Decentralized exchange Hyperliquid, which focuses on perpetual futures, unveiled new advances that hint at the extension of its trading ecosystem. The platform has already booked the ticker USDH and is currently working on having a stablecoin on its own network.

The project, as described in its official Discord channel, states that its future asset will be embedded directly into the chain and may become one of the main liquidity instruments. Currently, Hyperliquid uses USDC, which has already provided over $5.3 billion in total inflows. However, the drawback of USDC is that it is a freezeable token, which is the opposite of what Hyperliquid described it to be.

USDH Activation by Means of Voting

The road to USDH will entail a number of governance processes. The ticker is ready, but will not become enabled until validators approve it via an on-chain voting process. The stablecoin, assuming it is issued, would be compliant with current compliance requirements in order to be considered a legitimate dollar-pegged asset.

After the activation, the validators will help address directly buy the token. When the community completes the vote, then trading in USDH pairs will be done. Besides that, Hyperliquid has introduced an official proposal system to choose the team of developers that will create the token. The address on the contract of the winning team will serve as the formal deployment source of USDH.

Hyperliquid’s Spot Market Readjustments and Fee Cuts

The next network upgrade will not be restricted to the infrastructure of stablecoins. Hyperliquid will incorporate significant changes to its spot market, such as an 80% reduction in taker fees. Discounted charges will apply to markets with pairs of stable or quote assets like USDT, USDC, and the future USDH. Hyperliquid will create greater participation in non-volatile trading pairs by reducing transaction costs.

We are also seeing a decentralization to the spot market. A system is being built, which will permit token teams to register their assets in a permissionless fashion. Listings would require projects to satisfy staking requirements and slashing requirements, which would include an extra layer of security.

Increasing Futures Volumes and Market Share

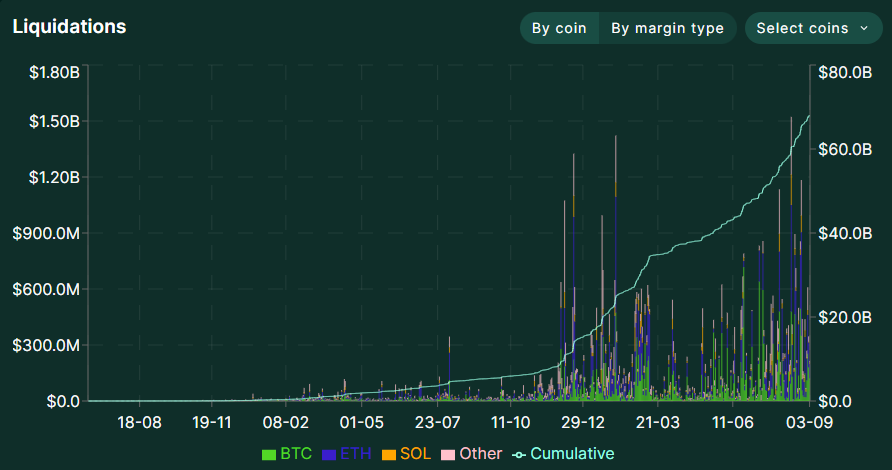

There is also increased activity in Hyperliquid on the exchange of its derivatives products. The exchange has reported high perpetual swaps demand in ETH and SOL, in particular, in August, with BTC activity remaining stable. These ETH and SOL markets were the location of large-scale liquidations on the platform, as the proportion of altcoin traders increased.

The growth in the Ethereum activity drove daily trading volumes to highest levels of over $28 billion. Hyperliquid traded $398.14 billion of perpetual futures contracts during the whole month. Comparatively, the market leader Binance achieved $2.8 trillion in the same time. In spite of this gap, Hyperliquid has been able to establish a position and is now 6th among all perpetual futures exchanges, outdoing some older centralized proving grounds.

Network Performance and Token Movement

Statistics by Hyperchain, which is the blockchain underlying platform, reveal that the blockchain has surpassed its key competitors in terms of settlements, trading volumes, and fees charged. HYPE, the native token of the exchange, has undergone a robust recovery and has experienced growth in tandem with the expansion. In three months, HYPE has rocketed up 36%, reaching its highest point of $46.17, its best price in about three months.

The project is still continuing to support the token value based on the buyback model. The recent disclosures indicated that 99% of the trading fees are used to buy HYPE; this will keep supporting the asset as the trading volumes increase.

The road to USDH will entail a number of governance processes. The ticker is ready, but will not become enabled until validators approve it via an on-chain voting process. The stablecoin, assuming it is issued, would be compliant with current compliance requirements in order to be considered a legitimate dollar-pegged asset.

After the activation, the validators will help address directly by buying the token. When the community completes the vote, then trading in USDH pairs will be done. Besides that, Hyperliquid has introduced an official proposal system to choose the team of developers that will create the token. The address on the contract of the winning team will serve as the formal deployment source of USDH.

Also Read: Crypto Legislation Draft Nears Release as SEC Text Deletions Stir Controversy