- GWEI governance aims to guide how Ethereum blockspace is allocated and executed

- ETHGas prioritizes scheduled execution to minimize fee fluctuations and enhance reliability.

- Genesis Harvest snapshot will reward active Ethereum users in early distribution.

ETHGas has introduced its new GWEI Token in a bid to bring more structure to how Ethereum block transactions are executed. The move comes as the team attempts to step away from the network’s long-standing dependence on gas auctions, a system that often forces users and developers into unpredictable bidding contests during periods of congestion.

ETHGas Introduces GWEI Token for Ethereum Block Trading (Source: X)

By reframing blockspace as something that can be reserved and priced in advance, the protocol is signaling a shift toward more deliberate transaction planning on Ethereum. The team described Ethereum as the strongest settlement layer in the industry, yet one that still struggles to match rising application demand.

In an X post, the ETHGas platform acknowledged that latency and sharp fee swings remain familiar problems, particularly during periods of high activity. However, ETHGas argues that execution becomes more stable when blockspace itself is treated as an asset, rather than a free-for-all competition in the mempool. The GWEI token sits at the center of that shift, serving as the governance tool for the system.

ETHGas: From Gas Auctions to Programmable Blockspace

According to reports, gas may determine payment, but blockspace is the real commodity inside each Ethereum block. ETHGas focuses on the latter, saying the current auction model provides no guarantees and leaves complex applications without the certainty they increasingly need.

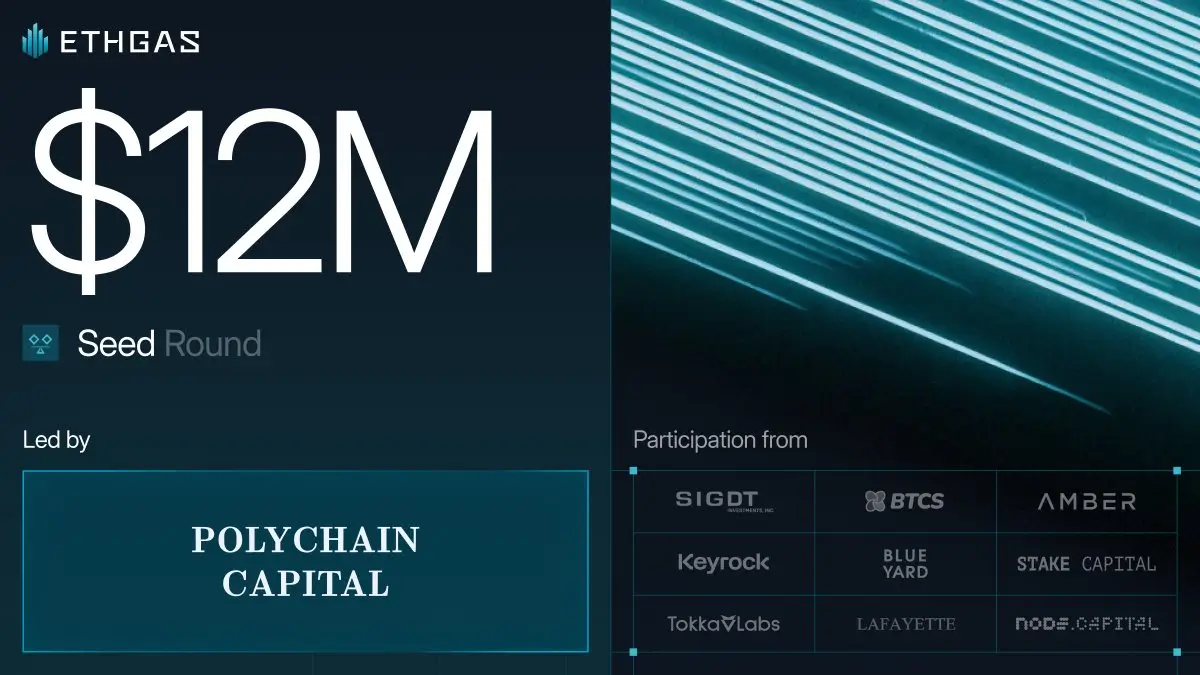

Its push toward scheduled execution builds on momentum from last year, when the project raised $12 million and launched a blockspace futures market backed by about $800 million in commitments. That early liquidity suggested institutions were already exploring ways to secure predictable throughput.

