- Bitmine lifts its ETH stock to 4.326M as the firm adds 40K tokens during a sharp market slip

- Ethereum activity rises with fresh highs in daily use, even as the asset trades far below last year’s

- Staking income jumps as Bitmine pushes 2.9M ETH into validators to grow long-term rewards

Bitmine Immersion Technologies expanded its Ethereum position again this week, adding another 40,600 ETH as the market drifted back toward the $2K mark. Per reports, the company now sits on 4.326 million ETH, roughly 3.58% of the network’s circulating supply, at a moment when sentiment across the sector has been pinned down by months of selling pressure.

The move folds into a broader reshaping of the firm’s balance sheet, which has climbed to $10 billion across crypto assets, cash, and a handful of equity bets. Executives offered little gloss around timing; instead, they pointed to the steady buildup of network activity and what they describe as durable fundamentals that have not softened even as prices sagged.

For a company that has tied its long-term strategy to Ethereum’s proof-of-stake economy, the downturn appears to have accelerated rather than slowed its buying.

Bitmine: Ethereum Holdings and Balance Sheet Breakdown

The updated figures present one of the largest ETH inventories held by any corporation. Of the 4.326 million ETH on the books, about 2.897 million are already staked, anchoring most of the company’s exposure to Ethereum’s validator income rather than short-term price drift. At current pricing, the staked portion is valued at roughly $6.2 billion.

Alongside Ethereum, the company holds 193 Bitcoin and several smaller equity stakes, including $200 million in Beast Industries and $19 million in Eightco Holdings. Yet, cash reserves stand at $595 million. Together, they form a balance sheet that tilts overwhelmingly toward ETH, with executives offering no sign that stance will change.

Rising Demand Metrics Despite Market Lows

In a press release, Executive Chairman Thomas Lee told investors that Ethereum’s underlying activity continues to climb even as the token trades far below last year’s highs. Daily transactions recently hit about 2.5 million, according to data from The Block, while active addresses have hovered near one million per day in early 2026.

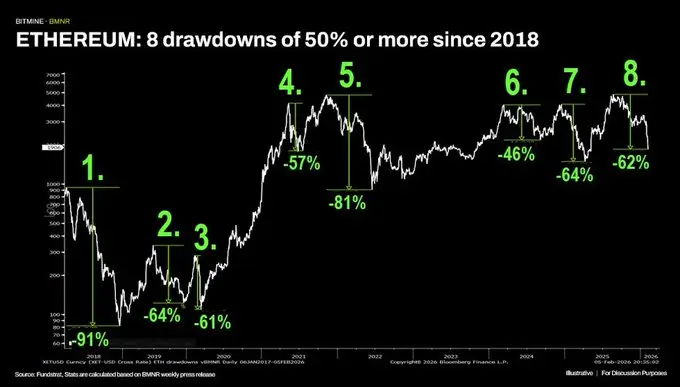

Those numbers, he said, reinforce internal confidence at a time when prices have fallen more than 60% from 2025 levels. Lee noted that Ethereum has endured eight drops of at least 50% since 2018, often followed by sharp recoveries.

ETH 50% or More Drawdowns (Source: Bitmine)

He referenced the early-2025 selloff, when ETH lost more than half its value before climbing from $1,600 to $5,000 later in the year. The pattern, he suggested, has become a feature of the asset’s market cycle rather than an anomaly.

Staking Revenues and Validator Strategy

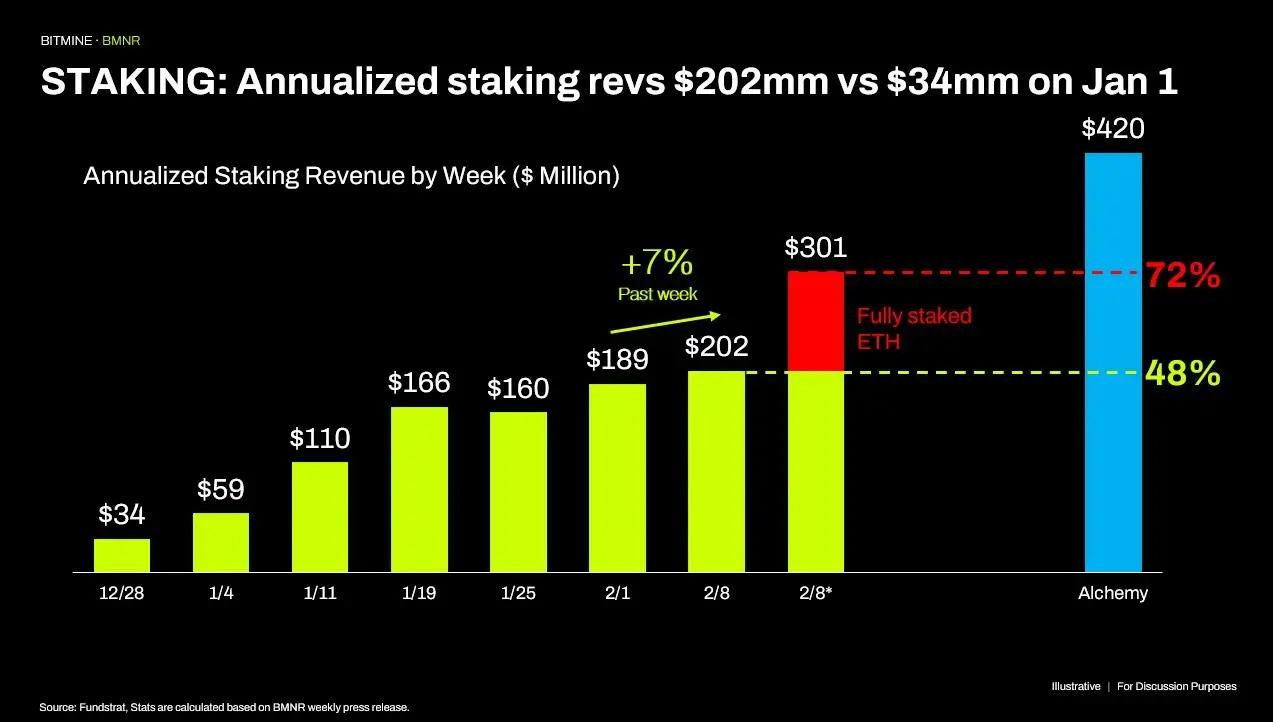

Staking now drives a sizable share of the company’s revenue. According to the press release, annualized staking income stands at $202 million, up about 7% in the past week. Similarly, the firm’s internal staking operations reported a seven-day annualized yield of roughly 3.32%, slightly above the broader composite rate of about 3.11%.

Bitmine Annualized Staking Revs (Source: Bitmine)

Executives said that once all holdings are routed through its validator platform, the Made in America Validator Network, annual rewards could approach $374 million. The rollout is planned for early 2026 and is being finalized with three outside providers.

Market Backdrop Keeps Pressure on ETH

At press time, Ethereum traded around $2,025, a modest 5% slide in the past 24 hours after retesting the $1,700 area in the previous week. Meanwhile, market gauges placed the relative strength index near 32, a level that often suggests selling momentum is wearing thin and hints at a potential reversal to the upside in the near term.

ETH Price Action (Source: TradingView)

Elsewhere in the sector, Strategy reported another round of Bitcoin purchases, approximately 1,142 BTC for $90 million at $78,815 per bitcoin, underscoring how corporate strategies are diverging across major digital assets. For now, Bitmine remains firmly anchored to Ethereum, expanding its position even as the market struggles to find its footing.