- Crypto ETPs post a strong US$1.07bn rebound after four weeks of redemptions.

- Bitcoin, Ethereum, and XRP lead inflows as U.S. buyers dominate weekly activity.

- XRP records its largest weekly inflow ever, with US$289m added to investment products.

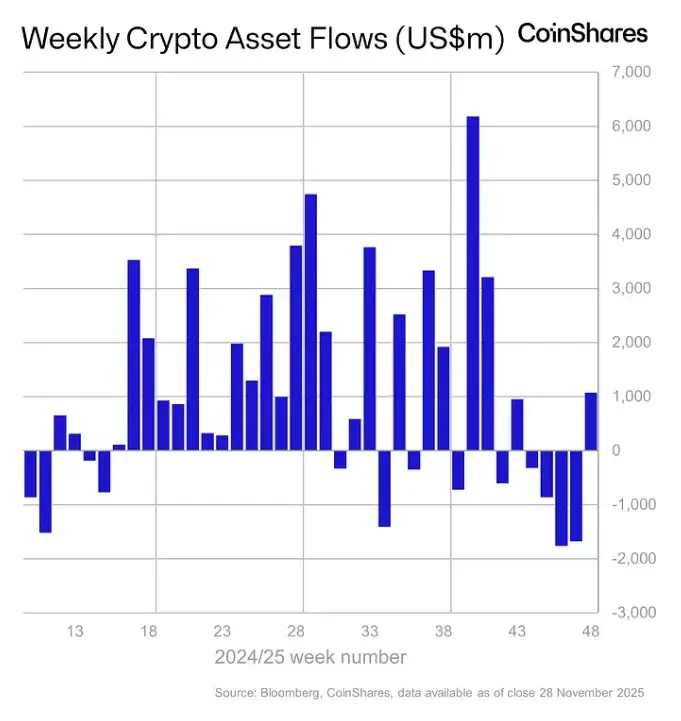

The week brought a dramatic change for crypto ETPs. After watching four straight weeks of redemptions that drained US$5.7 billion, investors returned with force, adding about US$1.07 billion. What triggered the swing wasn’t a market event but remarks from FOMC member John Williams, who reminded markets that policy is still tight, a comment many read as an early hint that rate cuts may not be far away.

Crypto ETPs Gain $1bn (Source: CoinShares)

Even with the Thanksgiving slowdown, activity around crypto ETPs stayed steady. Weekly volumes slid to US$24 billion, far lower than the record US$56 billion logged the previous week, but the lower turnover didn’t stop the renewed inflow.

US Leads as Crypto ETPs Record a Broad Rebound

According to reports, most of the momentum came from the United States, which accounted for almost US$994 million of the total. Canada added US$97.6 million, and Switzerland posted US$23.6 million, while Germany moved the other way with roughly US$57 million in outflows.

