- Tether reached 24.8M active users in Q4 as demand for stable value held firm through volatility

- USDT gained a 68.4% share of stablecoin users, while major competitors posted quarterly declines

- Tether’s reserves hit $192.9B in Q4 as New York officials challenged the proposed GENIUS Act

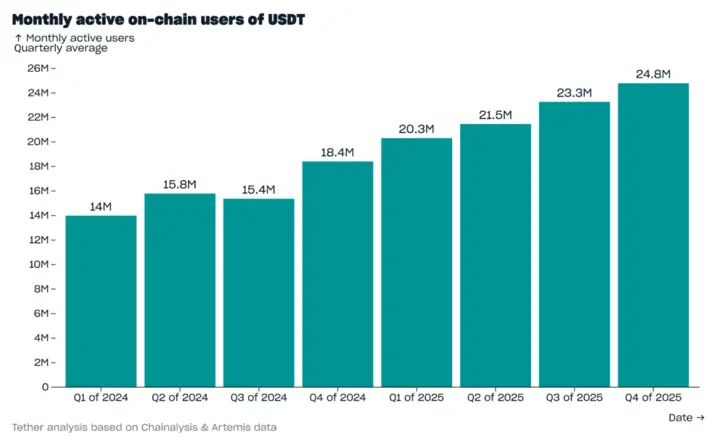

Tether closed 2025 on a stronger footing than much of the broader market, finishing the year with its highest-ever count of monthly active users. According to Tether’s ‘USD₮ Q4 2025 Market Report’ released yesterday, on-chain activity climbed to roughly 24.8 million users in the fourth quarter.

This marks a sharp rise from early 2024 and is a sign that demand for stable value continued even as crypto markets struggled to regain momentum. The increase also pushed Tether’s share of all stablecoin monthly active users to 68.4%, giving the token a wide lead during a volatile stretch for digital assets.

Tether Hits Record Q4 Users With 68.4% Stablecoin Share (Source: X)

Notably, the growth streak came during a period marked by uneven liquidity, shifting user behavior, and a market still adjusting to the October liquidation shock. Yet Tether’s user base kept expanding, quarter after quarter, offering a counterweight to the sector’s broader contraction.

User Activity Surges Despite Market Strain

In addition, Tether’s Q4 report noted several new peaks in wallet creation, monthly active addresses, and on-chain transfer counts. These highs stacked up even as total crypto market capitalization dropped by more than one-third from 10 October through early February.

Over that same span, USDT in circulation inched 3.5% higher. Meanwhile, the next two largest stablecoins moved in the opposite direction, one slipping 2.6% and the other falling far more steeply.

According to reports, growth in Q4 was not confined to one network or user category. Usage was scattered across centralized exchanges, payment channels, and personal wallets, driven in part by traders rebalancing risk and savers looking for shelter during turbulent swings.

