BONK Market Overview

Launched in December 2022, BONK is a dog-themed meme token based on Solana. Its community-driven ethos gives users an opportunity to engage with the Solana ecosystem while connecting with other members of the community. To gain traction in the marketplace, BONK uses a large airdrop to give away tokens to users, developers, and NFT holders, and emphasizes a fair distribution of tokens and organic growth of its user and developer base instead of traditional venture capital investments.

BONK is important within the larger meme coin market as the primary meme token for Solana. It also provides usability through tipping, NFT engagement, and integrated tools of decentralized finance (DeFi). These functionalities have moved the BONK token from purely speculative to functional.

The current price of BONK is approximately around $0.000011 per BONK, with a market cap of $1 Billion, and a circulating supply of 88 trillion BONK. BONK has recently experienced spikes in trading activity, community token burns aimed at decreasing supply, and a renewal of interest in Solana Meme Coins, but volatility still remains high regarding price. This page will discuss more about the BONK long-term forecast and give readers an answer to “Is BONK a good investment?”

BONK Price Analysis

Currently, the BONK price analysis indicates a slight downside pressure on the price due to several failures in holding above the most recent breakout area.

-

Current trend (Bullish/Consolidation)

Analyzing from a technical perspective, the BONK trend demonstrates a range-bound trading pattern with bearish impulsiveness occurring due to lower highs produced by buyers failing to break into the upper range of resistance areas and selling pressures created when breaking through support levels.

-

Key support and resistance levels

BONK support and resistance levels are discussed below –

Support Level – Current support level is around $0.0000129 and $0.0000131, where buyers have repeatedly re-entered the market to support price after breakdowns. If the support level holds, it will prevent further downside momentum.

Resistance Level – Short term resistance on the upside is expected to be around $0.0000137 and $0.0000144, where stronger sellers have repeatedly defended their sell bands across several sessions. To turn the sentiment bullish, prices need to break above the resistance level.

-

Trading Volume behavior

Volume has surged on breakdowns for BONK, along with failed rallies, which is indicative of distribution vs accumulation. This means there is more selling pressure than buying for BONK tokens. A very observable spike in daily volume occurred just before explosive sell-offs, signifying heavy seller market participation.

-

Momentum indicators

Looking at Bonk’s momentum indicators, BONK is currently trading at or above the major Exponential Moving Averages (EMAs), suggesting there is still potential for some bullish behaviour from longer-term price structures. However, the price is trending significantly lower on the 5-minute to hourly time frame while trading in a sideways channel. RSI values are fairly neutral or slightly overbought on various timeframes. Therefore, it indicates a lack of strong directional commitment. Overall, BONK technical analysis suggests consolidation in a bearish-pulling pattern, depending on the ability to hold above approximately $0.000013.

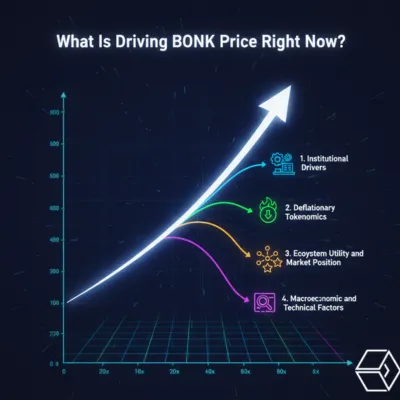

What Is Driving BONK Price Right Now?

According to our BONK future price analysis, the reasons for higher BONK price levels are the following:

1. Institutional Drivers:

- As a publicly traded company, Bonk, Inc. (Nasdaq: BNKK) has created a revenue flywheel in which the revenue is generated from its ownership of BONK.fun, the company’s launch pad. It is utilized to add additional BONK tokens to Bonk, Inc.’s treasury. In the fourth quarter of 2025, Bonk, Inc. injected $1 million into its asset portfolio, which was split between cash and BONK tokens, creating a consistent buy pressure for the BONK token.

- TenX Protocols (TSXV: TNX) announced its acquisition of over 229 billion BONK tokens, worth approximately $2.5 million, to add to its corporate treasury on January 7, 2026. This acquisition supports the assertion that BONK is a viable investment to facilitate the acquisition of institutional-grade assets that can be placed on the balance sheet of publicly traded companies.

- The establishment of the BONK Exchange Traded Product (ETP) on the Swiss Exchange allows traditional European investors access to the BONK tokens. This enlarges the pool of potential investors beyond simply crypto retail traders.