ETHGas Secures $12M and Launches Blockspace Futures Backed by $800M (Source: X)

The project frames its goals around what it calls “Realtime Ethereum,” an environment where applications commit to execution ahead of time rather than fight for position once transactions enter the mempool. It is a subtle shift in logic, but one that supporters argue could shape the next phase of Ethereum scaling.

Governance Under the GWEI Token

The GWEI Token operates strictly as an ERC-20 governance asset. Holders who stake the token receive veGWEI, which determines how much influence one holds over protocol changes. This includes tuning system parameters, approving treasury decisions, and authorizing future upgrades.

The structure avoids the typical blend of utility and governance functions found in many tokens. Instead, it narrows the purpose: shaping the direction of the protocol. Notably, influence increases with longer lock-up periods, a model meant to reward users who commit more deeply to the system’s future.

Holders are also allowed to transfer their power of voting to people or groups they trust, which is a characteristic that wants to ensure widespread participation without compelling every user to give their opinions on every proposal.

Notably, ETHGas places significant weight on community control. Treasury deployment, grant funding, and strategic partnerships all pass through governance. veGWEI holders also serve as the final authority during upgrades or emergency adjustments. This approach mirrors a wider trend in decentralized governance, though ETHGas applies it with a tighter focus on execution markets.

Distribution and the Genesis Harvest

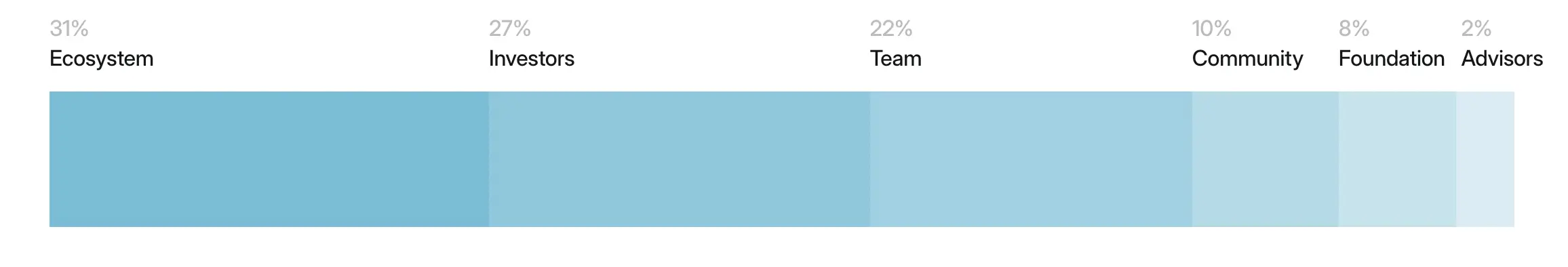

The supply of the GWEI token is fixed at 10 billion. The distribution is strongly inclined towards ecosystem building, with only 31% going to the other growth initiatives. Moreover, investors are assigned 27%, the core team 22%, the community 10%, the foundation 8%, and advisors 2%.

GWEI Token Tokenomics and Distribution (Source: ETHGas)

The protocol’s first major event, the “Genesis Harvest” airdrop, hinges on a snapshot planned for January 19, 2026, at 00:00 UTC. According to ETHGas, the main factor for qualifying will be the account of past Ethereum usage and participation in the community that has been verified. The final criteria are still being worked on, but the announcement of the snapshot indicates how ETHGas intends to reward early activity.

Meanwhile, the broader debate over predictable execution continues within the Ethereum community. Previously, Vitalik Buterin explored trustless gas futures as one way to stabilize fee exposure, though his comments also raised questions about added risks. ETHGas is now attempting to turn those theoretical discussions into a functioning market with clearer rules and a governance layer rooted in the GWEI token.