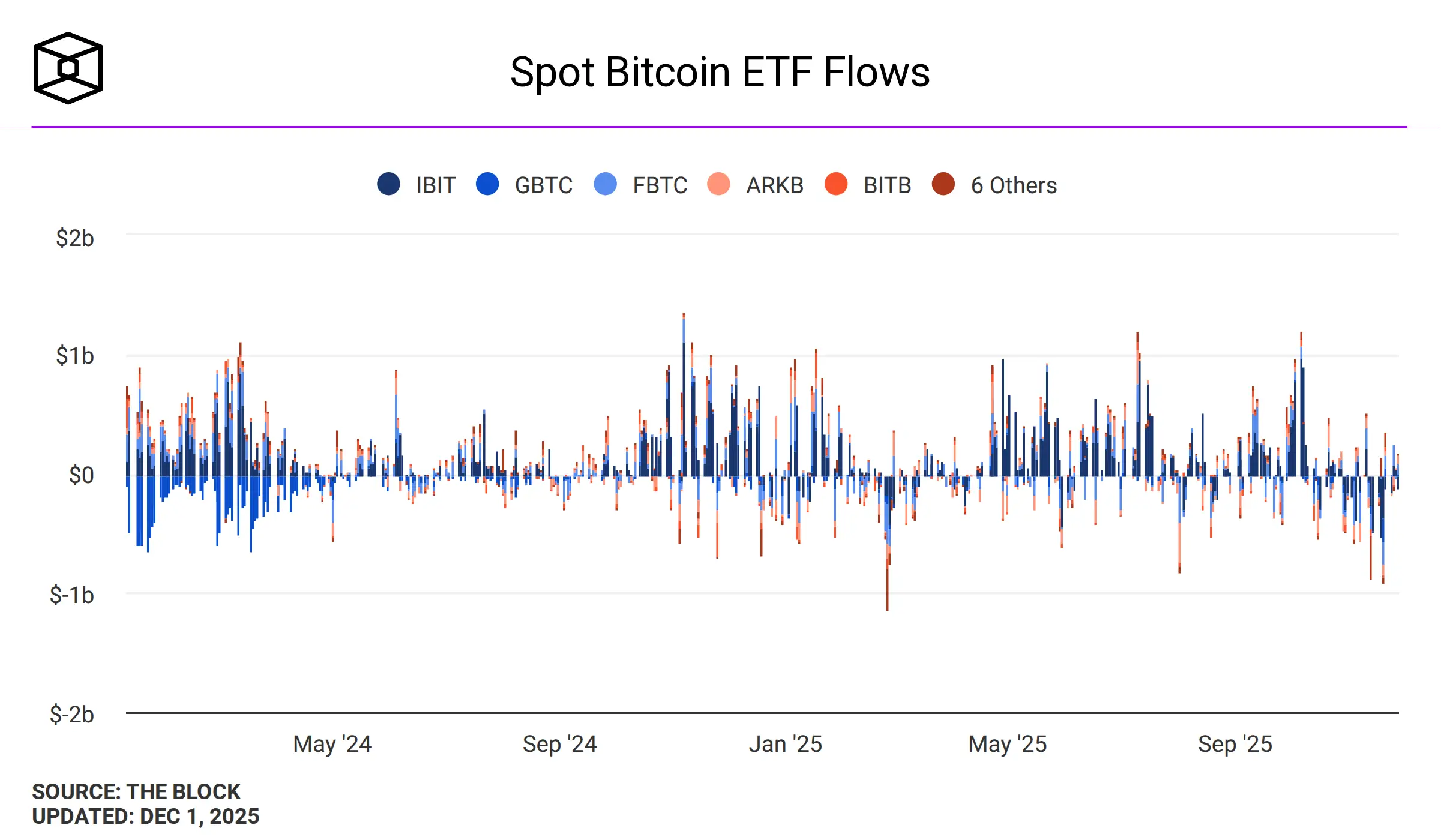

Bitcoin-linked ETPs captured the biggest portion of investor interest, drawing US$461 million. Short positions were cut back, as shown by US$1.9 million leaving short-bitcoin products. In the U.S. market, spot Bitcoin ETFs brought in US$70.1 million, helped by Fidelity’s FBTC with US$230.5 million. Products from iShares, Volatility Shares, and Grayscale added smaller inflows.

Spot Bitcoin ETF Flows (Source: TheBlock)

Ethereum ETPs followed with US$308 million. The U.S. accounted for nearly all of that amount, recording US$312.6 million in spot ETF inflows that outweighed redemptions in other regions. Ethereum products now hold US$25.51 billion in assets under management this year.

Record-Setting Week for XRP as Crypto ETPs Gain Traction

Similarly, XRP posted a milestone week. Its crypto ETPs attracted US$289 million, the highest weekly figure ever recorded for the asset. Over the last six weeks, XRP products have taken in flows equal to 29% of their total assets, a rise closely linked to the launch of U.S. spot XRP ETFs.

Year-to-date inflows have reached US$2.89 billion, and total assets under management now stand at US$3.13 billion. Other crypto ETPs showed mixed patterns. Solana added US$4.4 million, lifting its month-to-date figure to US$101.7 million. Litecoin, on the other hand, slipped by US$0.9 million, while Sui gained US$0.6 million.

Cardano saw one of the sharper moves, losing US$19.3 million, equal to 23% of its entire product assets. Multi-asset crypto ETPs brought in US$26.3 million, continuing a slow but steady accumulation trend.

Macro Shifts and Regulation Keep Crypto ETPs in the Spotlight

What stands out is how quickly sentiment rotates around crypto ETPs. Optimism around interest rates played a major part in last week’s rebound, but broader regulatory progress has also changed how institutions approach the sector. Recent stablecoin rules and clearer digital-asset guidelines in the United States have encouraged more traditional firms to treat Crypto ETPs as long-term allocation tools rather than short-term trades.

Hedge funds have been part of that shift, too. Their digital-asset exposure climbed to 55% in 2025, up from 47% the year before. This shows that crypto ETPs are becoming part of mainstream portfolio construction, even if the market can swing sharply in either direction.

That sensitivity was visible almost immediately. Days after the US$1.07 billion surge, global crypto ETPs saw US$1.17 billion flow out again as new macro concerns surfaced. It underscores a market that reacts instantly to policy signals, liquidity shifts, and central bank remarks.

Still, the inflow week highlighted how central crypto ETPs have become for institutions managing digital-asset exposure. As rules strengthen and more regulated products enter the market, crypto ETPs continue to pull the focus of the global investment industry, whether sentiment is rising or falling.