- Revolut adds direct crypto buys inside Trust Wallet for faster EEA access.

- Users gain instant BTC, ETH, SOL, and USDC with no Revolut Pay fees.

- Assets move straight to self-custody as firms expand regulated services.

Revolut and Trust Wallet have introduced a new way for people in the European Economic Area to move directly from traditional finance into digital assets. The two companies have connected their services so that users can buy crypto inside the Trust Wallet app and have it appear immediately in self-custody.

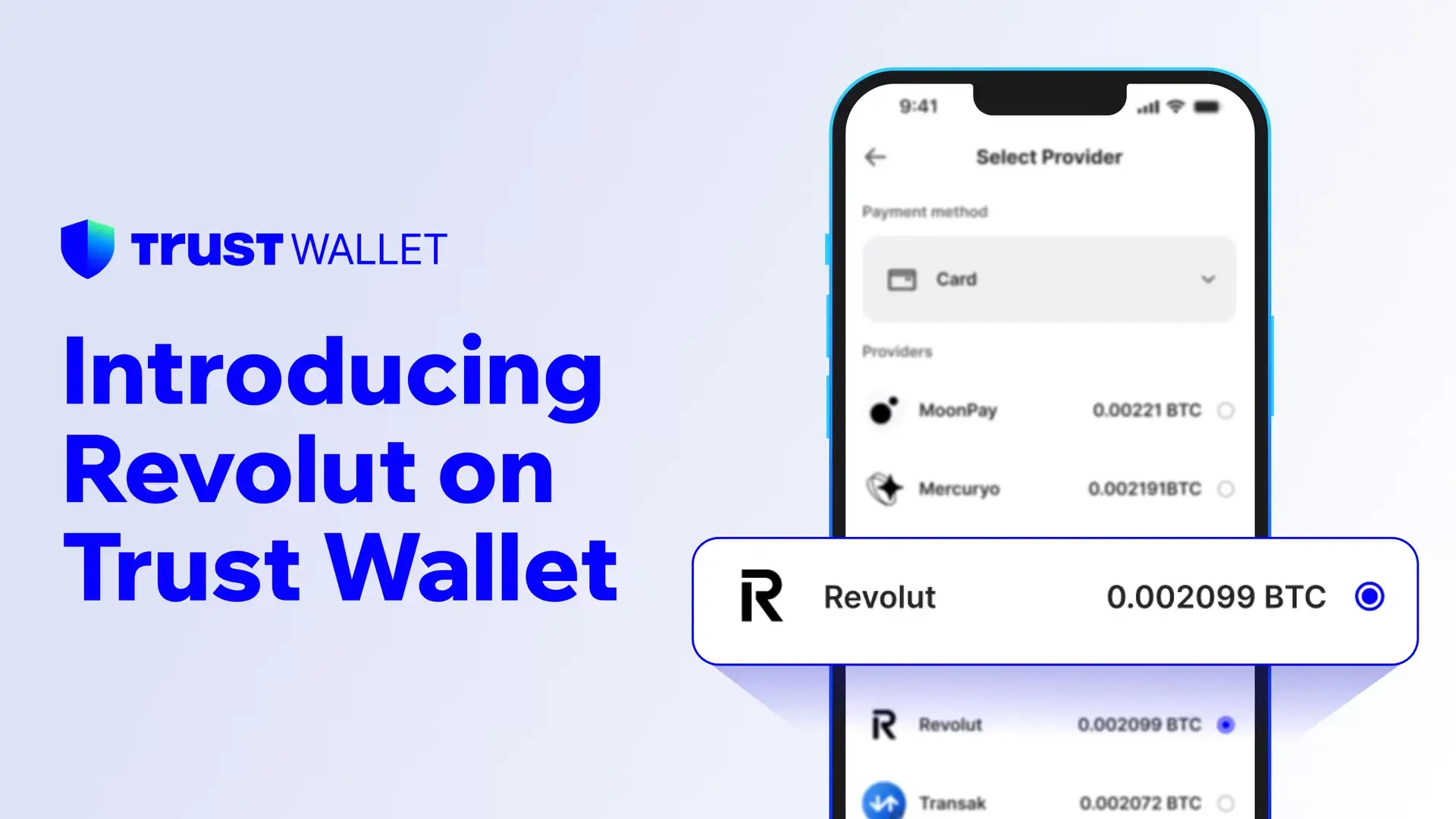

Revolut and Trust Wallet Link to Launch Instant Crypto Buys (Source: Trust Wallet)