2. Deflationary Tokenomics

- The ecosystem has promised to burn 1 trillion BONK tokens, which is about 1.2% of the total supply, once the network reaches a total of 1 million unique on-chain holders. As of early January 2026, the total number of holders is just under 950,000. This has created an environment to speculate on ‘front-running’ ahead of the anticipated supply shock.

- The launchpad programmed 50% of the trading fees generated through BONK.fun launchpad’s activities directly towards buy-back and burn of BONK tokens. Since the BONK.fun launchpad is generating large amounts of revenue ($1.36 million in the first two weeks of December 2025 alone), which acts as an ongoing, volume-based deflationary approach.

3. Ecosystem Utility and Market Position

- The Market Position of BONK.fun has resulted in a significant market share compared to the competition. For example, Pump.fun has an estimated market share of over 55% of the total Solana Meme Coin LaunchPad market. This creates a solid path for BONK’s “fee to burn” utility, creating a fundamental roadmap that continues to keep the fee stream for the burn pipeline strong while diversifying Bonk’s revenue model.

- A Governance Proposal is being discussed that may create a strong connection between the dYdX trading ecosystem and BONK. If approved, all trading conducted through BONK’s GUI will allow traders to use bonk, while 50% of protocol fees generated by dYdX traders will be allocated back into the bonk ecosystem.

- BONK functions as a high-beta investment on the Solana Network. Solana is projected to create the highest revenue level of $2.4 Billion in 2025, breaking away from commercial metrics relating to price. Hence, BONK will provide support for the leading meme asset in Solana and businesses developing in the Solana ecosystem.

4. Macroeconomic and Technical Factors

- Bitcoin price remains above $90,000, creating a risk-on environment and driving capital flows into riskier investments, including meme coin investments.

- As of January 2026, BONK has broken through its multi-month descending wedge pattern and is now reclaiming key 20-day and 50-day moving average indicators, invalidating the previously established bearish trend and creating a trigger for momentum traders to enter the asset.

- Meme-coins gained $8 billion in value during the first week of 2026, demonstrating a cyclical rotation of liquid capital back into the cryptocurrency market.

BONK Price Prediction Scenarios

Based on recent data and market conditions provided by reliable sources, the Solana meme coin price outlook can be developed using a scenario-based approach. Rather than providing a precise outcome for the price of the Solana meme coin, we will instead provide ranges of potential prices depending on different scenarios.

Scene 1: Conservative Scenario

In an adverse or conservative scenario, increased speculation in the broader market can shift away from meme coins towards larger capitalised assets. This can slow down Solana’s activity levels, creating a decrease in BONK’s on-chain demand.

Key Drivers –

- Low level of momentum associated with meme coins on various social media networks.

- Decrease in activity levels throughout the Solana ecosystem.

- Low volume and lower numbers of potential catalysts to drive additional demand.

Considering these market conditions, BONK’s price will either continue to be flat or decline over time, with prices trading within historical support levels.

Estimated Price Range:

- Short-Term: $0.000010 – $0.000018

- Mid Term: $0.000015 – $0.000022

This scenario reflects consolidation phases witnessed previously when meme narratives cooled and risk appetite declined.

Scene 2: Moderate Scenario

In the moderate growth scenario, BONK is expected to maintain an engaged community and benefit from periodic meme-cycles. Solana activity can remain strong, with a continued moderate growth-driven increase in DeFi and NFT user sentiment.

Key Drivers:

- Consistent engagement with the community.

- Consistent use of meme-driven rallies.

- Continued support from the gradual increase in Solana’s Liquidity.

Considering these conditions, over time, BONK is expected to appreciate steadily, having some pullbacks and recoveries rather than having large breakouts.

Estimated Price Range:

- Short-Term: $0.000018 – $0.000030

- Mid-Term: $0.000025 – $0.000040

This is a relatively balanced price outlook for Solana meme coins with optimistic support but without large amounts of speculators involved.

Scene 3: Bullish Scenario

Assuming that the meme coin supercycle continues to develop with new investment capital flowing into Solana, it is expected that there will be growing social media interest and increased ecosystem developments leading to renewed interest in the BONK token through its viral narrative.

Key Drivers:

- Conditions that lead to the Meme Coin Supercycle

- Strong investment in Solana, as well as increased and continued usage of the Solana Network

- Viral narratives around BONK

Considering the above conditions, BONK could experience rapid upside expansions driven by FOMO and liquidity acceleration.

