- The crypto market rises 0.6% despite the ongoing weekly downtrend.

- The SEC dismisses the Gemini lawsuit as the exchange had fully repaid its customers.

- Grayscale’s spot BNB ETF filing has boosted institutional optimism.

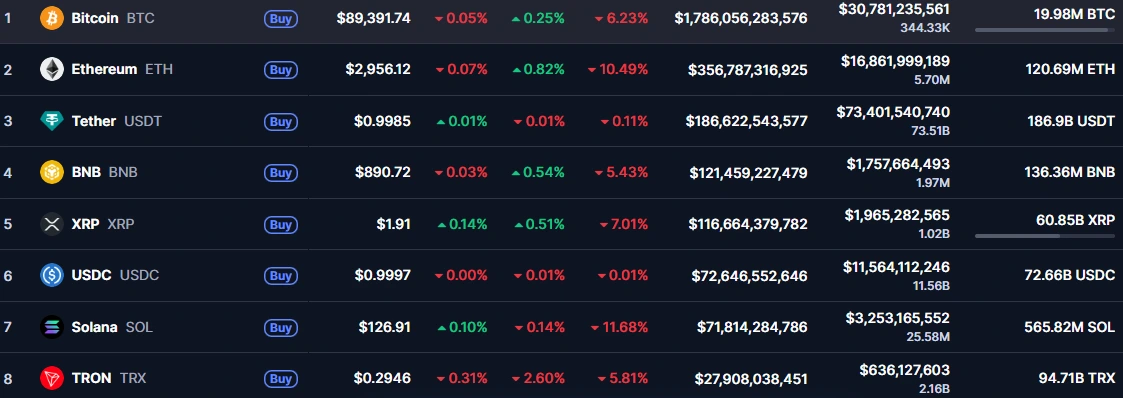

The crypto market has edged higher today after a volatile week, as Bitcoin, Ethereum, XRP, and other top assets post modest gains. The overall market has seen a marginal growth of 0.6% in the last 24 hours, hinting at a short-term pause in the broader downtrend.

Now, traders and experts are looking for the major drivers of this positive momentum. This article analyzes the two key factors that have influenced the crypto market’s current performance.

Crypto Market Up Today: Here’s Why

Despite recent fluctuations and volatility, the crypto market is finally closing the week on a positive note. The market is currently in the green zone, sparking widespread optimism. As per CoinMarketCap data, the total crypto market cap is marked at $3.02 trillion, with 0.45%.

Although key players like Bitcoin, Ethereum, and XRP have slipped below their key support levels recently, they have managed to maintain positive momentum. They have posted marginal gains over the past day, invoking fresh enthusiasm about their potential future.

At the time of writing, Bitcoin is valued at $89,382, up by 0.22% in a day. Despite a 6% decline over the past week, the coin has surged by 2.16% in a month. Ethereum is trading at $2,957, up by 0.86% in a day. Although the token has seen a monthly surge of 1.12%, it is still down by a massive 10% in a week.

At the same time, XRP is valued at $1.91. The token is up by 0.51% and 2.82% in a day and a month, respectively, but is still down by about 10% in a week. But what led to today’s surge?

SEC Drops Gemini Lawsuit

According to an earlier Reuters report today, the US Securities and Exchange Commission dropped the long-running Gemini lawsuit. As the Winklevoss Twins have already repaid the funds of Earn product customers, the SEC stated that the lawsuit is no longer valid. The court filing stated that both the SEC and Gemini have jointly agreed to end the case permanently.

The SEC first sued the company in 2023, claiming the crypto exchange had illegally offered unregistered securities to its clients. Under the Gemini Earn program, users lent their assets to Genesi Global Capital. After the collapse of the FTX exchange, Genesis froze these assets, with users unable to withdraw them.

Grayscale Files for BNB ETF

Another major reason for today’s crypto market surge is Grayscale’s strategic move. As Times of Blockchain reported yesterday, Grayscale has filed with the US Securities and Exchange Commission to launch a BNB ETF.

With this move, Grayscale is positioning itself as a major player in the crypto space, expanding its ETFs. Currently, the investment giant issues Bitcoin, Ethereum, Solana, XRP, and Dogecoin ETFs. If approved, this BNB ETF will be listed on the Nasdaq under the ticker GBNB.

This significant development has sent shockwaves through the crypto market, especially impacting the BNB token. Immediately after the asset manager’s ETF filing, the BNB price rose to a daily high of $901, sparking widespread optimism. As of now, the token is trading at $890, up by a marginal 0.5% in a day. Despite a 5% drop in a week, the token has soared by 6.5% over the past month.