Aptos Sees 20M Monthly Addresses as India Leads Usage

Aptos is deepening its focus on India as a core growth market, with the country driving a majority of network activity. CEO Avery Ching said the blockchain records “around 20 million monthly active addresses,” noting that India accounts for more than half of them.

Aptos Sees 20M Monthly Addresses as India Leads Usage (Source: X)

The project’s joint effort with Reliance Jio supports expansion into payments, advertising, and consumer-scale use cases. Ching also highlighted that centralized exchanges earn “more than $50 billion in revenue,” a share he wants to move on-chain.

Aptos has backed Indian startups such as Chingari, Stan, and KGEN and is running government pilots in Telangana, where over 20,000 students already store resumes on-chain.

Ripple Crosses 300-Bank Milestone as Finance Tests Blockchain

Ripple has quietly crossed a notable threshold. More than 300 banks and financial institutions now sit inside RippleNet, spanning over 45 countries across six continents. The list mixes global lenders, regional banks, and payment firms, many using blockchain rails to shorten settlement times and reduce friction in cross-border flows.

Ripple Crosses 300-Bank Milestone as Finance Tests Blockchain (Source: X)

Not every partner touches XRP directly, but that nuance hasn’t slowed momentum. What stands out is institutional comfort. Banks are testing live blockchain infrastructure, not whitepapers. Stablecoins, on-demand liquidity, and compliance-ready rails are entering routine operations.

For the blockchain sector, this marks steady normalization. Adoption isn’t loud or speculative. It’s incremental, operational, and increasingly hard to reverse.

Aura Blockchain Tracks 70M Luxury Items, Earns Sustainability Award

The Aura Blockchain Consortium quietly crossed a threshold few enterprise blockchain projects reach. More than 70 million luxury items are now tracked end-to-end. That scale mattered. It helped Aura secure a sustainability award and, more importantly, industry credibility. Backing from LVMH and Prada anchored the effort in real commercial demand, not pilot-stage ambition.

This wasn’t about hype cycles or token launches. Aura showed blockchain working quietly in the background, cutting counterfeits, tightening supply chains, and improving disclosure. For the sector, it reinforced a simple message: durable adoption comes from solving specific problems, at scale, inside existing industries.

Humanity Protocol Reaches $1.1B Valuation After $20M Raise

Humanity Protocol vaulted into the unicorn tier, landing a fully diluted value of about $1.1 billion after raising $20 million in fresh funding. As reported by Reuters, the firm is rolling out a palm-scan system meant to confirm real users online without exposing their personal details, a pitch that has drawn growing interest as deepfakes and fraud spread across the web.

Humanity Protocol Reaches $1.1B Valuation (Source: X)

The deal hints at a broader shift. Investors are backing identity tools that anchor trust rather than speculative assets. Humanity’s upcoming token launch and wider product release suggest that biometric verification may become one of blockchain’s more durable use cases.

Yuga Labs Debuts Otherside, Marking Its Biggest NFT Bet Yet

Yuga Labs finally switched on its long-promised metaverse, Otherside, closing a three-year build that began after its hefty $450 million raise. The launch, revealed during ApeFest in Las Vegas, arrived with more weight than most NFT projects have carried in recent memory.

Otherside landed as a working example of what asset ownership in virtual worlds might look like. Players could bring their NFTs in as full 3D avatars and move digital items across different spaces, a shift that gave the blockchain sector something it has needed: proof that these ideas can operate at scale, not just on paper.

JPMorgan Bets $100M on Tokenized Finance With MONY Debut on Ethereum

JPMorgan pushed deeper into digital markets with a $100 million tokenized money market fund built on Ethereum, a move that landed with more force than past experiments. The new vehicle, MONY, leans on the bank’s Kinexys platform to tighten settlement and give qualified investors a cleaner look at underlying liquidity.

The launch arrives as tokenization picks up speed across major firms, helped by clearer rules and rising demand for on-chain versions of traditional assets. JPMorgan’s entry adds weight to that momentum, suggesting the shift isn’t a passing trial but a structural change in how market plumbing may evolve.

Coinbase’s ‘Everything Exchange’ Vision Takes Shape With Stocks Rollout

Coinbase has begun its broadest shift yet, folding U.S. stock trading and regulated prediction markets into its retail app. The update pulls equities, crypto, and event contracts into one interface, signaling a push toward what executives frame as an “everything exchange.” Stock trading launches with zero commissions, near-continuous access, and settlement in dollars or USDC.

Coinbase’s ‘Everything Exchange’ Vision Takes Shape (Source: X)

Prediction markets arrive via a regulated partnership with Kalshi, keeping the product within established oversight. Alongside this, Coinbase is expanding stablecoin and payment tools. The move echoes wider institutional momentum, including JPMorgan Chase & Co.’s $100 million tokenized fund built on Ethereum.

