- XRP Ledger adds 21,595 new wallets in 48 hours as XRP price climbs above the $2.20 mark.

- XRPL surpasses 100 million validated ledgers, achieving flawless uptime since its 2012 launch.

- DeFi metrics strengthen with $76.3M TVL and $307.9M stablecoin market capitalization growth.

The XRP Ledger (XRPL) has entered one of its most active periods in recent memory. In just two days, more than 21,500 new wallets came online, the sharpest rise since January. That surge came to life as XRP’s price pushed above $2.20, after touching the $2 mark earlier in the week.

XRP Ledger Gains 21,595 New Wallets in 48 Hours (Source: Santiment)

However, the momentum did not appear out of thin air. Analysts say it reflects fresh trust in XRP’s real-world use and the ledger’s long-term scalability. Each spike in wallet creation has historically hinted at more market activity ahead, often marking the early phase of renewed rallies.

XRPL Network Hits 100 Million-Ledger Milestone

Beneath the price excitement lies a deeper story of consistency. The XRPL just yesterday validated over 100 million ledgers since its launch, adding nearly 7 million in 2025 alone. Not once has the network halted. Every block has closed on schedule, a rare reliability even among leading chains.

Moreover, between November 3 and 5, users created more than 44,000 wallets, while November 3 alone saw nearly two million transactions. Those numbers show an expanding base that continues to transact daily, not just speculate.

Similarly, Ripple’s link-up with Mastercard is adding institutional weight. Their joint efforts introduce RLUSD-based settlements directly through the XRPL, making near-instant credit card payments possible. It ties Ripple’s blockchain rails to Mastercard’s vast financial network, blending digital speed with traditional compliance.

DeFi Growth Anchors Broader Expansion

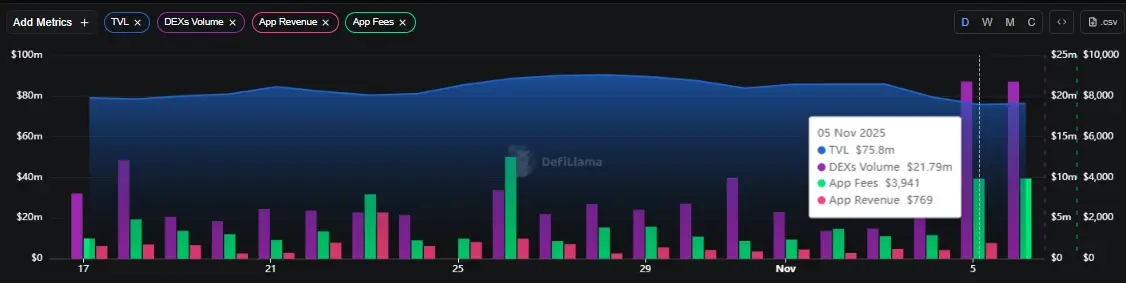

Activity across XRPL’s decentralized finance layer tells a similar story. Recent DeFiLlama data shows:

- Total Value Locked: $76.3 million, up slightly 0.65% in 24 hours.

- Stablecoin Market Cap: $307.9 million, a 43.8% weekly rise.

- DEX Volume (24 hrs): $21.8 million, jumping 62%.

- RLUSD Share: 67.6%, showing a strong liquidity pull.

XRPL Network (Source: DeFiLlama)

A consistent TVL above $76 million may not turn heads like billion-dollar protocols, but it signals steady participation and trust. Developers, too, seem more active, with app revenue and fees inching higher each day.

Ripple Prime, the firm’s new over-the-counter platform, is also fueling institutional demand. Through its acquisition of Hidden Road, Ripple now offers regulated U.S. access to trading and custody. Roughly 300 institutions have joined since launch, an adoption rate that few blockchain platforms achieve in a single quarter.

Real-World Assets Strengthen the Ledger’s Foundation

The XRPL’s role in tokenized real-world assets keeps growing. Current rankings place it 11th globally with $381 million worth of tokenized holdings, up 4% in a month. The RLUSD stablecoin alone now exceeds a $1 billion market cap, giving the ecosystem a deeper liquidity base.

These advances mark Ripple’s evolution from a payments-only network into a broader financial engine connecting DeFi, stablecoins, and tokenized assets. The combination is pushing XRPL closer to becoming the infrastructure layer between banks, fintechs, and blockchain markets.

XRP’s Market Snapshot

XRP trades near $2.21 at press time, down a few points after touching $2.38. Trading volumes remain above $6 billion a day, strong for any digital asset outside Bitcoin and Ethereum.

Short-term dips aside, the ledger’s fundamentals keep strengthening. Over 100 million validated records, tens of thousands of new wallets, and expanding institutional participation suggest an ecosystem that’s maturing, not fading.

In an industry known for volatility, XRPL’s stability and scale tell a quieter story, one about endurance.