- A Trump insider takes a $430M long position on Bitcoin and Ethereum before the Fed meeting.

- The whale’s 12-for-12 win rate record fuels talk ahead of the expected Fed rate cut.

- Analysts link the move to Trump’s upcoming trade talks with China’s Xi Jinping.

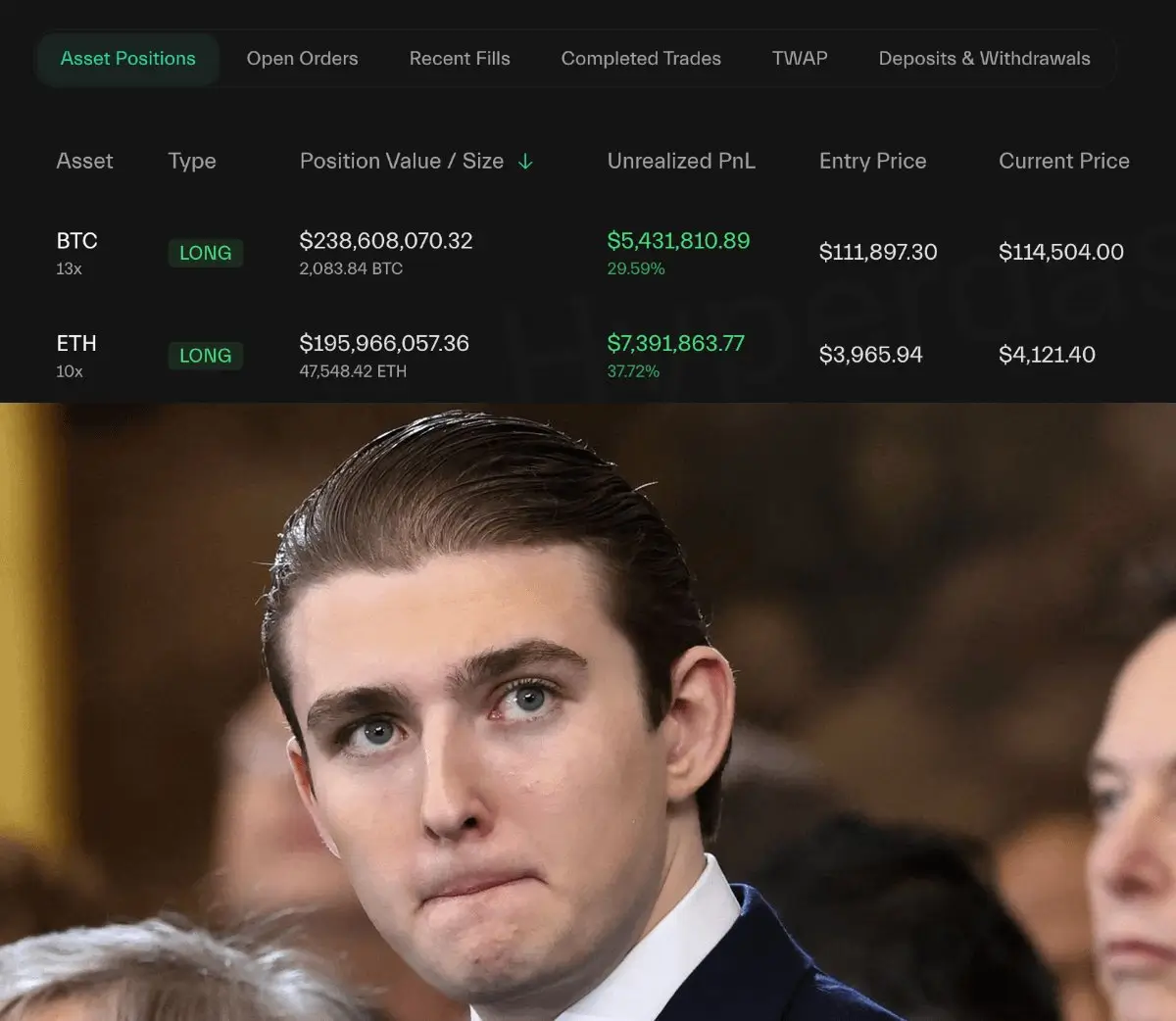

A “Trump Insider whale” has reportedly opened a $430 million long position in Bitcoin (BTC) and Ethereum (ETH) just a day before the Federal Reserve’s next interest rate decision. According to trading data shared by analyst CryptoNobler on X (formerly Twitter), the investor holds about $238.6 million in Bitcoin and $195.9 million in Ethereum, using high leverage on both assets.

