- Hang Seng debuts a gold ETF that blends physical bullion with controlled blockchain rails

- Ethereum tokenized units give investors verified on-chain ownership without market drift

- Hong Kong deepens its push into regulated digital finance as tokenization gains traction

Hong Kong’s ETF market picked up an unusual milestone this week as Hang Seng Investment Management introduced a gold fund that straddles two parallel systems: the conventional exchange and a blockchain-based alternative.

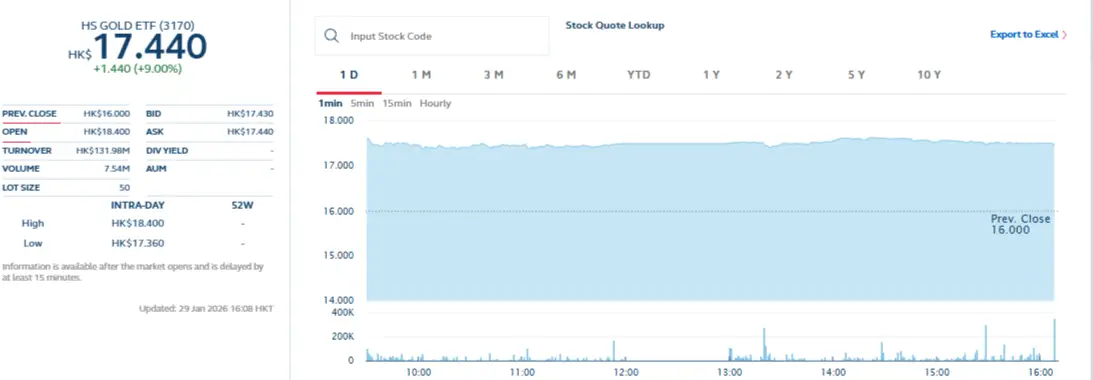

The launch adds a new twist to how investors hold bullion exposure at a time when tokenization trials are gaining traction across global finance. Per reports, the Hang Seng Gold ETF, listed under stock code 3170, opened at HK$17.39 and edged up roughly 9% in its first trading session.

Hang Seng Gold ETF Market Share (Source: HKEX)

Interest came in early and stayed fairly steady as the fund began tracking the LBMA Gold Price AM, the widely used benchmark set in London. Essentially, it’s a passive product with physical backing, holding bars that meet the London Bullion Market Association’s Good Delivery requirements.

Physical Metal Anchored in Hong Kong

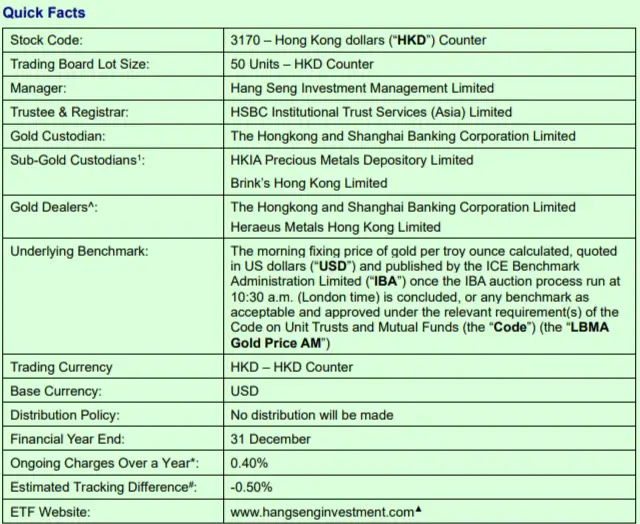

According to reports, all gold sits in Hong Kong vaults, with HSBC serving as custodian. The structure skips dividends entirely, so any return follows the movement of gold itself. The listed shares trade in Hong Kong dollars, with a board lot of 50 units, and carry estimated ongoing charges of 0.40% a year.

Hang Seng Debuts Gold ETF Offering Ethereum Tokenized Access (Source: Hang Seng)

The tracking difference is projected at roughly minus 0.50%. As a result, investors trade it on the secondary market like any ordinary ETF. Creation and redemption occur through participating dealers, either in cash or, in very specific cases, through in-gold settlement. However, retail investors do not interact with those mechanics.

The model resembles established bullion ETFs but keeps storage, settlement, and administration inside Hong Kong’s financial infrastructure. That local anchor matters, especially as the region positions itself more assertively in digital finance.

Tokenized Units Bring a Controlled Digital Layer

The distinguishing feature sits slightly outside the exchange: a separate, non-listed class of tokenized units issued on Ethereum. These units represent the same underlying gold but never touch a secondary crypto marketplace.

Subscriptions and redemptions run only through authorized distributors, and transfers stay in the controlled environment set by Hang Seng and its partners. HSBC, on the other hand, acts as the tokenization agent. This digital layer gives institutions a way to hold positions on-chain without exposing themselves to market dynamics common in digital tokens.

Notably, records remain immutable, ownership is transparent, and settlement can move with fewer operational frictions. Yet the ETF avoids the speculative attributes often associated with blockchain-linked assets. The approach widens the audience without loosening compliance boundaries, a balance that financial regulators in Hong Kong have increasingly sought.

Broader Momentum Behind Tokenized Finance

Authorities have been pushing the sector toward practical experimentation. The Hong Kong Monetary Authority, for instance, recently ran a pilot involving tokenized deposits and digital assets, testing how real-value transactions behave in a regulated environment. The timing aligns with developments elsewhere.

The New York Stock Exchange and the Intercontinental Exchange also announced plans to build an infrastructure system for tokenized stocks and ETFs, targeting near-instant settlement and eventual 24/7 trading once regulators sign off. Traditional institutions appear to be moving in a similar direction.

A report from Sygnum forecasts that tokenization could shift closer to the core of capital markets by 2026. Co-founder and CEO Mathias Imbach estimated that roughly 10% of new institutional bond issuance might debut in tokenized form within that window.

For now, the Hang Seng Gold ETF stands as a rare example of a hybrid model that keeps physical metal, exchange structure, and blockchain rails in the same frame. It is still early, but the design hints at how asset managers may try to fold traditional commodities into a more digital settlement landscape without overhauling the basic concept of an ETF.