Yet, none of these episodes were severe on their own, but taken together, they underline why margins feel thinner than they did even a few months ago.

For Bitcoin miners, the near-term playbook rarely changes: power down inefficient rigs, renegotiate energy contracts where possible, or move capacity to cheaper regions. Some firms have leaned further into demand-response programs, selling excess load back to electrical grids when prices spike.

Technical Picture for BTC Adds Another Layer

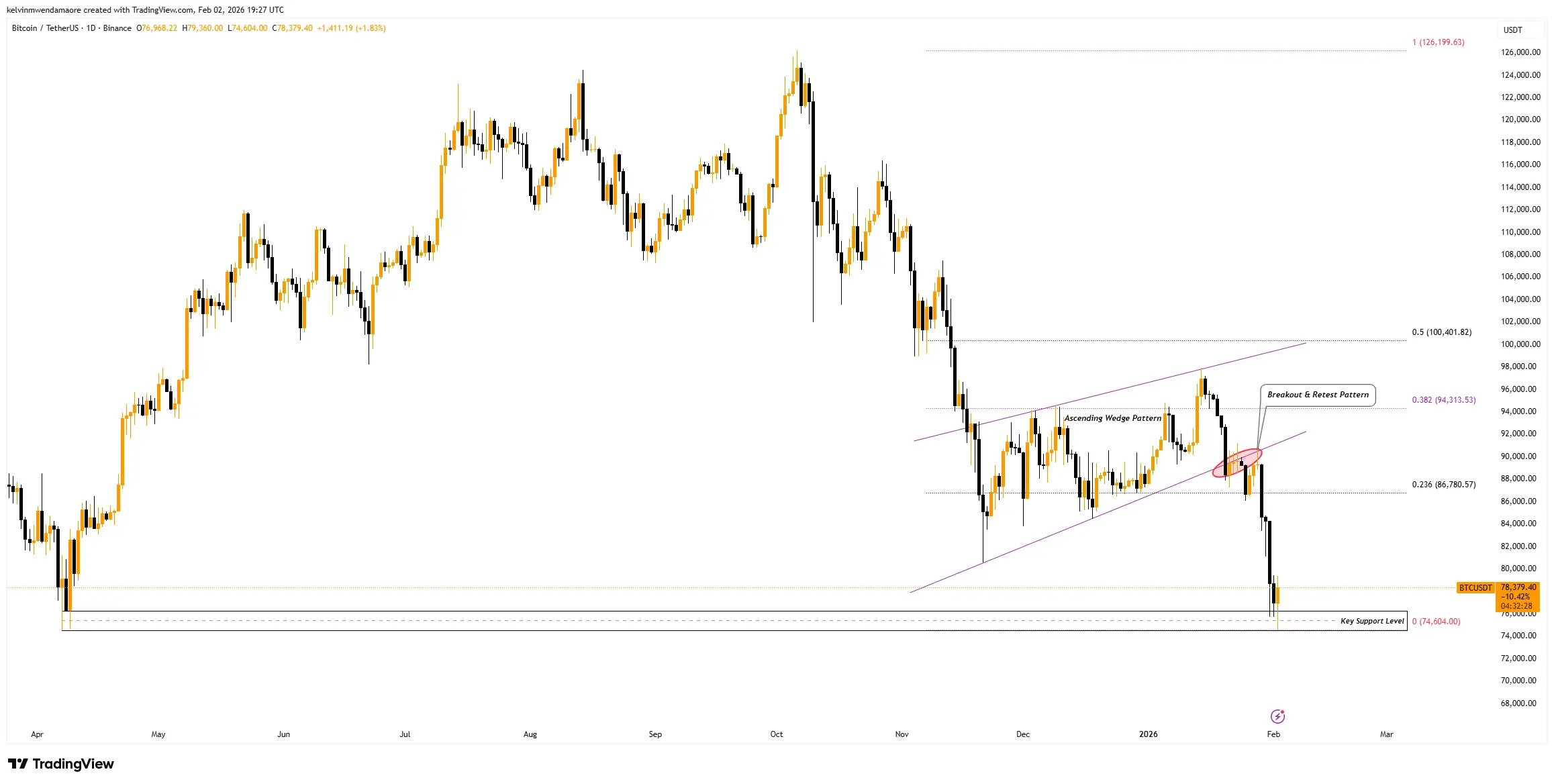

On the market side, the tone has softened after Bitcoin slipped out of an ascending wedge pattern. TradingView analysis shows a clean break below support, followed by a brief retest that failed, reinforcing a bearish tilt.

BTC Price Chart (Source: TradingView)

Still, a familiar demand zone between $74,000 and $76,000 has held firm so far. Bitcoin’s latest rebound to roughly $78,424 suggests buyers continue to defend that range, even if momentum looks shakier than it did earlier in the month.

Taken together, the data paint a mining sector increasingly defined by divergence. Operators with modern fleets and low-cost energy retain an advantage, while older machines inch closer to the point where running them no longer makes sense. As always, difficulty adjustments may eventually offer some relief, but miners will have to endure the current strain until the network resets.