The trader’s accounts indicate 13x leverage on Bitcoin and 10x on Ethereum, with entry prices near $111,897 for BTC and $3,965 for ETH. At the latest market update, Bitcoin traded around $114,500, and Ethereum was close to $4,120, giving the positions a combined gain of more than $12.8 million.

Trump Insider Bets $430M on Bitcoin and Ethereum (Source: X)

What makes this move more remarkable is the trader’s 12-for-12 winning record on previous high-value trades. Early reports indicate that the trades are already up $35 million in unrealized profits after just a few days.

That streak has captured the attention of both institutional and retail traders watching the market ahead of the Federal Open Market Committee (FOMC) announcement.

Fed Meeting Adds to Market Tension

The timing of the positions coincides with the Federal Open Market Committee (FOMC) meeting that began on October 28 and concludes tomorrow. Federal Reserve Chair Jerome Powell is expected to announce the latest policy update and outline the central bank’s view on inflation, jobs, and overall economic health through 2026.

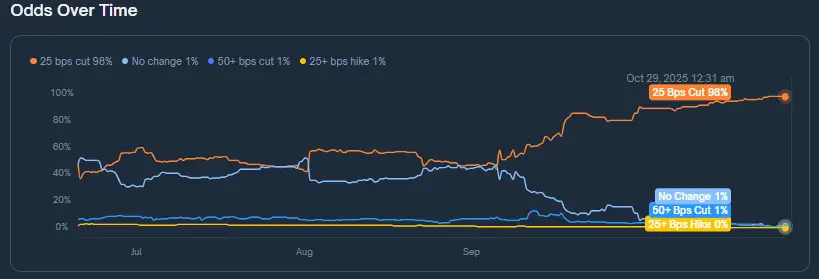

The Fed’s previous 25-basis-point rate cut brought the benchmark range down to 4.0%–4.25%, marking the first easing of the year. Now, 98% of traders on Polymarket expect another similar reduction.

Fed Rate Cuts Forecast (Source: Polymarket)

A rate cut typically weakens the U.S. dollar and encourages investors to seek higher-yield assets. Analysts view the Trump insider’s move as a strategic bet on that trend—positioning for an influx of capital into risk assets such as Bitcoin and Ethereum once the Fed confirms a dovish stance.

If the central bank lowers borrowing costs again, liquidity across global markets is likely to increase, driving greater demand for digital assets.

Trump Insider: Trading History and Geopolitical Backdrop

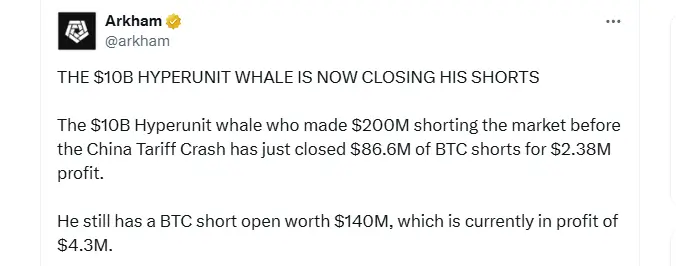

The trader’s record of timing key macro turns adds weight to the move. Earlier this month, the same account reportedly closed $86.6 million in short positions, generating a realized profit of $2.38 million after correctly predicting the “Trump tariff crash.”

Some analysts suggest this may be the same entity that opened a $255 million long position in Bitcoin and Ethereum following Trump’s confirmation of a meeting with Chinese President Xi Jinping during the upcoming APEC summit.

Insider Whale Shorts Market Before the China Tariff Crash (Source: X)

The two leaders are scheduled to meet in South Korea later this week to discuss trade disputes, export controls, and agricultural imports amid ongoing tensions. A breakthrough in talks could calm markets, while renewed friction might spark another wave of volatility across global assets.

The geopolitical calendar, coupled with the Fed’s rate decision, lends exceptional significance to the $430 million trade.

Markets Brace for the Outcome

As the Fed meeting nears its conclusion, both Bitcoin and Ethereum remain sensitive to any shift in monetary policy. Historically, cryptocurrency markets have rallied after rate cuts, as liquidity expansion boosts speculative appetite and weakens the strength of fiat currencies.

The “Trump Insider whale” appears to be betting that history will repeat itself. The move underscores how major traders now treat cryptocurrencies as macro-linked assets, moving in step with global financial trends rather than in isolation.

Whether this record-breaking position pays off will depend on two key events: the Fed’s tone on interest rates and the outcome of Trump’s meeting with Xi. Both could define the next chapter for Bitcoin, Ethereum, and the broader digital asset market.