Estimate Price Range:

- For Upside Zone: ~$0.000035 – $0.000070

- For Extended Rallies: ~$0.000050 – $0.000080

BONK Price Prediction by Year

BONK Price Prediction 2026

BONK is still obtaining retail interest. Currently, the price is around $0.00001078 with an ATH value of $0.00005916 in late 2024, showing the positive potential for the bulls and large drawdowns in the bears.

Required Market Growth Conditions:

- Regular moderate growth of Solana’s current activity

- Sustained volume from the top exchange

- Periodic meme rotation stimulates speculative interest

BONK Price Prediction 2026 is expected to be between $0.000008 and $0.000025. However, investors should be careful about the weakness of the current meme cycles resulting in losing traders, along with increased selling pressure from long-term holders, and a broader bearish trend in crypto dominating low markets.

BONK Price Prediction 2028

The market is expected to witness crypto bullishness during the mid-2028 period, which may include a resurgence of meme interest. If the utility of the Solana ecosystem, including DeFi and NFTs, continues to increase, new speculative funds may flow into BONK.

Required Market Growth Conditions:

- Widespread adoption of Solana

- Re-emerging cycles of speculative meme coins

- Increased liquidity and exchange listings for these coins

BONK Price Prediction 2028 is expected to be around $.000020 and $.000050. However, investors must look out for the red flags, such as meme exhaustion, that may create an environment where utility tokens are more likely to gain market share. They must also be alert about the massive supply of coins that will likely overhang the marketplace and the volatility that may create wide retracements in price points.

BONK Price Prediction 2030

BONK’s sustainability in the long-term could heavily rely on the community maintaining relevance after the normal meme cycle passes. With the current market indicators, there have been both extreme drops and peaks in the past, so long-term stability cannot be assured.

Required Market Growth Conditions:

- Continued excitement from the community

- Many additional use cases within the ecosystem, other than just being a meme trader.

- A positive macro environment for the price of cryptocurrencies.

BONK Price Prediction 2030 is expected to be around $.000030 and $.000080. Nonetheless, it is important for investors to be aware of the red flags, such as a change in how people speculate on meme coins, other platforms competing with Solana to make profits, and the extreme volatility of the currency that may discourage an investor from being a long-term holder.

Risks, Volatility & Reality Check

- Meme-driven volatility: Meme-driven price volatility is one of the key risks associated with BONK. Historically, there have been rapid price increases and decreases as corrective moves, with timeframes for each being extremely short. This is predominantly due to social media trends, influencer effects, and larger Solana meme trends, rather than any sustainable level of demand for BONK. Therefore, as social media activities about BONK start to fade, the price will decline at a rapid rate.

- Whale concentration: The concentration of holders is another source of volatility. Only a limited number of large holders or whales hold a significant amount of the total circulating supply of BONK. Therefore, when whales accumulate, the price can increase in a short time. However, once they start to sell, there will usually be large pullbacks in price during such sell-offs.

- Sentiment dependency: Another key risk is the dependence on market sentiment. BONK price tends to be highly correlated to the general market sentiment, the overall optimism for the Solana ecosystem, and the ongoing meme cyclical activity. Hence, a negative outlook toward Solana or meme coins will likely create downward pressure on the BONK price, regardless of what the larger crypto market is doing.

- No intrinsic valuation floor: BONK doesn’t have an intrinsic floor value. Unlike utility tokens, BONK doesn’t have cash flow generation, protocol fees, or any other type of fundamental value indicators to support the price during periods of market declines. Therefore, in bearish environments, the BONK price may drop substantially closer to its original lows without anything to provide structural support for the price decline.

BONK is a high-risk, volatile crypto asset that must be traded carefully instead of holding it as an investment for the long term. Since most BONK price movements are driven by the narrative surrounding the token, including memes, social sentiment, and short-term speculation in the Solana ecosystem, BONK’s price is subject to erratic movements as a result of these factors.

There are opportunities for substantial upside when significant hype occurs, which raises the question, “Can BONK go higher?”

Unfortunately, price movements are often not supported with any type of solid foundational backing and are very susceptible to sharp reversals should sentiment change. In addition, BONK is not an instrument that has intrinsic value, including cash flows, utility-based demand, or revenue-generating opportunities. Hence, BONK functions primarily as a speculative instrument for short-term trades and is best suited for experienced traders with a strong understanding of the complexities existing in meme coins.