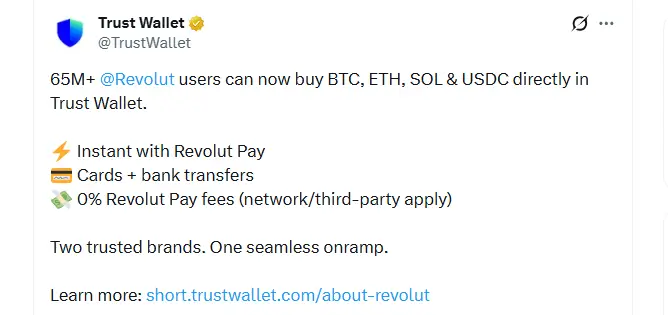

The update went live through Trust Wallet’s official accounts and includes support for Bitcoin, Ethereum, Solana, and USD Coin. Per the reports, purchases can be made through Revolut Pay, card payments, or bank transfers. Notably, Revolut Pay does not add its own fee, although standard network costs still apply.

A New Bridge Between Banking and Self-Custody

For years, entering the crypto market required a series of steps that felt disjointed to many newcomers. Exchange accounts needed verification, transfers took time to clear, and moving funds from one platform to another often added confusion. However, the new link between Revolut and Trust Wallet cuts away much of that process.

Instead of passing through a custodial exchange, purchased assets land directly in the Trust Wallet. Users hold their own keys from the moment the transaction is completed. For people who prefer keeping control of their assets, this change removes one of the most common barriers to self-custody.

Yet, what makes the shift notable is the scale of both platforms. Revolut counts more than 65 million customers worldwide. Meanwhile, Trust Wallet reports more than 200 million users and support for over 100 blockchains. Combining those networks creates a large, ready-made on-ramp for Europe’s crypto market.

Trust Wallet X Revolut: How the rollout works

Launch notes shared by the Trust Wallet describe several core functions. Among them are the purchases for BTC, ETH, SOL, and USDC that settle instantly inside Trust Wallet. On the other hand, Revolut Pay, alongside cards and transfers, covers the payment side. Revolut Pay applies no additional fee, though blockchain fees still exist.

How the Trust Wallet X Revolut Works (Source: X)

Notably, the transfer process does not pass through an exchange. There is no custodial holding period, and no extra withdrawal step is needed. For some users, the most important detail is that the private keys never leave their possession.

Revolut’s Expanding Crypto Strategy

The integration arrives at a time when Revolut is widening its global footprint. A recent secondary share sale pushed the company’s valuation to about $75 billion, backed by investors such as Fidelity, Coatue, and NVIDIA’s NVentures.

Regulation has also shaped this phase of growth. Revolut previously secured a MiCA license through Cyprus, allowing it to offer crypto services throughout the EEA under Europe’s new digital-asset rules. Beyond the region, Revolut is expanding into Mexico and Colombia after receiving new banking approvals.

Financial results reflect that momentum. The firm reported $4 billion in revenue for 2024, with pre-tax profits reaching $1.4 billion. Such sentiment indicates that crypto services are becoming an increasingly visible part of the company’s wider strategy.

On the other hand, Trust Wallet continues to grow as well, serving millions of users who prefer decentralized control. Its focus on direct asset ownership aligns neatly with the direction taken by many crypto communities in recent years.

What It Means for the EEA Market

For users across the EEA, the new integration gives a quicker route into crypto ownership without relying on centralized intermediaries. Being able to use familiar payment methods also lowers the barrier for people who may have avoided exchanges due to long onboarding steps or complex interfaces.

Regardless, analysts note that some practical considerations remain. Network fees, regional rules, and the gradual rollout of the service across Europe all shape the user experience and may influence adoption as the feature expands.

Even with those factors in mind, the joint effort stands out as a strong example of how financial platforms and self-custody tools can work together. By pairing regulated payment systems with direct asset control, the integration offers a cleaner, more efficient entry point at a time when many users are seeking simpler and safer ways to hold digital assets.