- SpaceX shifted 281 Bitcoin in a significant $31 million transaction this week.

- Musk’s company now holds over $783 million in Bitcoin reserves securely stored.

- Analysts watch if this move signals a new storage setup or a future sell action.

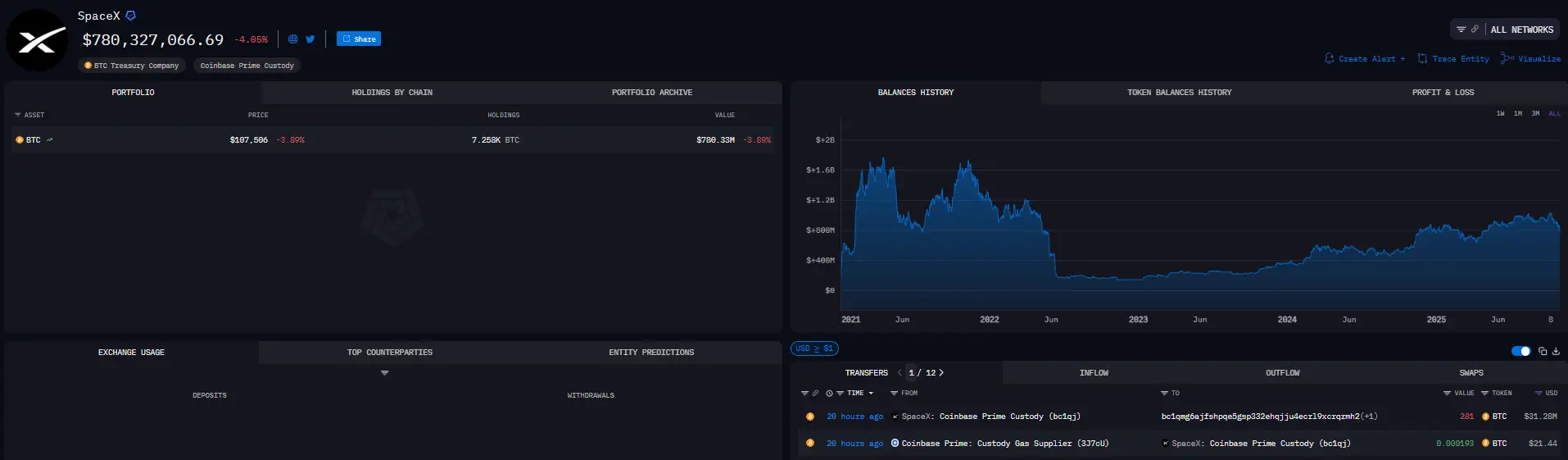

SpaceX has shifted another large batch of Bitcoin, transferring 281 BTC—worth more than $31 million—from Coinbase Prime custody to a new blockchain address. The move, captured by Arkham Intelligence about 18 hours ago, continues a pattern of steady, calculated transfers that have marked the company’s digital-asset strategy in recent months.

SpaceX Bitcoin Reserve: Source (Arkham Intelligence)

The firm, led by Elon Musk, now holds approximately 7,258 BTC, valued at nearly $783.4 million, at an average market price of $107,938 per coin.

Inside SpaceX’s Latest Bitcoin Movement

The transfer occurred during a week of mild market turbulence, which shaved approximately 3 percent off Bitcoin’s value. SpaceX’s own holdings dipped by a similar margin, reducing its on-chain balance by roughly $23.5 million overnight.

Arkham’s dashboard indicates that the coins were transferred from a Coinbase Prime account to a new wallet ending in jqjua4e. Analysts say such transactions often indicate internal restructuring rather than liquidation. No new inflows were detected, suggesting the company may simply be shifting funds into deeper cold storage.

Historical data shows the same thing: volatility. During Bitcoin’s peak in 2021, SpaceX’s balance was very close to $2 billion, but it had decreased to $800 million by 2023. This path is similar to Bitcoin’s fluctuations, thus strengthening the connection between the companies’ finances and the market’s temperament.

Musk’s Market Presence and Crypto Outlook

Musk’s name continues to move markets. His decisions—whether through Tesla, SpaceX, or brief social media posts—routinely ripple through the cryptocurrency community. This latest transfer landed just as traders debated his long-term stance on digital assets.

In a recent exchange on X, the user zerohedge argued that global money printing distorts economies, comparing the creation of fiat currency to manipulation. Musk replied, “That is why bitcoin is based on energy: you can issue fake fiat currency, and every government in history has done so, but it is impossible to fake energy.”

The comment renewed discussion about his view that Bitcoin’s foundation in energy gives it intrinsic strength. Musk’s past influence remains legendary—his single “Doge” tweet in February 2021 drove the meme coin’s price up more than 50 percent in hours. Even years later, each crypto-related action tied to him draws scrutiny from investors and analysts alike.

Strategic Adjustment or Long-Term Security Move?

The motive behind this week’s transfer is still a mystery. The new wallet has yet to make any outgoing transactions, which could mean that the transfer is not a sale at all but rather a matter of accounting or regulatory compliance.

The history of transactions by SpaceX suggests a steady strategy: they remain silent for a long time and then implement large, thoughtful changes. Such behaviors indicated that the corporation views Bitcoin as a reserve asset rather than a tool for speculation.

SpaceX, on the other hand, with its trimming down of 783 million dollars in Bitcoin, continues to be one of the largest private owners of crypto assets. The question still looms as 2025 nears: Is it a prelude to the sale of the whole lot or just the repeating of the silent locking up of Musk’s crypto vault again?