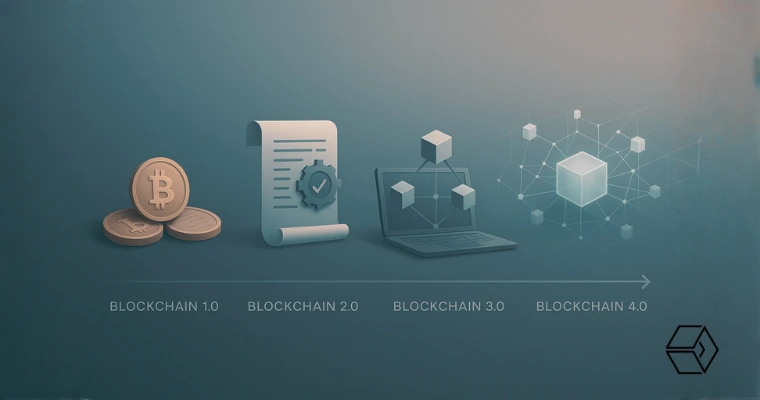

Blockchain has evolved dramatically since its introduction with the first cryptocurrency, Bitcoin, in 2009. Since then, it has undergone considerable transformations with each version building on the previous to resolve limitations.

In this new era where virtual currencies are slowly taking over the market, applications built on blockchain have gone beyond cryptocurrency, touching various industries from healthcare to finance and supply chain. Blockchain conferences are particularly useful to learn more about the blockchain generations and how it has evolved over the years. In a world where trust, scalability, and security are important issues, understanding how the different blockchain generations and how they’ve evolved matters today.

What is Blockchain?

Blockchain is a chain of blocks containing information that is impossible to manipulate or change. It is a distributed ledger shared across the nodes of a network, and can be stored safely. It contains digital records of transactions spread across the network of computer systems or nodes. Every block on blockchain includes multiple transactions – for every new transaction taking place on blockchain, a trace of it is added to every participant’s ledger.

The core features of blockchain are –

Decentralization – No single organization or individual oversees the blockchain framework since the collection of network nodes does all the work, and there is no need for a blockchain regulation or third-party centralized intervention.

Immutability – This feature makes it impossible to alter or modify any information shared on the blockchain network, making it less vulnerable to hacking and fraud.

Transparency – Blockchain has created a new standard when it comes to transparency, as the data is open and transparent in ways that weren’t previously possible in traditional financial systems.

Consensus – The mechanism used in blockchain allows the network to make impartial and quick choices using the consensus blockchain algorithm, a validation process that exists within the active nodes in the decision-making process.

Blockchain Then and Blockchain Now

The First Spark – Blockchain 1.0

Blockchain 1.0, the first ever version of this technology, focused on decentralisation and digital currencies using distributed ledger technology. This version was the initial step of the tech revolution that we are witnessing in 2025.

The objective behind Blockchain 1.0 was to bring a new way of dealing with finances within a decentralised, immutable, and distributed system of transactions that introduced greater public access and transparency to global finances.

Essentially, the first ever cryptocurrency, Bitcoin, gave rise to Blockchain 1.0. Thereafter, Bitcoin solidified itself as “digital gold”, which provided a hedge against the problems of inflation and the best alternative to the conventional financial system. Bitcoin and other blockchain digital assets inspired the creation of various other projects based on Blockchain 1.0.

The Programmable Web – Blockchain 2.0

Next up in the blockchain events came Blockchain 2.0, soon after Bitcoin’s release, when people started to realise that the technology might have a bigger purpose beyond cryptocurrency. The credit goes to Vitalik Buterin, who introduced the programmable blockchain in 2013, called Ethereum.

Compared to Bitcoin, which functioned only to facilitate financial transactions, Ethereum could perform various other functions and record assets using smart contracts. The sole purpose of developing Ethereum was to extend blockchain’s functionality beyond monetary transactions and allow smart contract execution – a program that runs exactly as programmed with no downtime, interference, or censorship.

