- Crypto’s deep slide boosts demand for tokenized gold as traders seek stable value.

- XAUT and PAXG lead sector growth with record caps as gold hits historic highs.

- Asset managers expect rising RWA tokenization as blockchain use expands.

The crypto market’s extended downturn is amplifying demand for tokenized gold, as investors shift toward proven safe-haven assets backed by hard value. With Bitcoin sliding below $90,000 and losing nearly 30% in six weeks, gold-backed tokens like Tether Gold (XAU₮), Paxos Gold (PAXG), and others are reporting record activity, rising market caps, and accelerating institutional interest.

The shift reflects a broader structural trend: as digital assets face turbulence, blockchain-based versions of physical gold are emerging as one of the most resilient sectors in the real-world asset (RWA) market.

Crypto Correction Deepens as Market Value Drops by Trillions

Bitcoin’s retreat below $90,000 marks one of its steepest multi-week corrections since the beginning of the year. Data from TradingView shows that BTC has fallen roughly 27%–30% from its early October all-time high of $126k, driving commentators to describe the drawdown as the “Great Bitcoin crash of 2025.”

Market-wide damage is equally notable:

- $1.2 trillion in crypto value erased in six weeks

- Market cap down to $3.08 trillion, a 3.31% daily decline

- BTC’s 24-hour trading volume fell by 24%, to $78 billion

- Major altcoins Ethereum, Solana, and Cardano have lost 5%–8% in the same period

- CoinDesk Market Index down 5.6% in 24 hours

Amid this pressure, ETF inflows and outflows are hitting record extremes, reshaping liquidity conditions for both institutional and retail traders. The volatility is reinforcing a familiar investor instinct: during systemic stress, rotate toward assets with long-term historical stability.