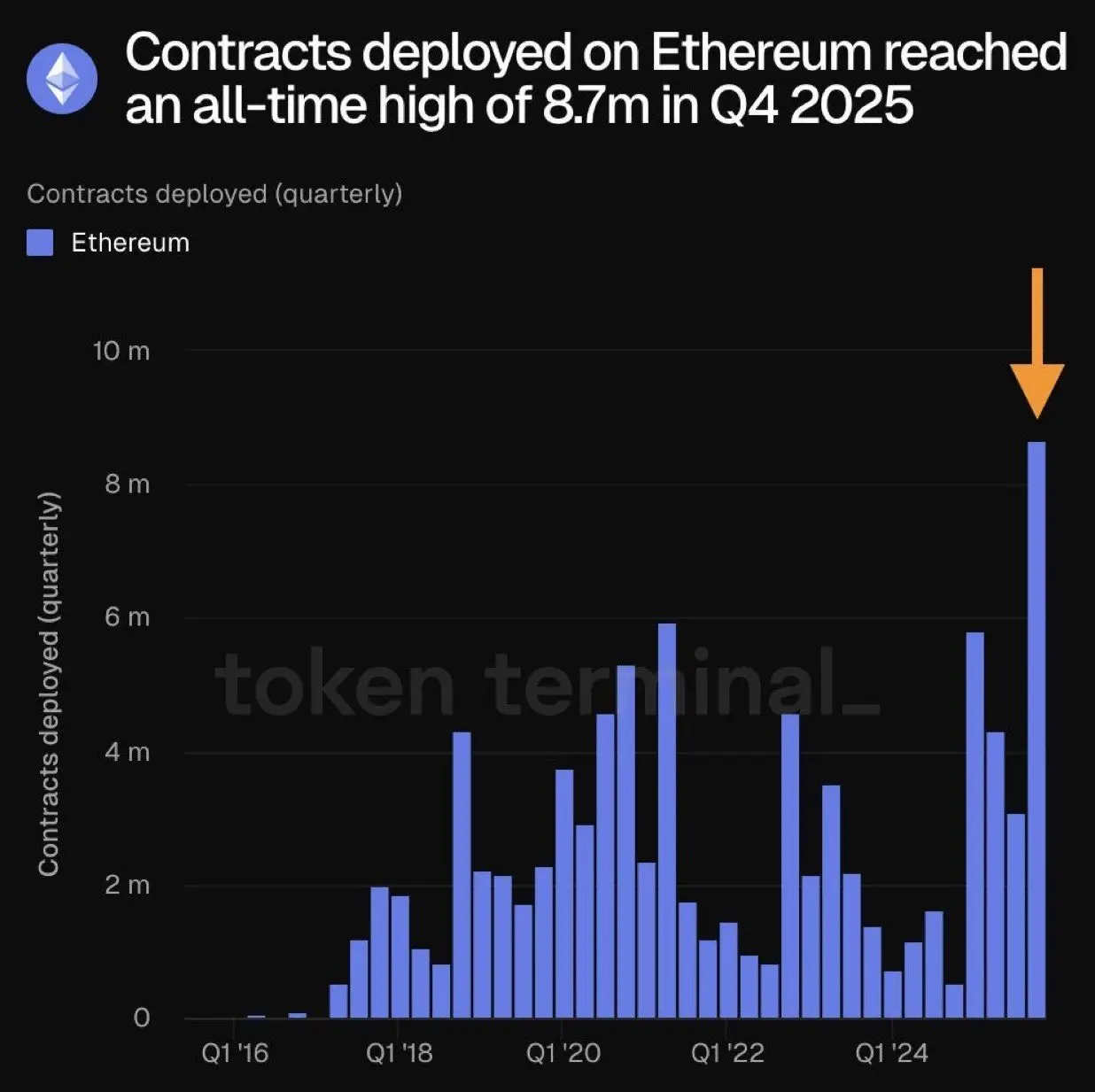

Ethereum Quietly Sets a Record With 8.7M Contracts in One Quarter

Ethereum ended the fourth quarter with a signal that markets largely ignored. While Ether’s price drifted sideways, developer activity surged. Data from Token Terminal shows that 8.7 million new smart contracts were deployed on Ethereum in Q4, the highest quarterly total ever recorded for the network.

Ethereum Quietly Sets a Record With 8.7M Contracts (Source: X)

The figure marked a decisive rebound. Contract creation had slowed noticeably in the middle of the year, tracking broader risk aversion across crypto markets. However, by late Q4, that hesitation had faded.

Builders returned, not in bursts of speculation, but in steady volume tied to infrastructure and settlement use. Token Terminal described the shift as organic. No single application category dominated. Instead, the growth came from several layers of the stack moving at once.

Bitcoin Core Clears First Public Audit With No Critical Issues

Bitcoin Core quietly crossed a milestone. For the first time in its 16-year history, the software underpinning most of the Bitcoin network underwent a fully public, third-party security audit. The review, led by Quarkslab and backed by Brink and OSTIF, found no critical, high, or medium-risk issues in the areas examined.

Auditors focused on peer-to-peer networking, mempool behavior, chain handling, and consensus logic. While only minor issues surfaced, the process delivered something more lasting: stronger fuzzing tools and deeper test coverage. Together, they leave Bitcoin Core better tested, better understood, and more resilient going forward.

Gate Goes All In on Web3 as Volumes and Users Surge

Gate spent 2025 quietly redrawing its identity. What began as a centralized exchange widened into a vertically integrated Web3 platform, backed by regulatory clearances in Dubai and Europe. Licenses under VARA and MiCA gave the firm room to scale, while new products, from tokenized stocks to crypto travel payments, filled out the retail edge.

Gate Goes All In on Web3 (Source: X)

Infrastructure did the rest. Gate launched its own Layer 2 network, pushed into decentralized perpetuals, and saw its user base swell past 46 million. Monthly spot volumes climbed above $160 billion, lifting Gate into the global top tier. By year’s end, reserves were strong, transparency was tighter, and market presence was hard to ignore.