Balances Shift as Users Reposition

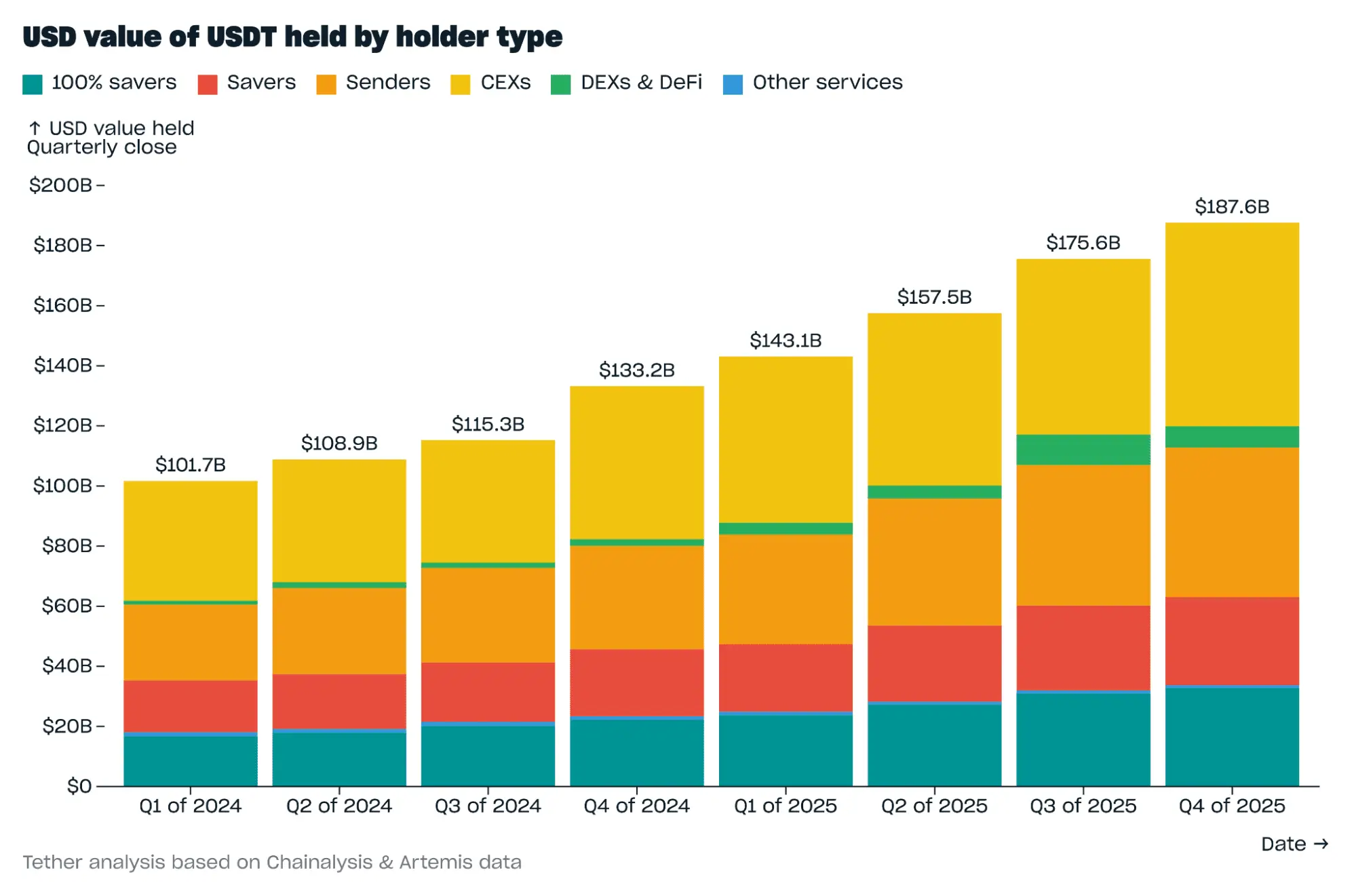

By the end of the quarter, centralized exchanges held 36% of Tether’s supply, up from the previous period. The bump came as balances in decentralized exchanges and DeFi protocols thinned following the October sell-off, with about $3 billion flowing out of those systems and leaving them with a 3.8% share.

Tether’s USDT Held By Holder Type (Source: Tether)

Savers represented the next largest group, holding 33% of the supply. They added $2.9 billion during the quarter, lifting their combined total to $62.1 billion. That accumulation placed Tether ahead of competitors in terms of both the number of savers and the overall value stored, with nearly 60% of stablecoin savings parked in USD₮.

When excluding the largest institutional wallets, that figure climbed above three-quarters. Senders, wallets that move stablecoins frequently, ended the quarter with 26.5% of the supply. Their holdings changed only slightly compared with Q3, though they still added more than $2 billion as transactional demand held steady.

Market Cap and Reserves Hit New Records

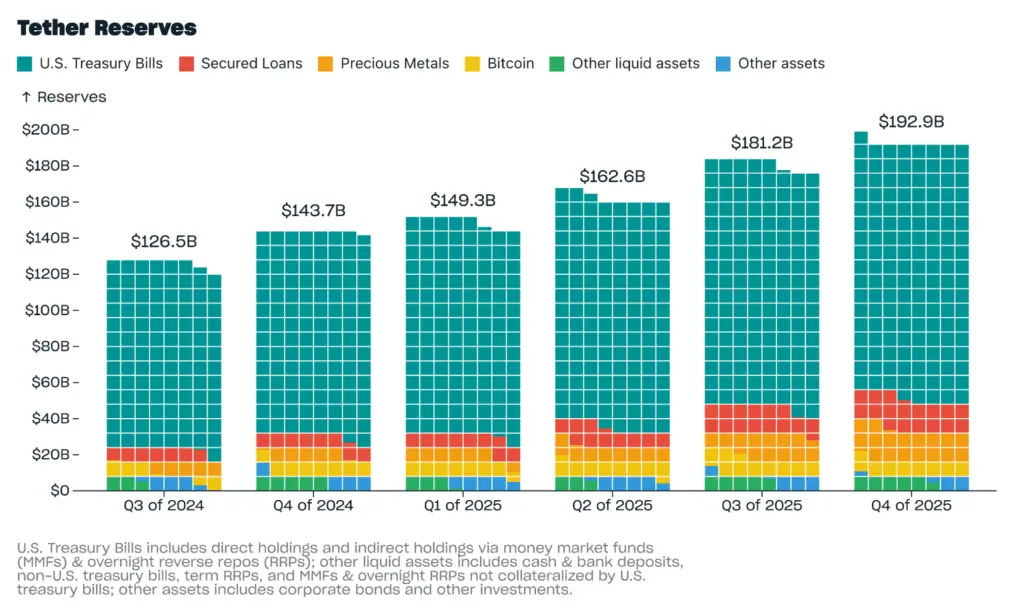

As a result, Tether’s market cap rose by $12.4 billion in Q4, landing at $187.3 billion. October saw the strongest month of growth at 4.9% before the pace eased. Besides, reserves totaled $192.9 billion, exceeding liabilities by $6.3 billion.

Tether Reserves (Source: Tether)

The issuer increased its bitcoin holdings to 96,184 and expanded its gold reserves to 127.5 metric tons. Its growing exposure to U.S. Treasuries reached $141.6 billion, a level that, if ranked alongside sovereigns, would position it ahead of several major economies.

Regulatory Debate Intensifies

Regulators, however, have not eased their concerns. Even as adoption expands, stablecoins continue to sit under a spotlight, with lawmakers in several jurisdictions weighing frameworks that would define how issuers operate.

In the United States, the pending GENIUS Act has become the center of that debate, pitched as a way to clarify the legal standing of dollar-pegged tokens and set a common rulebook. Policy specialists say the sector will need to navigate that process carefully, balancing new products with guardrails that reduce the risk of liquidity strain or improper use.

That discussion turned sharper in New York. The state’s top prosecutors have pushed back forcefully on the GENIUS Act, arguing in a letter obtained by CNN that the measure does too little to protect consumers harmed by crypto-related misconduct.

The letter, signed by Attorney General Letitia James and four district attorneys, including Manhattan’s Alvin Bragg, contends that the law grants an “imprimatur of legitimacy” to stablecoins while allowing issuers to sidestep the kinds of regulatory checks typically used to curb money laundering, terrorism financing, drug-trade flows, and the types of fraud that have plagued the industry.