Blockchain 2.0 introduced Ethereum as a pivotal development that led to a plethora of applications and the rise of dApps, ICOs, and DAOs through smart contracts. While benefits like automation, trustless agreements, and expanded use cases made Ethereum and Blockchain 2.0 a significant event, the other side of the coin included security risks, network congestion, and gas fees, which needed to be resolved for better performance.

The Speed & Scale Era – Blockchain 3.0

The innovations in blockchain and digital assets came with the challenge of the Blockchain Trilemma, which suggested that the network could optimise two of the three aspects – decentralisation, scalability, and security – making it challenging to achieve them simultaneously.

Therefore, blockchain networks take varied approaches, which have led to the development of new chains. While Bitcoin prioritises decentralisation and security, lacking scalability, Solana focuses more on scalability while compromising on decentralisation. Ethereum balances decentralisation and security and addresses scalability. This helps in eliminating the limitations of the Blockchain Trilemma. More chains have been introduced by blockchain developers to deal with the issues of energy, cost, and speed, and bring about various solutions like Layer 2 scaling solutions, DeFi, NFTs, charding, and modular blockchains. Newer blockchains like Solana, Polkadot, and Cardano have also improved cross-chain interoperability and communication, thereby making it easy to connect or transfer value and data across different networks.

The Intelligent Layer – Blockchain 4.0

With Blockchain 3.0 still developing, Blockchain 4.0’s future is expected to propel blockchain into the mainstream and make it entirely usable for industries. While the previous versions provided an idea of their potential, with advantages like automated recordkeeping, security, and immutability, limitations like user experience and scalability prevented the previous versions from being widely adopted. Blockchain 4.0 aims to integrate with advanced technologies like artificial intelligence (AI), the Internet of Things (IoT), big data, and the Metaverse to create a world of financial systems that can function efficiently and autonomously. The next-gen of blockchain bank, the Intelligent Layer, will address the existing problems that hinder mass adoption and real-world utility across different industries like supply chain, digital identity, and healthcare, and prioritise privacy, interoperability, and scalability.

Emerging projects such as Sahara AI, Canton Network, and Hyperledger-Healthchain, along with the growing integration of Real-World Assets (RWAs) on-chain, exemplify how Blockchain 4.0 is already taking shape in practical, industry-driven innovations.

Setting the Stage: Why Blockchain Matters Today

Blockchain is important now more than ever since it solves some of the major problems that exist in digital technology. It is open yet transparent and secure, where everyone can see every transaction record, but no one can modify it once a block is added to the chain. Within a blockchain network, there is no threat of security or manipulation, both of which are modern-day concerns.

Therefore, the blockchain system is trustworthy, transparent, and immutable, overcoming the issues of the existing financial system. Overall, blockchain development has reduced obstacles that slow down operational processes across industries like banking, finance, logistics, and healthcare.

The Road Ahead: Where is Blockchain Going?

The blockchain technology holds the promise to transform digital services, public administration, and finance across the world. The potential entirely lies in offering tamperproof, transparent systems that eliminate the reliance on centralised intermediaries.

Despite such advances, challenges still lie on the table with issues related to scalability, security, and regulation. Many initial blockchain networks, especially those employing the Proof-of-Work consensus mechanism, still struggle with high energy use and limited transaction throughput.

There are emerging frontiers with tokenised real-world assets, Web3 ecosystems, and cross-border trades that will drive wider adoption and help create more secure, transparent, and efficient systems across industries. As we learn about blockchain now, the market is growing and will reach $306 billion by the end of 2025, and bitcoin is expected to reach $1Million by 2030, where a more decentralized, trustless economy will be built, and blockchain will fade into the background, empowering financial systems invisibly.

Closing Thoughts

The blockchain evolution has taken many years to transform into what it is today: massive distributed networks to facilitate transactions, use automation to initiate and complete agreements, and allow decentralised applications to be developed on them. From Bitcoin and Ethereum to newer networks like Solana, Cardano, and Polkadot, each blockchain version is developed to resolve the underlying issues or challenges that come with decentralisation, scalability, and security. The fundamentals of blockchain need to be understood at length to know its importance and full potential to disrupt industries.

Stay tuned to our blockchain guide for more information on blockchain and cryptocurrency!