- HIP-4 introduces outcome trading that expands Hyperliquid’s derivatives toolkit

- Canonical markets will settle in USDH once testing and development reach completion

- HYPE jumps over 10 percent as traders respond to Hyperliquid’s latest protocol upgrade

Hyperliquid moved a step deeper into alternative derivatives this week, unveiling a new upgrade, HIP-4, that will eventually let its users trade outcome-based contracts. The announcement arrived through an X post and immediately nudged the market, with HYPE climbing more than 10% in a matter of hours. Besides, the token has been unusually resilient in a shaky market, adding more than 40% over the past seven days.

Hyperliquid Rolls Out HIP-4 as HYPE Price Jumps 10% (Source: X)

The rollout marks a shift in how the platform frames its toolbox. Instead of relying solely on perpetual futures, long the backbone of its activity, Hyperliquid is sketching out a parallel lane for contracts that settle within fixed ranges. These are fully collateralized and avoid the liquidation mechanics that typically define derivative trading across crypto markets.

What HIP-4 Brings Into Play

Under HIP-4, HyperCore will support “outcomes,” a term the team uses for contracts whose payoff curves bend away from linear exposure. They settle with full collateral posted upfront and fall into a range of use cases, from prediction markets to more structured, bounded instruments that echo options without mirroring their complexity.

Hyperliquid explained that outcomes add dated contracts and a different risk profile to its ecosystem. That added flexibility may be useful for traders who want exposure that does not hinge on leverage or sharp swings. The structure also slots into the platform’s existing setup, integrating with portfolio margin and the HyperEVM so that builders can combine outcome contracts with other tools.

For now, HIP-4 sits entirely on testnet. The team plans to launch Canonical markets only after technical work stabilizes. Those markets will lean on objective settlement sources and use USDH, the platform’s stable unit, as collateral. A wider, permissionless deployment could follow later, but it depends on how early users respond.

A Follow-On From HIP-3 Momentum

The timing is notable. The exchange only recently rolled out HIP-3, which lets users open custom perpetual markets by staking HYPE. That feature quickly attracted activity, especially in commodities and equities, where open interest climbed to new highs.

HIP-4, on the other hand, extends that momentum but does not replace the core perpetual engine. Instead, it widens the rails for traders who want exposure outside linear price tracking. It also positions the exchange within a sector where competition is tightening.

Prediction markets have seen renewed interest over the past year, though they still operate far below the scale of crypto’s perpetual futures. Hyperliquid’s move signals an attempt to bridge that gap while offering a model that avoids leverage-heavy dynamics.

Analysts Weigh the Revenue Impact

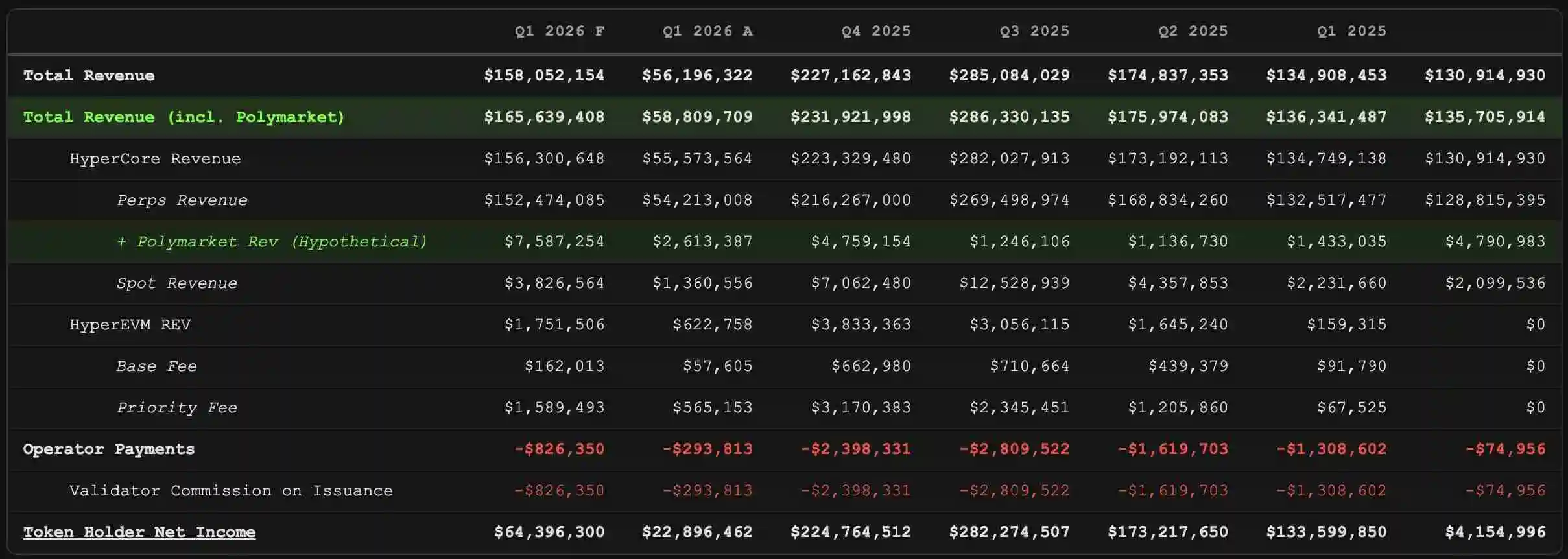

A useful comparison came from analyst Shaunda Devens, who noted that even if HIP-4 absorbed all of Polymarket’s current trading volume, the revenue impact would hit roughly 5% of Hyperliquid’s total take. That figure underscores how large perpetual futures remain relative to prediction-style activity.

Hyperliquid’s HIP-4 Revenue Prediction (Source: X)

Devens added another point: valuation gaps. Hyperliquid’s estimated value sits near $7 billion, while Polymarket recently drew attention with a $10 billion figure during fundraising. The analyst’s comments suggested that the exchange might be underpriced relative to its footprint, even though HIP-4 itself may not dramatically reshape near-term financials.

Devens later clarified that the small revenue share does not diminish the upgrade’s importance. HIP-4 uses USDH as collateral, which could gradually pull more activity into the unit and build additional flows over time. The structural change, Devens argued, matters more than the early revenue math.

HYPE Price Reaction

The market’s reaction was immediate and blunt. HYPE price moved from about $29 to more than $32 within hours of the announcement, extending a weeklong rally despite a broadly negative backdrop. The price move reflects confidence in Hyperliquid’s expansion rather than broader sentiment.

As HIP-4 moves from testnet toward live markets, its significance will hinge on adoption rather than fanfare. For now, the upgrade gives the exchange a more diverse derivative structure and a wider field to build into, one that traders have been quick to notice.