- Grayscale adds 36 new tokens as sector focus steadily shifts toward deeper utility layers

- New entries highlight rising interest in DeFi trading tools, liquidity systems, and compute hubs

- Market reaction stays calm, but long-term visibility grows for tokens now under review

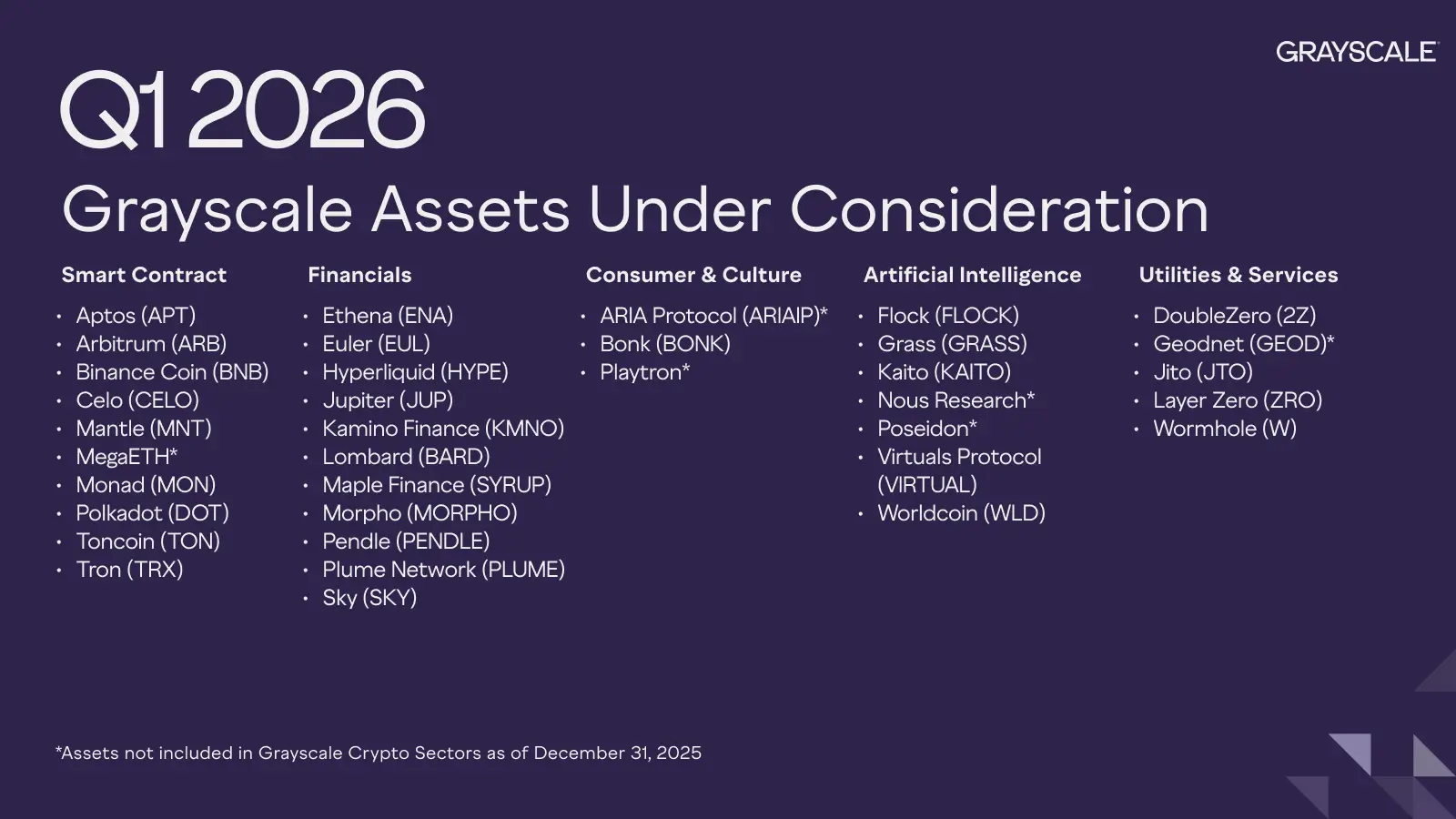

Grayscale Investments has expanded its digital asset watchlist for the first quarter of 2026, including 36 new cryptocurrencies in its research pipeline. The update arrives at a time when institutional interest is moving towards those sectors that combine technical depth with more apparent real-world applications.

The latest inclusions stretch across emerging areas in decentralized finance, infrastructure, artificial-intelligence-linked computation, and consumer-focused token models. The watchlist appears in Grayscale’s routine “Assets Under Consideration” report, a quarterly snapshot meant to flag assets that may eventually fit into regulated investment vehicles.

Grayscale Expands Crypto Focus With DeFi, AI, and 36 New Tokens (Source: X)

However, placement on the list offers no guarantee of a future product, yet it hints at where institutional analysts believe market activity and sector development are quietly reorganizing. This quarter’s expansion breaks into five broad categories: smart contract networks, financial protocols, consumer and culture tokens, computation-driven projects, and infrastructure or services.

The two categories, the platforms of smart contracts and financial protocols, take hold of the biggest part, which strengthens the belief that the base-layer systems and yield-generating primitives are still the main focus of the long-term institutional strategy.

Grayscale: Smart Contract and Financial Protocols Drive the Update

According to the Grayscale report, smart contract platforms feature prominently once again. Tron is among the most recognizable entrants, a network often linked to high-volume settlement flows and rapid transaction throughput. Its appearance on the list suggests rising curiosity about chains that consistently support large payments and day-to-day activity rather than headline-driven spikes.

The financial and DeFi segment accounts for several of the most notable newcomers. Ethena, Hyperliquid, Jupiter, and Morpho were added for their work in derivatives, lending, liquidity routing, and broader capital efficiency. These projects help run the machinery behind decentralized markets, processing substantial flows even during quieter trading cycles.

Their inclusion underscores sustained interest in protocols that generate recurring fees, offer leveraged market tools, or anchor liquidity in ecosystems that depend heavily on on-chain settlement.

Grayscale: Computation and Infrastructure Projects Gain Ground

A separate cluster of additions centers on computation-driven networks. Projects such as Nous Research and Poseidon point toward expanding institutional study of distributed compute markets and data-coordination frameworks. These systems attempt to merge transparent verification with large-scale processing environments, a combination attracting more builders as workloads become heavier and more specialized.

Infrastructure and service networks also appear, including DoubleZero, which operates within decentralized physical infrastructure models that use tokens to coordinate real-world resources. These systems often target bandwidth, compute, or distributed connectivity and appeal to analysts watching for applications that do not rely on centralized vendors.

Not to leave out, consumer and culture tokens make a smaller yet still significant showing. ARIA Protocol, which focuses on rights management and intellectual-property tokenization, reflects a steady push toward blockchain-based licensing tools and creator-centric revenue models.

Regulatory Signals and Market Outlook

The wider watchlist arrives alongside procedural steps in Delaware, where statutory trusts tied to potential BNB and Hyperliquid products were recently registered. Such moves typically occur before any exchange-traded structure advances through regulatory review, though approval is never implied.

Market response to the update stayed muted. Analysts say that watchlist placement tends to generate visibility rather than immediate inflows. Even so, assets added to the review process often see deeper research coverage over time.

In broad terms, the new batch illustrates how institutional interest is shifting toward utility-heavy sectors. Besides, the 36 additions hint at how regulated product menus may evolve as demand broadens beyond the largest layer-one networks.