- Bitcoin crosses 95% supply mined, strengthening its long-term scarcity narrative.

- Shrinking issuance pushes miners toward fee-driven revenue as margins tighten.

- ETFs and institutions absorb more supply as Bitcoin enters its scarcity-led phase.

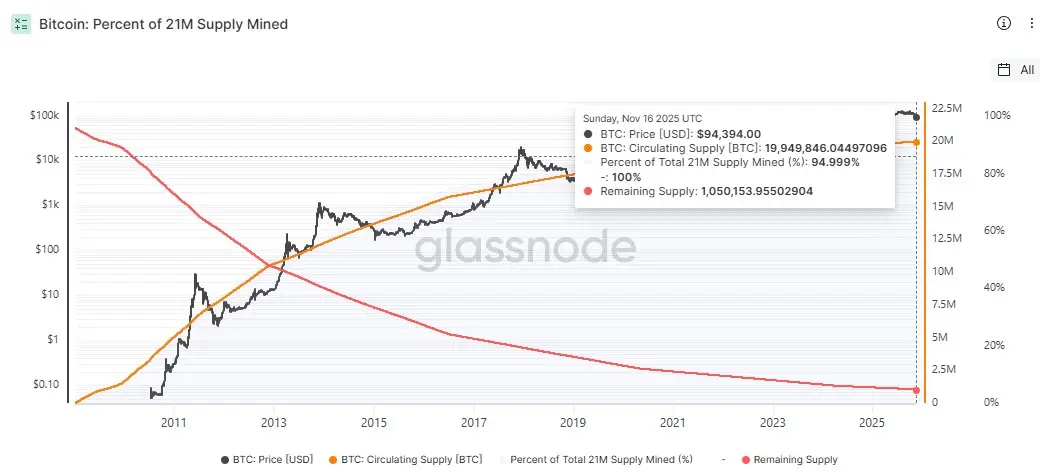

Bitcoin has crossed a major threshold in its supply timeline, with more than 95% of the total 21 million coins already mined. Glassnode data shows that 19.949 million BTC are currently in circulation, leaving only about 1.050 million BTC to be issued over the next century. The milestone underscores the purpose behind Bitcoin’s fixed-supply structure: a gradually tightening supply that becomes more influential as halving events slow issuance.

Bitcoin Hits 95% Supply Mined (Source: Glassnode)

This moment signals Bitcoin’s shift from a fast-expanding digital asset to a mature, scarcity-anchored monetary network. With annual inflation falling toward 0.8%, Bitcoin now expands at a slower pace than gold.

Investors who follow its monetary design have long pointed to this moment as a turning point where scarcity stops being a distant concept and becomes a real force in market behavior.

The Supply Architecture Is Almost Fully Realized

When the first block was mined in 2009, the idea of a hard cap was mostly theoretical. No one knew whether the system would function for a year, let alone long enough to reach 95% completion. And yet here it is, still running on the same rules.

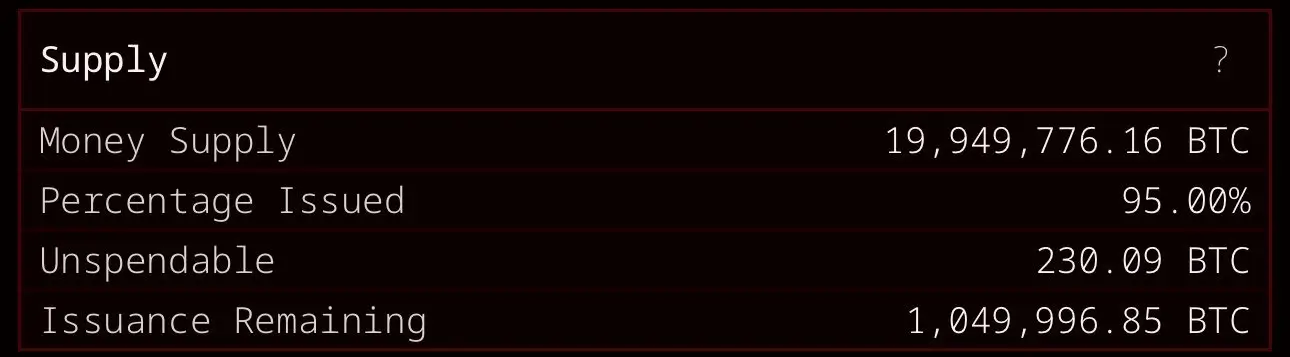

Current supply at a glance:

