- Beacon enables real-time crime detection with instant alerts and blocked withdrawals.

- Major firms like Coinbase, Binance, Ripple, and Kraken back the new defense system.

- TRM Labs enforces accountability to ensure responsible use of its flagging authority.

The cryptocurrency sector is entering a new phase of security with the launch of the Beacon Network, the first unified defense system against digital asset crime. The initiative, created by blockchain intelligence firm TRM Labs, has gained the support of major platforms including Coinbase, Binance, Ripple, Kraken, and PayPal. It brings in real-time monitoring, intelligence sharing, and coordinated response to prevent illicit funds from exiting the crypto ecosystem.

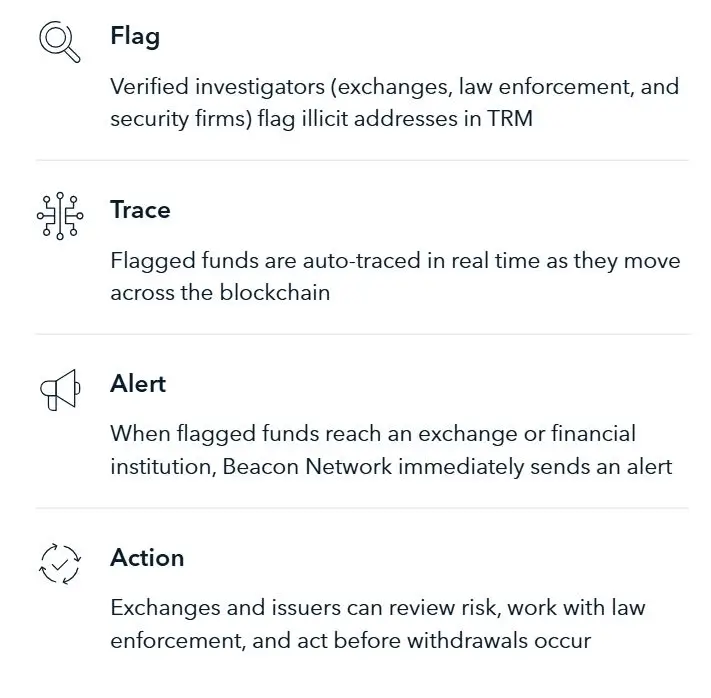

How the Beacon Network Works

The Beacon Network functions through four major processes aimed at enhancing the security of crypto in real time. Its first capability allows trusted investigators and security researchers to mark suspicious wallet addresses. Once identified, the second function, ‘trace,’ comes into play, spreading flagged labels across associated accounts on connected platforms.

Beacon Network’s Central Operation Functions (Source: TRM Labs)

This makes threats easily identified within the ecosystem. The third feature sends immediate alerts in case illicit funds are detected on a participating exchange or platform. This timely notification enables teams to act on the spot, minimizing the chances of withdrawals or laundering.

Finally, exchanges have the option to place flagged deposits on hold for review. This creates a fast-response loop that blocks criminals from cashing out while investigations continue.

Expanding to the Wider Crypto Ecosystem

The Beacon Network is built for accessibility. It welcomes vetted exchanges, stablecoin issuers, DeFi platforms, and law enforcement agencies at no cost. By combining these functions, the system forms a unified defense, offering proactive tools to detect, block, and disrupt criminal activity across multiple blockchains in real time.

“Network’s real‑time intelligence allows us to act within moments…,” said CJ Rinaldi, Chief Compliance Officer at Kraken. “We’re proud to be a member and look forward to working closely with our peers to stay one step ahead of illicit actors.”

The launch also arrives at a time of growing regulatory attention. Authorities in multiple jurisdictions have criticized the crypto sector for allowing illicit funds to flow unchecked. However, by adopting Beacon Network, companies hope to establish a model of collaboration and openness, which could be implemented worldwide by regulators.

Addressing Global Threats in Real Time

According to TRM Labs, at least 47 billion dollars of cryptocurrency have been linked to fraud-related addresses since 2023. North Korean-affiliated hacks, ransomware, terrorism financing, and child sexual abuse material (CSAM)-related transactions continue to be the primary targets of the system.

The Beacon Network is already credited with freezing $1.5 million connected to a global scam and identifying $800,000 in deposits tied to fraudulent activity at a large exchange. Its design has been described as a complete “kill chain” for illicit crypto assets, moving from detection to interdiction in minutes rather than days.

“Until now, law enforcement and cryptocurrency platforms have operated in silos, reacting only after illicit funds have disappeared. The window for interdiction is often measured in minutes, not days. With Beacon Network, that changes,” the firm said.

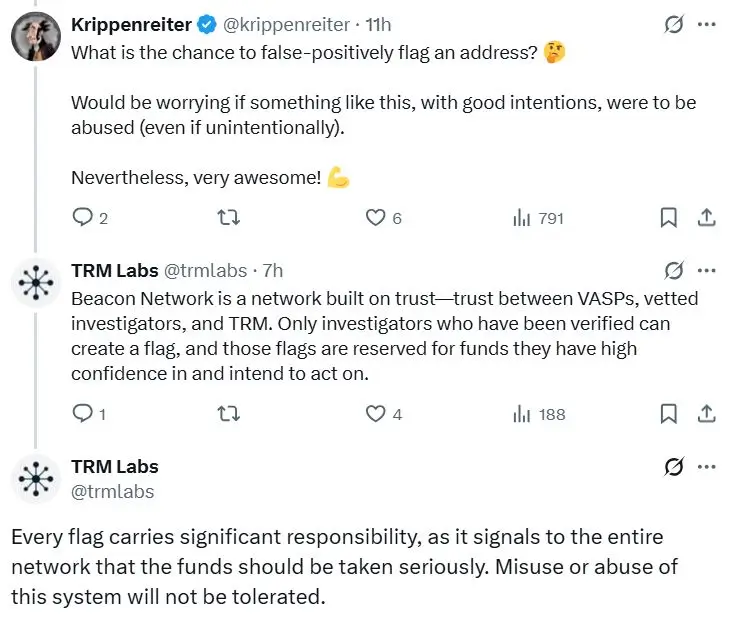

Safeguards Against False Flagging

When asked by an X user about the risk of false positives, TRM Labs addressed the concern directly. The query indicated anxiety that some people have, that well-intentioned actions might have unintended consequences, and that innocent addresses might be labeled erroneously.

TRM Labs Response Toward False Flagging (Source: X)

In response, TRM Labs emphasized that Beacon Network is not an open system in which anyone can label an address as suspicious. Instead, only vetted investigators with proven expertise are allowed to flag funds, and they must act with high confidence in the evidence they hold.

“Every flag carries significant responsibility, as it signals to the entire network that the funds should be taken seriously,” TRM Labs noted. The company added that any misuse or abuse of this authority “will not be tolerated.”