- Ark Invest bought $21M of Robinhood stock across ARKK and ARKW after a short-term dip.

- The firm also invested $21.2M in Bullish, raising exposure to fintech and crypto assets.

- Robinhood’s global expansion and acquisitions fuel growing institutional confidence.

Cathie Wood’s Ark Invest added to its fintech portfolio this week with another major purchase of Robinhood Markets (NASDAQ: HOOD) stock. The asset manager bought roughly $21.3 million in shares on Tuesday through its ARK Innovation ETF (ARKK) and ARK Next Generation Internet ETF (ARKW).

Filings show ARKK acquired 131,049 shares while ARKW took in 36,440, bringing the total to 167,489. The move marked Ark’s third straight day of buying Robinhood, following earlier purchases worth $14 million on Monday and $9 million on Friday.

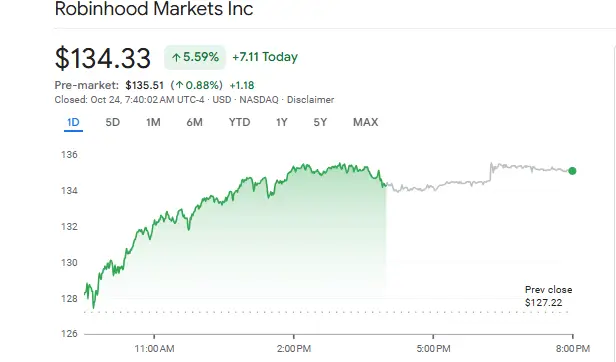

Robinhood Markets Inc (Source: Google Finance)

The latest buy came as Robinhood shares slipped 3.5% to $127.22, offering an entry point after recent volatility. By Wednesday, the stock rebounded sharply, closing up more than 5% at $134.33. The recovery suggested renewed investor confidence, driven in part by Ark’s continued interest and Robinhood’s steady growth in global markets.

Ark Invest: Building Broader Fintech and Crypto Exposure

Ark’s trade activity on Tuesday also included a $21.2 million purchase of Bullish shares through ARKK, extending its position in the newly listed crypto exchange. The firm now holds more than $172 million worth of Bullish stock across three funds following the exchange’s debut on the New York Stock Exchange last week.

The investment deepens Ark’s footprint across digital finance. Alongside Bullish and Robinhood, Ark holds stakes in Coinbase and BitMine, both viewed as key players in crypto infrastructure. This indicates Wood’s investment strategy continues to focus on companies positioned at the intersection of blockchain and mainstream financial systems.

However, Ark’s approach remains active and flexible. In September, the firm trimmed 40,000 Robinhood shares, worth about $5.1 million, to buy $4.3 million in BitMine stock. The decision came just days after S&P Global confirmed Robinhood’s addition to the S&P 500 index, a move that surprised analysts but showed Ark’s readiness to shift capital quickly when opportunities appear.

Adjusting Positions Across the Innovation Space

Ark’s daily filings reveal broader moves across its innovation funds. On the same day it bought Robinhood shares, the firm also purchased 15,756 shares of Netflix, valued at about $19.6 million. The buy came after Netflix’s stock fell roughly 10% following weaker quarterly results.

Ark Investment in the Stock Market (Source: X)

At the same time, Ark scaled back on several high-growth technology names to rebalance its exposure:

- Advanced Micro Devices (AMD): 44,909 shares sold, worth about $10.7 million.

- Palantir Technologies (PLTR): 23,768 shares sold, valued at $4.3 million.

- Roblox (RBLX): 111,849 shares sold, worth $14.9 million.

- Roku (ROKU): 55,255 shares sold, worth $5.4 million.

These changes indicate a strategic rotation from stretched valuations in entertainment and semiconductor stocks toward fintech and digital asset sectors, where Ark sees more substantial medium-term growth potential.

Robinhood’s Global Expansion Gains Traction

Robinhood’s recent performance has drawn growing attention from institutional investors. The company’s expansion beyond the U.S. market is accelerating through a series of high-profile acquisitions.

In May, Robinhood acquired Toronto-based WonderFi for approximately $180 million to expand its crypto services in Canada. The following month, it acquired Bitstamp for roughly $200 million, a move that strengthened its presence in international trading.

The firm also introduced support for Binance Coin (BNB) trading on its platform, widening access to digital assets. These developments highlight Robinhood’s effort to shift from a retail trading app into a global fintech brand with a larger role in cryptocurrency markets.

Analysts expect Robinhood to report $1.19 billion in quarterly revenue and earnings of $0.51 per share. A strong performance on both fronts would affirm the company’s progress toward sustained profitability, which Ark Invest appears to be anticipating.

Conclusion

In summary, Cathie Wood’s $21 million Robinhood purchase shows Ark Invest’s steady conviction in financial technology and crypto-driven innovation. Buying during a short-term dip positioned the firm for potential upside tied to Robinhood’s global expansion and improving fundamentals. As the stock jumped 5% following the trade, Ark’s decision reflected both timing and long-term confidence in the evolution of digital finance.