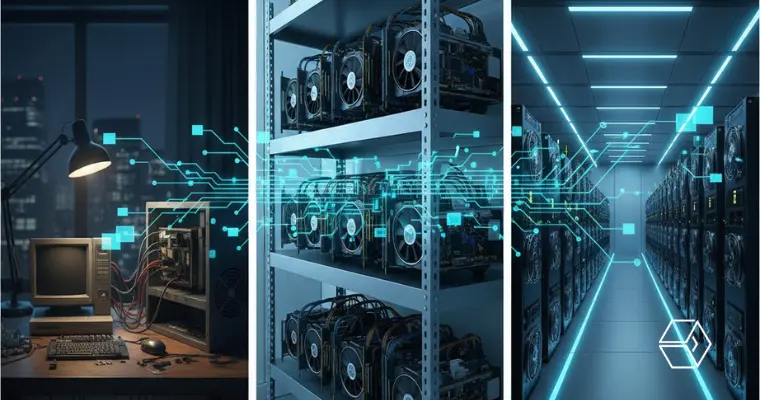

Crypto mining has changed completely from the early days of Bitcoin, when enthusiastic individuals could mine meaningful amounts of coin using a simple computer. In 2009 and 2010, Bitcoin mining was nothing more than a painstakingly slow process driven by a few curious computer-savvy hobbyists who took it as an academic experiment. The starting point was CPU mining on personal computers, then GPU mining and USB crypto miners, followed by massive industrial operations with ASIC miners and huge server farms devoted solely to hashing power.

This transformation was driven by the rise of the Bitcoin network, an increase in mining difficulty, economic incentives, and rapid advances in Bitcoin mining hardware. The blockchain’s growth and the influx of new players all contributed to the battle for block verification, and hence the intensification of the whole cryptocurrency rewards distribution system. The situation has come to a point where the crypto-mining ecosystem nowadays is classified as an advanced one; it encompasses everything from small individual miners to huge international mining farms, and the scenario clearly reflects the trend from decentralization to mining dominance on a large scale.

Phase 1 — The Hobbyist Era: CPU, GPU & USB Miners

When cryptocurrency mining just started, not only was the Bitcoin network small, but its difficulty was so low that even a computer with a standard processor could participate in the process. CPU mining was simply about downloading mining software, joining the blockchain network, and performing the hashing calculations by using the computer’s general processing power. The initial cost was minimal, and the whole process felt more like a scientific experiment rather than seeking profit.

However, CPU mining very quickly revealed its limitations. With the increasing number of transactions and the growing difficulty of mining, CPUs couldn’t keep up. Then, miners found out that the GPUs’ ability to parallel process was the reason for the remarkable performance, and mining with GPUs became the norm. This happened virtually immediately since graphics cards were able to carry out more simultaneous hashing operations and thus provide significantly higher mining hashrate.

USB crypto miners were soon presented as a low-cost and easy-to-use way for people to train themselves and get plugged into the mining network by simply inserting a tiny device into a USB port. USB miners consumed low power in exchange for low hashing rates and small mining rewards. Nonetheless, thousands of early adopters saw the world of decentralization, through GPU and USB mining. Experimentation, open community dialogue, and hardware accessibility characterized crypto at this time.

Phase 2 — Industrialization Through ASICs and the Hashrate Explosion

Competition grew along with Bitcoin. Developers started to come up with hardware that was specifically optimized for hashing algorithms, which finally led to the birth of ASIC miners (Application-Specific Integrated Circuits). The use of ASIC miners changed the course of cryptocurrency mining history because they were the ones that wiped out the drawbacks of the general-purpose computing hardware. In contrast to GPUs or CPUs, the ASIC machines were solely designed for mining Bitcoin, making mining much more efficient, faster, and less power-consuming.

The mining operation saw great improvement in its performance, with the hashrate going from megahashes per second to terahashes and finally to petahashes. This change in the hash-rearing power of the network brought about a major change in the network difficulty, mining profitability, and market dynamics. The Bitcoin miners transformed from being a hobby to a big business that was investing in very expensive and exclusive Bitcoin mining hardware, electricity, cooling systems, and optimal operational environments.

Professional miners started using ASIC miners in very large numbers. The mining competition got very intense, and individuals could not compete anymore with big, industrial setups. During this period, the whole process of mining changed into a battle of logistics and engineering. To own one of the powerful mining machines was not enough anymore. Some operators started to optimize power consumption, cooling systems, data centre ventilation, electricity sourcing, hardware lifecycles, and maintenance schedules.

Phase 3 — The Era of Large-Scale Mining Rigs & Global Mining Farms

As cryptocurrency became valued and the Bitcoin mining system matured, large full-scale mining farms were sprouting all over the globe. Large-scale mining rigs transformed into specialized plants in which hundreds or thousands of machines were working nonstop. Today’s mining farms are looking very much like high-density computing centers that also have state-of-the-art cooling systems, custom electrical distribution panels, and AI-powered monitoring software.

Mining hubs were established in areas with great regulations, cheap power, and mild temperatures. Such regions provided economic benefits that not only helped the operators reduce their costs but also increased their profit margins. In several places, the mining operations actually made use of stranded natural gas, hydroelectric dams, geothermal power, or renewable power, which not only led to an improvement in efficiency but also started the debate about environmental concerns around Bitcoin mining.

Mining changed from personal trial to corporate-level investment and management. Competitive advantage in hardware purchasing, logistical planning, and continuous upgrades, defining the market as every new ASIC generation made the previous machines less profitable one after the other. On one hand, the growth of large-scale operations, critics worried about mining centralization and claimed that the big mining companies had too much power over the Bitcoin network. On the other hand, supporters argued that industrial mining was the most secure in the blockchain due to the large amount of computing power.

Future Outlook — Decentralization 2.0, AI-Enabled Optimization & What Comes Next

Nowadays, large-scale farms take up the whole mining market, but the advancements in technology are again allowing miners. The coming mining evolution will be able to share industrial growth along with new decentralization.

The following are the major future trends:

- Real-time adjustments to power consumption, heating, cooling, and hardware load by machine learning systems are helping to increase profitability and prolong the life of the equipment.

- Through the use of small and efficient mining devices, home mining becomes feasible again, allowing people to mine without a large upfront investment.

- Rather than relying on fans and airflow for cooling, the machines are created with coolants that transfer heat efficiently, improving the performance of the devices and extending their lifespan significantly.

- Mining contracts that are accessible through token ownership allow the user to get a share of mining rewards without the need to run physical equipment in the house.

- With mining rewards being halved every four years, the mining industry will depend even more on efficiency, strategic energy sourcing, and operational optimization.

The crypto or Bitcoin future will probably consist of a combination of big industrial players with dense mining farms and miners through more accessible systems, renewing decentralization models, and smarter hardware coexisting. The narrative of crypto mining is that of unceasing innovation, from early CPU and GPU systems to USB miners, ASIC hardware, global mining farms, and now advanced AI-optimized mining networks. The evolution illustrates how technology, economics, and community have pushed blockchain from a small experiment to a globally recognized digital industry—one block at a time.