Tokenized Gold Market Hits Record Highs as Physical Gold Surges

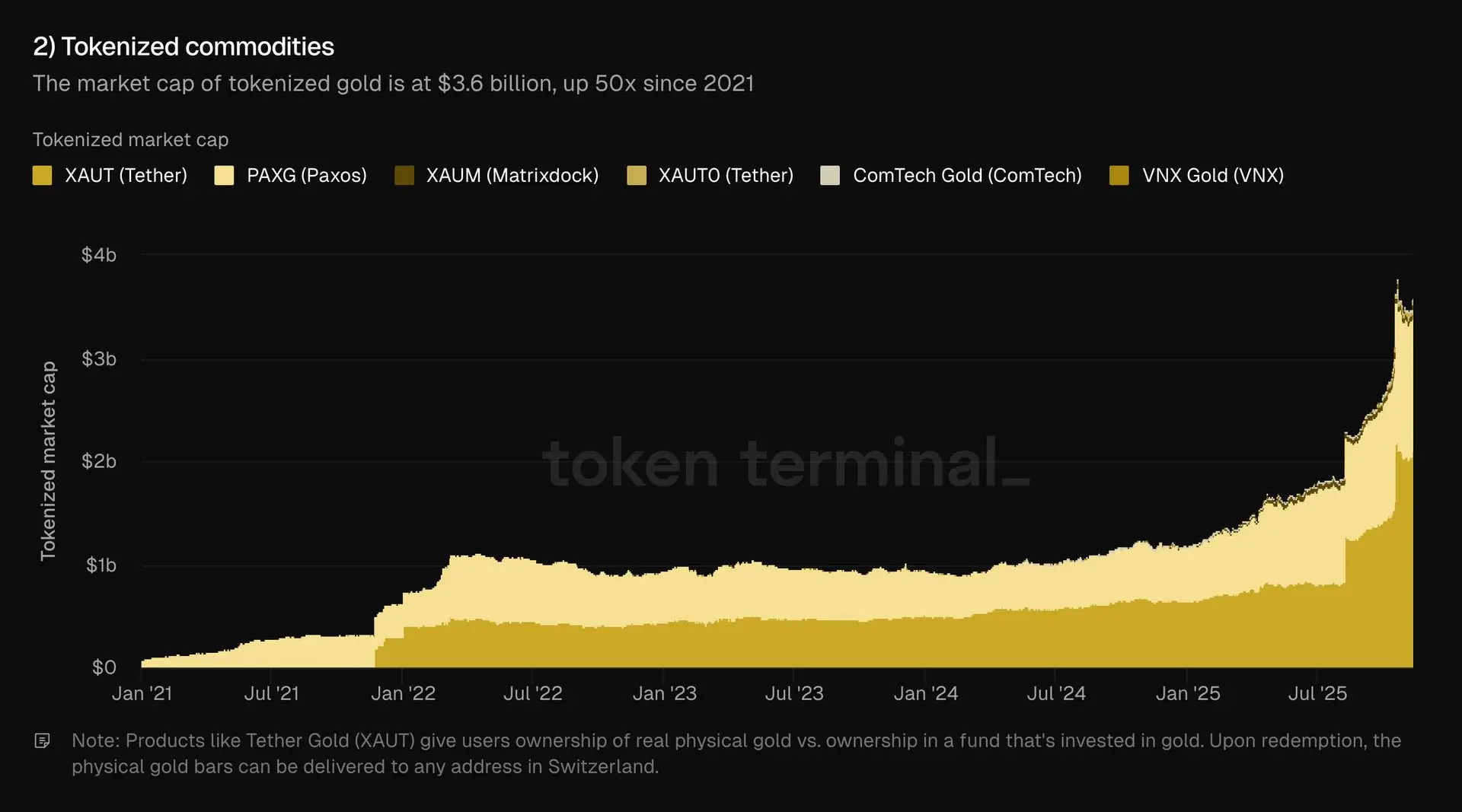

While digital tokens slump, tokenized gold has reached unprecedented levels. Data from Token Terminal shows total tokenized gold value hitting $3.6 billion on November 12, a figure 50 times higher than in 2021.

Tokenized Gold Commodities (Source: Token Terminal)

The sector is dominated by two leaders:

- Tether Gold (XAUT): $1.58 billion market cap

- PAX Gold (PAXG): $1.39 billion market cap

Together, they represent the bulk of the $2.9 billion market. Growth is tied closely to physical gold’s exceptional performance. Economist Peter Schiff notes that physical gold surged 60% between December 2024 and mid-November 2025, climbing to a historic high of $4,381 during the U.S.–China trade war escalation.

Peter Schiff’s Views on Gold’s 60% Surge in a Year (Source: X)

This trend highlights investor flight toward hard assets during periods of geopolitical and monetary stress. Despite the record size of tokenized gold markets, they remain a tiny fraction of the global gold supply, valued at $29.153 trillion.

Aurelion, Tether, and Asset Managers See a Convergence of Gold and Blockchain

Aurelion CEO Björn Schmidtke argues that the crypto downturn is accelerating, rather than slowing, blockchain evolution. He cites the $1.3 billion crypto correction and Bitcoin’s recent 28% drop as a backdrop for renewed interest in “foundational assets” that combine blockchain features with gold’s time-tested resilience.

According to Schmidtke:

- Gold’s stability

- Blockchain’s immutability

- Increasing regulatory clarity

- Rising institutional demand

…are “set for powerful convergence.”

Tether Gold’s latest reserve disclosure reinforces the sector’s scale. As of September 30, 2025:

- 375,572.297 fine troy ounces held in Switzerland

- 1:1 backing confirmed

- XAU₮ market value: $1.449 billion

- Reserves equal 11.6 tons

- Market cap has been approaching $2.1 billion in recent weeks

Tether CEO Paolo Ardoino said XAU₮ is proving that “real-world assets can thrive on-chain without compromise,” especially during periods of monetary instability.

Besides, real-world asset specialists echo this view. Kevin Rusher of RAAC notes that tokenized gold now functions actively in DeFi lending and borrowing markets, converting gold from a passive store of value into a productive digital instrument. Similarly, Standard Chartered’s Geoffrey Kendrick forecasts the RWA tokenization market could reach $2 trillion by 2028, with Ethereum possibly remaining the dominant settlement layer.

Safe-Haven Demand Positions Tokenized Gold for Continued Expansion

As global markets digest inflation risk, trade disruptions, government debt concerns, and crypto’s ongoing correction, the momentum behind tokenized gold continues to accelerate. Its appeal lies in the combination of physical security, blockchain-based transparency, and 24/7 liquidity—characteristics increasingly sought by investors navigating uncertain financial conditions.

With crypto assets under persistent pressure and gold prices at historic highs, tokenized gold now sits at the center of the RWA movement, emerging as one of the strongest-performing sectors in the digital asset ecosystem.