- The OCC removed barriers, allowing community banks to partner with stablecoin firms.

- Ripple’s RLUSD surged past $500M supply, fueled by $150M in new issues.

- Ripple’s $200M Rail acquisition expands RLUSD into cross-border settlement systems.

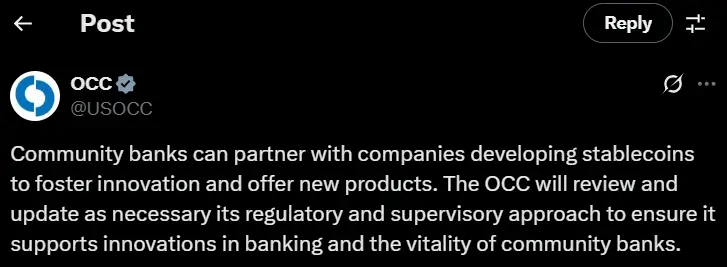

The OCC has cracked open the book of community banking by affirming that small lenders may now enter into direct partnerships with stablecoin firms. This policy change removes long-standing impediments and signals Washington’s acceptance of digital assets into mainstream finance.

OCC Greenlights Bank-Stablecoin Deals (Source: X)

Comptroller Jonathan V. Gould described stablecoins as a bridge between banks and a new payment world, with the technology potentially assisting these institutions in serving local communities with faster and more reliable services.

Jonathan V. Gould stated:

“Community banks play a crucial role in providing essential financial services. Stablecoins are one way for these institutions to better serve their communities’ payment needs.”

For years, these banks faced restrictions requiring special approvals before exploring crypto partnerships. With that hurdle gone, the path toward digital innovation suddenly looks wide open.

The OCC’s announcement builds on earlier guidance that permitted banks to hold crypto custody, stablecoin reserves, and even run blockchain-based payment systems. What was once experimental is now edging into standard practice.

Regulators still stress the need for strong risk controls, but the move highlights a growing recognition that digital currencies are no longer on the fringes of finance—they are becoming part of its foundation.

Ripple’s RLUSD Finds Its Moment

Few companies stand to benefit more from this shift than Ripple. The firm has been pressing to position its RLUSD stablecoin at the heart of traditional finance, even applying for a U.S. banking license. With the OCC’s greenlight, Ripple can now strike partnerships with community banks while it waits for full national approval.

RLUSD is already gaining ground. Its circulating supply has surged past $500 million, bolstered by fresh issuances worth more than $150 million. Unlike rivals struggling to expand, Ripple’s coin is racing ahead—powered not just by demand, but by infrastructure.

Earlier this year, Ripple sealed a $200 million deal to acquire Rail, a Toronto platform handling more than 10% of global B2B stablecoin volume. The acquisition transformed RLUSD’s role overnight, embedding it in cross-border settlement networks and treasury systems used by global firms. Observers call it “infrastructure chess”—a deliberate play to control the hidden pipes of the new financial order.

Confidence in RLUSD has also risen as Ripple wrapped up its legal battles over XRP. With a trust license in New York and backing from cash and U.S. Treasuries, the stablecoin is gaining traction among enterprises and institutions newly encouraged by the U.S. Treasury’s GENIUS Act, which is laying out clearer rules for the sector.

The Banking System’s New Backbone

For community banks, stablecoins are no longer abstract experiments—they are practical tools to stay relevant in a fast-changing economy. For Ripple, the OCC’s move may well be the last step needed to fully integrate RLUSD into the banking system.

The evolution of a financial setup in transition is unfolding: regulators opening doors, banks discovering new lifelines, and Ripple putting forth its stablecoin as the backbone of tomorrow’s payment system. With the approval of Washington, the stablecoin era has certainly transitioned from being merely possible to one set in stone.