- Quantum Solutions tops Japan’s market with $15.8M in growing Ethereum holdings.

- ARK Invest’s backing powers Quantum’s rapid digital asset treasury expansion.

- Japan’s supportive laws keep Quantum leading in corporate crypto adoption.

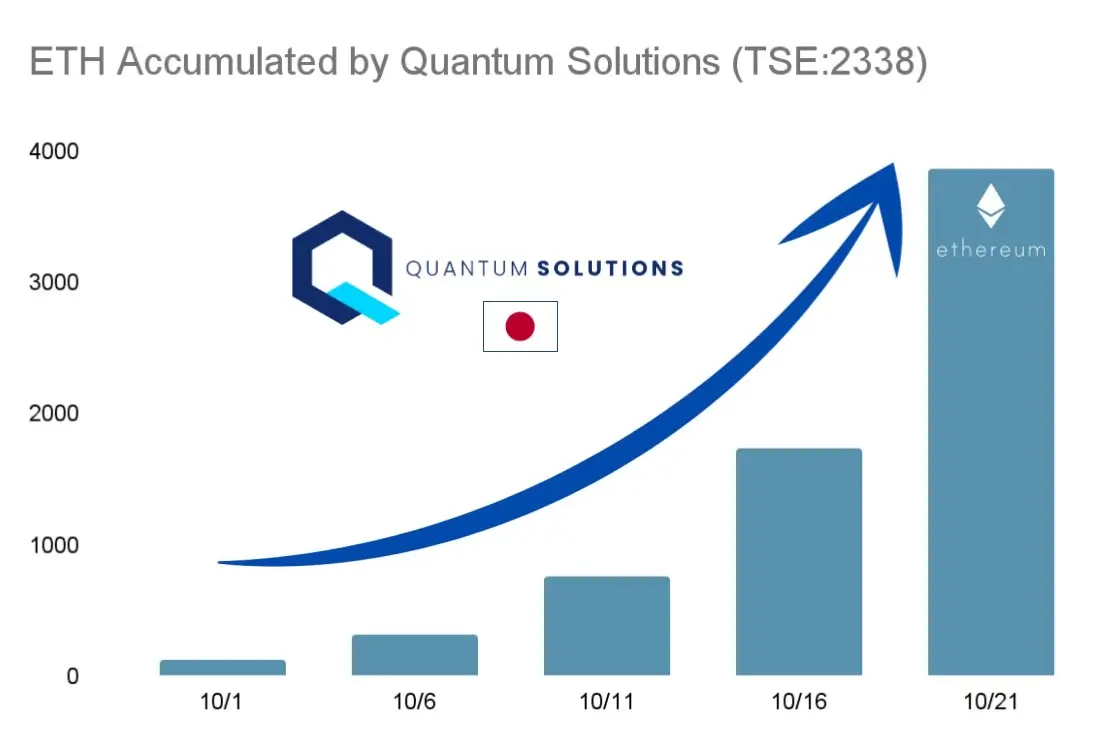

Tokyo-based Quantum Solutions has climbed to the top of Japan’s Ethereum market after purchasing 2,365 ETH in just a week. The company, listed on the Tokyo Stock Exchange and supported by ARK Invest, now controls 3,866 ETH—worth about $15.8 million—making it the largest Ether treasury in Japan and the 11th largest globally.

ETH Accumulated by Quantum Solutions (Source: X)

Founder Francis B. Zhou said that the recent accumulation was carried out through the firm’s Hong Kong subsidiary, GPT Pals Studio Limited, on October 21. The Ether was bought at an average price of $4,101 each, using funds raised through convertible bonds, stock acquisition rights, and external borrowings.

Zhou added that Quantum has been buying Ethereum at a pace of roughly 150 million yen, or $983,000, every day. The company’s long-term goal is ambitious—building a 100,000 ETH treasury—a plan backed by a 26 billion yen ($180 million) funding round completed in September 2025.

Institutional Backing Strengthens Expansion

Quantum’s rapid growth has caught the attention of major investors. Its recent funding round drew backing from ARK Invest, Susquehanna International Group (SIG) through CVI Investments, and Integrated Asset Management. The round marked ARK’s first direct participation in Asia’s public markets, showing growing institutional trust in blockchain-backed assets.

Cathie Wood, ARK’s founder and CEO, described the development as a major step forward for Japan’s digital economy.

“Three months into the DAT revolution, we’re happy to support Japan’s first institutional-grade ETH DAT,” she said in a recent statement.

Quantum also holds a small Bitcoin reserve—11.6 BTC, worth about $1.3 million—reflecting a balanced digital strategy as it continues to increase exposure to blockchain assets.

Market Reaction and Broader DAT Landscape

Despite the milestone, Quantum’s shares fell more than 28% in the past week. The dip reflects a broader slowdown across digital asset treasury (DAT) stocks, as investors lock in profits after a volatile few months.

Analysts say the decline is not specific to Quantum but part of a sector-wide cooling following heavy accumulation trends earlier this year. Still, Japan’s regulatory stance sets it apart from other markets.

Unlike India, Hong Kong, and Australia, where rules for listed crypto treasuries have become restrictive, Japan’s framework continues to support corporate participation. The country classifies digital assets as financial instruments, ensuring clear disclosures and investor transparency—a factor that has encouraged institutions to build crypto reserves through listed firms.

Ethereum Becomes the Center of Corporate Strategy

Quantum’s focus on Ethereum signals a broader corporate shift toward blockchain-backed balance sheets. Its Hong Kong branch oversees cryptocurrency operations and plans to steadily expand its holdings over time. The company noted that while the fiscal impact of these purchases will be limited in the short term, the long-term benefits could strengthen both liquidity and corporate value.

Even as enthusiasm for DAT companies cools, Quantum remains an outlier. Supported by ARK Invest and Japan’s favorable rules, the firm continues to accumulate Ether at a steady pace, positioning itself at the center of Asia’s growing digital asset movement.

Quantum’s rise reflects a broader trend: traditional corporations are increasingly treating digital assets as strategic reserves. The company’s expansion, backed by strong funding and institutional confidence, demonstrates the rapid growth of the digital asset treasury model in Japan’s evolving financial landscape.