- Coinbase adds new talent to scale prediction markets across major global events.

- Regulators increase pressure as outcome contracts gain traction in fintech.

- Industry experts warn that rapid user churn could reshape platform risks.

Coinbase has expanded its presence in event-driven trading, striking a deal to acquire The Clearing Company as it accelerates its push toward a broader “Everything Exchange” model. The decision follows the rollout of prediction markets inside the Coinbase app earlier this month, a feature the company introduced with little fanfare but clear ambition. The deal is expected to close in January 2026; however, neither side has disclosed the financial terms.

A Strategic Acquisition to Accelerate Market Expansion

The Clearing Company is a young outfit, raised about $15 million in seed funding, and already has Coinbase Ventures on its cap table. Now the entire team is heading to Coinbase, where their experience in building event-based trading tools is expected to fold directly into the company’s new product track.

Coinbase Advances Prediction Markets With Clearing Co. Deal (Source: X)

The exchange said the move is intended to attract specialists who understand the nuances of forecasting markets, where outcomes fluctuate based on political events, data releases, or even unexpected cultural developments. Coinbase has repeated its interest in pulling multiple asset types onto a single platform.

The firm plans to enable users to seamlessly move between cryptocurrencies, equities, derivatives, and now outcome contracts, without needing to navigate separate interfaces. In its blog update, the company described prediction markets as another step in that direction: a way for users to trade views on real-world events the same way they trade digital assets.

Prices in these markets often serve as probability signals, though their usefulness depends on liquidity and participation. Recent activity from Polymarket and Kalshi, particularly in a year dense with political contests and major sports schedules, has pushed volumes higher. Reuters and MarketWatch both noted unusual levels of user engagement around major election-related questions during 2025, a trend that has not gone unnoticed by larger firms.

Integrating Talent and Technology Into Coinbase’s Core Products

For Coinbase, the acquisition is as much about internal structure as it is about product design. Engineers from The Clearing Company will be working on the underlying systems that keep prediction markets compliant, auditable, and fast enough for retail flow.

Some of the founders came from earlier prediction venues and bring institutional knowledge that Coinbase has been light on until now. The company’s product leadership has echoed one theme repeatedly: giving users more ways to interact with events that unfold in real time.

Whether those events concern elections, economic benchmarks, or sudden shifts in entertainment headlines, Coinbase wants them available inside a single trading environment.

This approach is already visible in its recent tie-up with Kalshi, where Coinbase provided initial liquidity while preparing its own in-house marketplace. That partnership suggests a dual track: cooperate with established actors while simultaneously building a competing model.

Regulatory Friction and Industry Debate Intensify

The push into prediction markets has drawn attention from state regulators. Coinbase has been contesting attempts by several states to treat these markets as gambling products, a classification that would sharply limit distribution.

Barron’s reported that regulators in multiple jurisdictions have questioned whether outcome-based contracts fit within financial rules or fall under gaming statutes instead. At the same time, the broader industry debate has grown louder.

Vitalik Buterin has argued that prediction platforms can act as a counterweight to misinformation by requiring people to stake money on their claims. Similarly, analysts at Keyrock have pointed out that some markets react before official data prints, making them useful signals for traders who track economic direction.

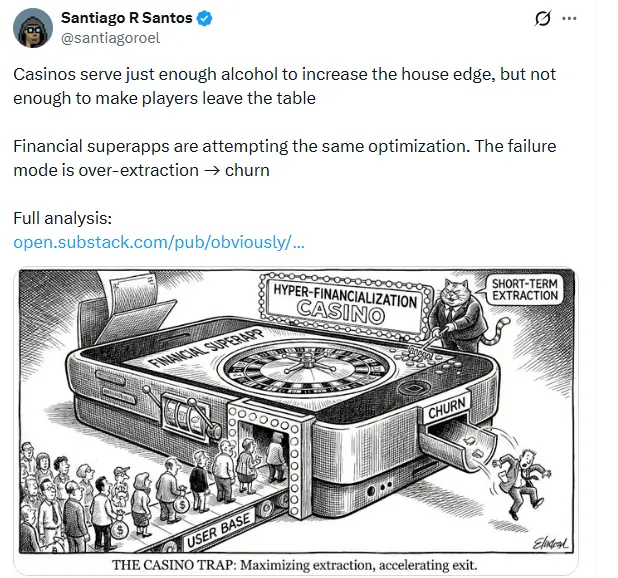

However, not everyone sees the upside. Santiago Santos of Inversion Capital warned that these products can resemble casino environments if not managed carefully. His concern centers on user churn: participants who lose repeatedly tend to leave the platform entirely, reducing long-term value.

Industry Debate Intensifies (Source: X)

He compared the risk to casinos that walk a fine line between engagement and exhaustion, a balance that is harder to maintain in digital settings.

A Pivotal Step Toward the “Everything Exchange” Vision

The acquisition gives Coinbase the in-house expertise it lacked as it attempts to broaden the scope of its marketplace. With prediction markets gaining momentum, rising scrutiny, and clear demand during high-stakes global events, the company is positioning itself for a more expansive future, one where outcome contracts sit alongside traditional financial instruments under a single roof.