- Maximum supply: 21,000,000 BTC

- Circulating supply: 19,949,776 BTC

- Portion mined: 95%

- Remaining issuance: 1,049,996 BTC

- Identified unspendable coins: 230.09 BTC

Bitcoin Market Tokenomics (Source: X)

Future issuance will arrive at an increasingly slow pace. Block rewards were cut to 3.125 BTC after the April 2024 halving and will continue shrinking until the final coin is created around the year 2140. Thomas Perfumo of Kraken notes that this slow-release approach reinforces Bitcoin’s appeal as an asset designed to resist inflation and arbitrary supply expansion.

How Scarcity Has Shaped Each Halving Era

Long-range charts covering some of BTC’s halving cycles show a rhythm that repeats, even if the percentages shift over time. Issuance drops, supply tightens, the market expands, and eventually a correction sets in.

Bitcoin Halving Cycles (Source: TradingView)

A brief cycle recap:

- 2016 halving: Price gained nearly 3,959% before its late 2017 peak, then fell 83%.

- 2020 halving: A rally of about 678% carried into late 2021, followed by a 77% contraction.

- 2024 halving: Price topped around $126K so far, with a drawdown of approximately 27% as of the current price around $93K.

Across every cycle, the repeating structure is unmistakable: reduced issuance leads to scarcity, scarcity feeds expansion, and expansion eventually cools.

Mining Economics Under Tightening Rewards

Beyond the scarcity story shaping BTC’s market behavior, the mining industry bears the strongest impact from this milestone. With rewards shrinking and network difficulty hovering near record levels, margins are tightening. Mid-size miners, in particular, are under pressure to reduce costs and improve efficiency. Since April 2024:

- Block reward fell to 3.125 BTC

- Difficulty: near all-time highs

- Margins: compressed for many operators

Nansen’s Jake Kennis says the 95% point will not shock the market immediately, but it highlights a brewing shift. Meanwhile, RedStone’s Marcin Kazmierczak expects miners to rely more on transaction fees as block rewards fade over future decades.

“We’re transitioning from block reward-dependent miners to transaction-fee-dependent miners. This creates pressure on miners to consolidate or seek efficiency gains,” he said.

Scarcity Begins to Shape Market Behavior

The broader market impact of the 95% mark reaches far beyond mining. The milestone reinforces long-term dynamics already shaping Bitcoin’s supply structure.

Key forces now steering the market:

- ETFs continue absorbing a growing share of available supply

- Institutional demand rises as supply expansion slows

- Exchange reserves hover near multi-year lows

- Long-term holders maintain dominant control of circulating coins

Experts agree that the milestone is not a direct price catalyst, yet its timing matters. It comes as ETF markets expand, regulatory frameworks mature, and corporations explore Bitcoin for treasury allocation. Perfumo describes the asset as operating “with the certainty of authenticity and scarcity you’d expect from a masterpiece like the Mona Lisa.”

Conclusion

Passing the 95% mark confirms the durability of Bitcoin’s fixed-supply model. The remaining issuance stretches across more than a century, and scarcity will play a larger role in the market as each halving pushes new supply even lower.

Historical cycles show that tightening supply often precedes extended phases of growth once mid-cycle corrections fade. With fewer than 1.1 million coins left, Bitcoin now moves into a phase where scarcity becomes a daily reality rather than a long-term projection.